Housing prices have risen sharply since the pandemic, is it sustainable?

Over the last almost two years demand for residential housing has been immense as just about everyone has heard anecdotal stories from friends, family, or acquaintances that have either bought or sold homes recently. The lack of supply due to construction being halted or slowed by the pandemic and historically low mortgage rates were massive tailwinds for housing prices, as well as home builders. In later 2021 and so far in 2022, we have seen the trend of higher housing prices begin to stall as more supply comes to market, and mortgage rates have increased alongside interest rates in general.

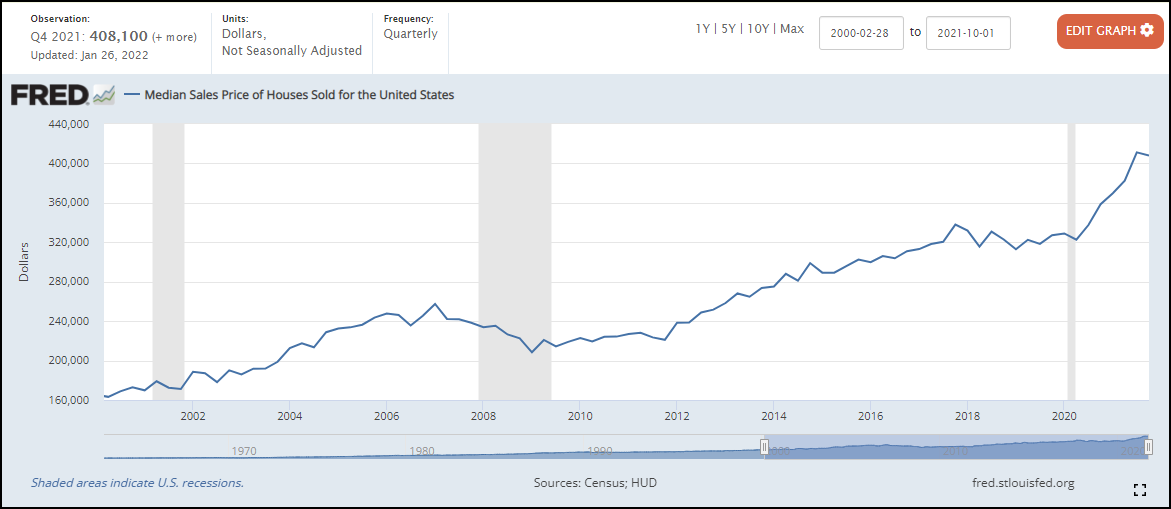

To start off, let’s look at the Median Sales Price of Houses Sold For in the US. In the chart below one can see that housing prices had trended higher since the GFC but began to stagnate around the $320,000 level from 2017 until 2020 before swiftly rising to around $400,000. That is an increase of about 25% in one year! Now, we do see a bit of a plateau on the chart below in the fourth quarter of 2021 signaling there may be some slowing down in housing prices, but this is just one quarter and is inconclusive on where we may be headed from here.

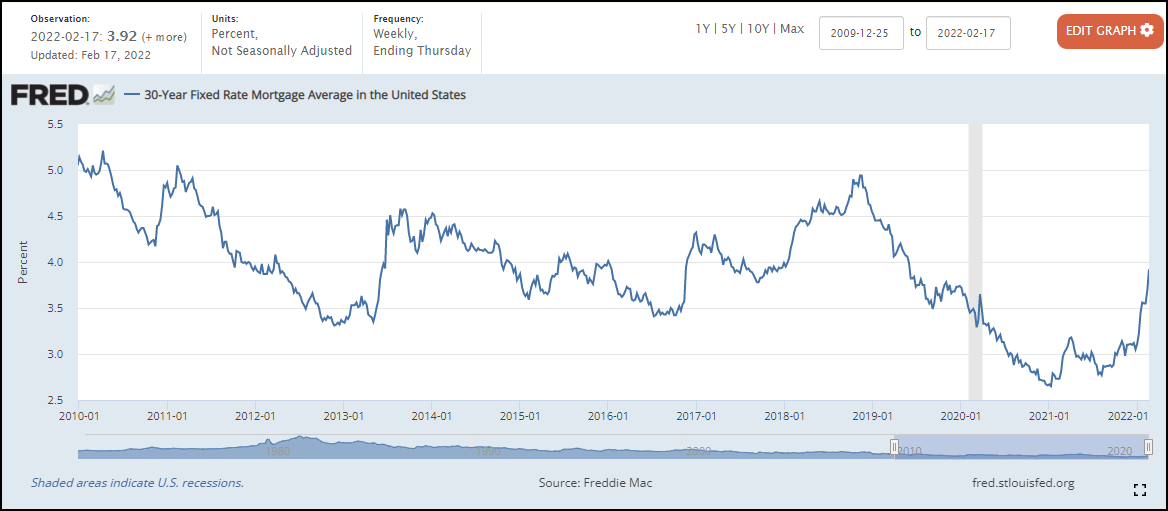

After looking at the increase in housing prices, what about the ability to finance these houses? The 30-Year Fixed Rate Mortgage Average in the US is now back above pre-pandemic levels with a reading of 3.92% and has increased quite drastically since the start of 2022. Coupled with rhetoric from the Federal Reserve of their plans to raise interest rates, it seems likely that mortgage rates will also continue higher. Not only has housing become more expensive, but the ability to finance these homes is also becoming more expensive. Lastly, on the economic data front, New Privately-Owned Housing Units Started: Total Units looks to have recovered since the pandemic slowed new developments. Right now, there are 1.638 million housing units started as of January of this year which is one of the highest readings since the GFC, but from a long-term historical perspective in the US, it is about average (FRED). Nonetheless, housing production is above where it was prior to the pandemic and looks to be making up for the lost time in 2020. You can view the Total Housing Starts on a Point & Figure chart on our system with the symbol ^HOUSESTARTS.

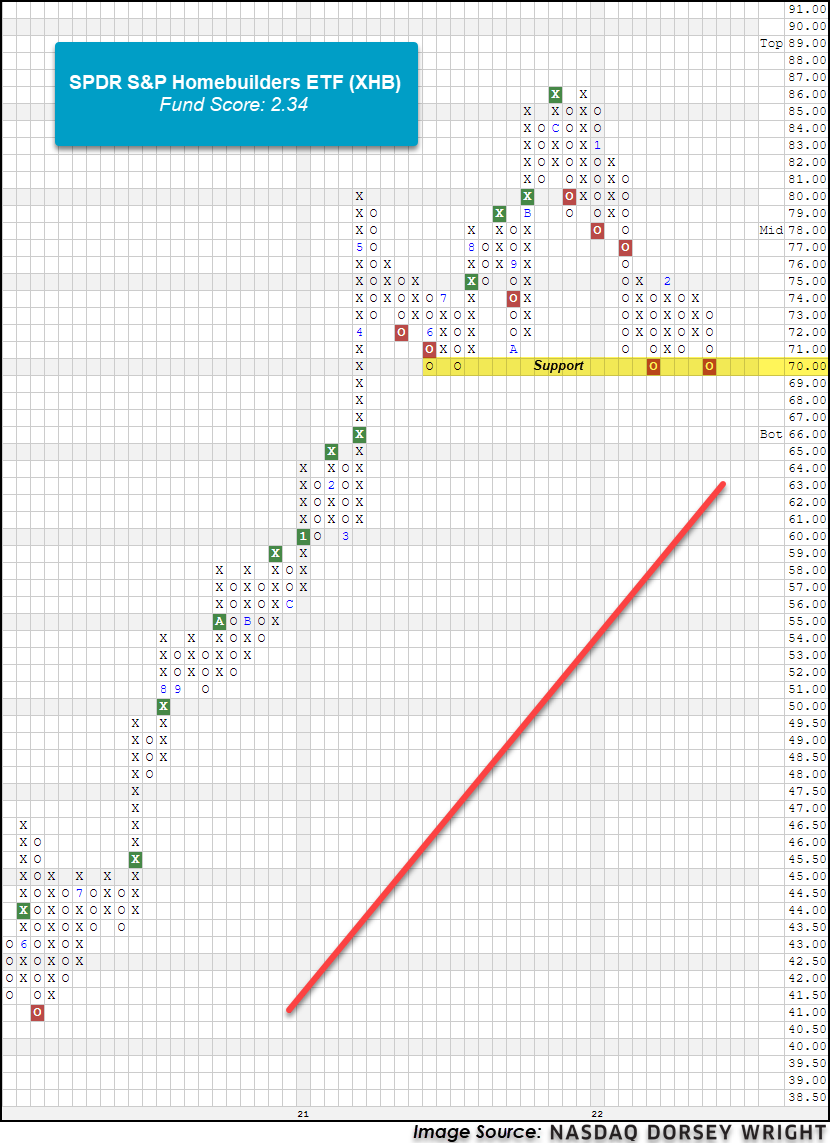

While the macroeconomic tailwinds for sharply rising home prices may be subsiding the technical picture for home builders has been weakening as well. The SPDR S&P Homebuilders ETF (XHB) has a fund score of 2.34 with a highly negative score direction of -3.52, pointing to the rapid deterioration of strength. XHB is trading on five consecutive sell signals and has formed a spread quadruple bottom at $70, its current chart level. The fund remains in a positive trend still partly due to its strong performance in 2020 and 2021, but the technical picture is deteriorating rather quickly as the fund has posted a year-to-date return of -18.05%. XHB isn't a perfect proxy for pure homebuilders as it has stocks like Home Depot (HD) and Lowes (LOW) nor is it necessarily tied to home prices, but its technical deterioration is noteworthy.

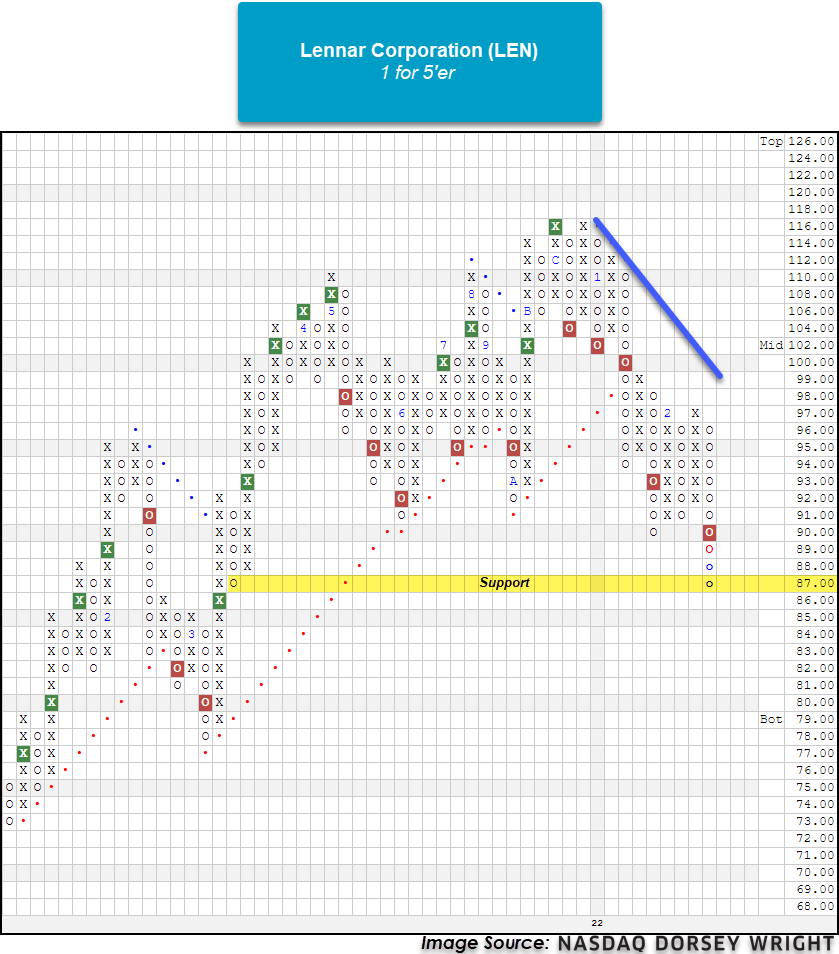

Individual stocks involved in residential real estate have also seen technical deterioration. Lennar Corporation (LEN) and D.R. Horton, Inc. (DHI) are companies more heavily involved in residential real estate development. Both LEN and DHI are weak attribute names with similar chart patterns as each has recently broken through major support levels. In the case of LEN, the stock is a 1 for 5'er and is trading on five consecutive sell signals. LEN broke through strong support in the $90 - $91 range last week and has continued lower in today's trading to test another area of support at $87. In conclusion, a combination of macroeconomic and technical headwinds have hit homebuilders quickly to start 2022. While macroeconomic data can be useful in crafting an explanation for the technical weakness we've seen in homebuilders, technicals are still paramount in the decision-making process. Economic data can be construed and interpreted in many different ways, but price is our guide.