Sector rankings shifts have helped low volatility equities pick up strength.

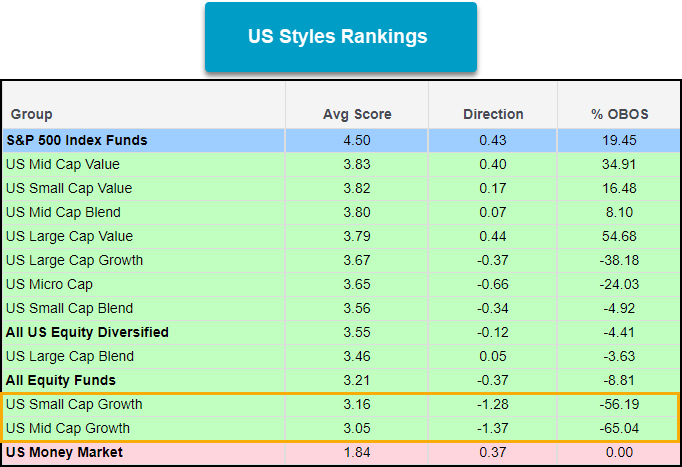

The start of 2022 has seen a notable surge in strength from value areas of the market as rates and commodity prices have swiftly moved higher. One of the major sectors affected by this has been technology, which was touched on in yesterday’s Fund Score Overview. Energy and financials have been the two sectors that have benefitted the most to start the year. Utilities, consumer staples, and real estate are also areas that have had strong upticks so far this year. This has had a clear effect on the size & styles rankings. The groups with the worst score directions on the US Styles view are mid-cap growth, small-cap growth, micro-caps, and large-cap growth while we see value styles leading the way in terms of average scores. The S&P 500 Index Funds group firmly remains in the leadership role and it should be noted that many of the mega-cap growth stock names are still technically strong from a long-term perspective despite large-cap growth and technology weakening.

Low volatility equities have perked up after a long stretch of being dormant and the group has quietly moved up the rankings over the past few weeks. The group has an acceptable average score of 3.33 with a positive score direction of 0.45, one of the highest on the Asset Class Group Scores page. The group is at its highest level since February of 2020. One of the main drivers behind the move has been the strength of utilities and staples over the past month which make up roughly 40% of the underlying sector exposure for the Invesco S&P 500 Low Volatility ETF (SPLV). SPLV currently has a fund score of 3.52 along with a positive score direction of 1.02.

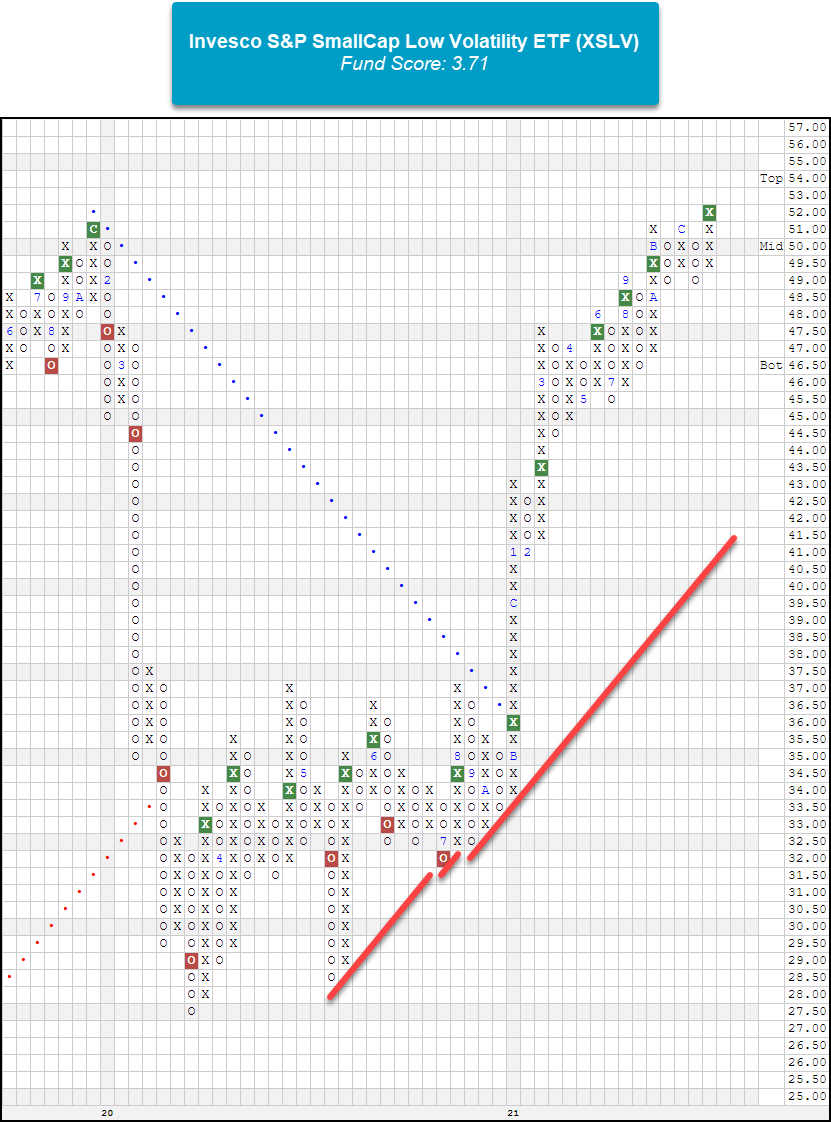

Large caps aren’t the only area to see their low volatility equities do well, small and mid-caps are also participating. The Invesco S&P SmallCap Low Volatility ETF (XSLV) possesses a fund score of 3.71 and a positive score direction of 0.91. Most notably, the fund broke a spread quadruple top to reach a new all-time high and is trading on seven consecutive buy signals. After a long period of relative weakness, the pick-up in strength in the low volatility shouldn’t be ignored especially given the current macroeconomic backdrop that seems to favor higher rates. When low volatility equities have acceptable levels of relative strength they can offer a unique way to add diversification to your clients' portfolios.