While some Chinese stocks showed drastic price appreciation this week, very few individual names have demonstrated any technical improvement. However, the frontier equity markets space has continued to demonstrate strength throughout the year.

The relative strength picture between developed and emerging markets has remained largely the same over the past week. Emerging markets saw some near-term improvement as many of the large Chinese technology names saw drastic price appreciation at the beginning of this week, leading the broader iShares MSCI Emerging Markets ETF EEM to show an improvement of just under 2.5% over a trailing seven-day timeframe. The iShares MSCI EAFE ETF EFA was about flat over the same timeframe (through 8/24). While the movement in China this week has been dominating most of the international equity news headlines, the broader Chinese equity space has yet to demonstrate notable technical improvement toward favorable positioning. As we touched on in a prior international equity overview, the shares of Chinese companies listed outside of mainland China have seen the sharpest technical deterioration, while the A shares listed on the mainland have held up significantly better. Unfortunately for US investors, it can be very difficult to access mainland Chinese equity listings, or A Shares, outside of broader exposure through an ETF. While many of the individual stocks of Chinese companies that are available on US exchanges saw significant price appreciation earlier this week, most of those names were previously in heavily oversold territory and have not shown significant technical improvement. Out of the 174 Chinese ADRs we track on the NDW platform, only 21% were on a point and figure buy signal following trading Tuesday, and only 13% were in an overall positive trend. Furthermore, the average technical attribute rating for these names arrives at a measly 0.81 points out of the 5 possible points (through 8/24).

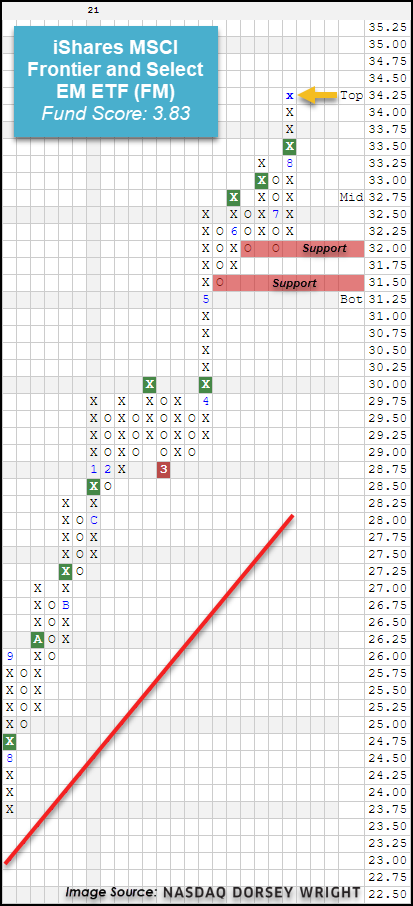

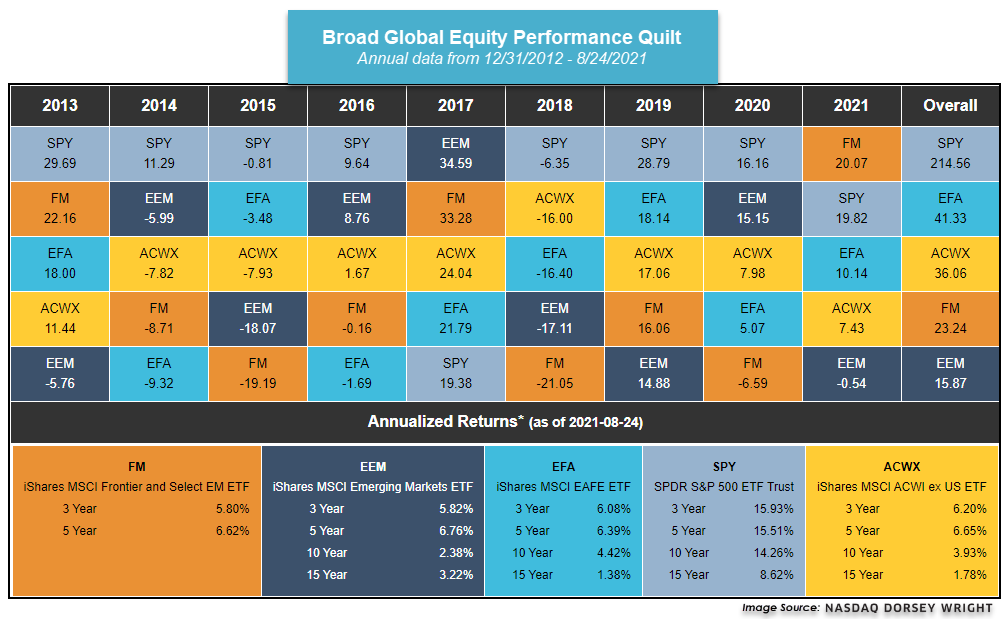

The frontier equity space is one area of foreign equity markets that has continued to demonstrate consistent improvement throughout the year. This can be seen through the iShares MSCI Frontier and Select EM ETF FM, which moved to a new multi-year high on its more sensitive ¼ point chart Wednesday with movement to $34.25 after giving four consecutive buy signals since April of this year. The fund has also posted a year-to-date return of 20.07% (through 8/24), outpacing representatives from developed markets (EFA), emerging markets (EEM), broad international equities (ACWX), and even the S&P 500 Index (SPY) over the same timeframe. If this holds through the end of the year, this would mark the first calendar year that FM outpaced all of these representatives since the inception of the fund in 2012.

FM carries a recent fund score posting of 3.83, which bests the average emerging market equity fund at 2.60 as well as the average non-US fund at 2.96. The score is also paired with an intensely positive 2.77 score direction, providing further indication of the fund’s consistent improvement. While the technical picture of FM is stronger than most international equity areas at current levels, those looking to add exposure should note that the fund is entering an overbought territory, so those looking to add exposure may be best served to ease in at current levels or wait for a pullback/normalization of the trading band. Initial support can be found at $32 on the more sensitive ¼ point chart, with additional support offered at $31.50.