Bond yields have risen this week, while high yield spreads have fallen. Investors will be looking to the Jackson Hole Symposium for guidance on the Fed's schedule for tapering its asset purchases.

- Bond investors will be looking to the Jackson Hole Symposium and Chair Powell’s speech on Friday for further any guidance on when the Fed may begin to taper its asset purchases.

- The US Treasury 10YR Yield Index TNX reversed up sharply on Wednesday, printing five Xs on its default chart and reaching 1.35%. A move to 1.4% would mark a second consecutive buy signal for the index.

- The US Treasury Five-year Yield Index FVX also rose on Wednesday, reaching 0.825% on its chart. This puts the index just one box away from giving a second consecutive buy signal and returning to a positive overall trend.

- Further out on yield curve, the 30YR Yield Index TYX also reversed up, reaching 1.95% on its default chart; it would need to reach 2.05% in order to give a second consecutive buy signal.

- After giving a second consecutive buy signal in last week’s trading, CBUS10YRPREAD, which measures the spread between Treasuries and high yield corporate bonds, reversed down in Tuesday’s trading. At least some of the recent upward movement in high yield spreads can be attributed to the deterioration of the energy sector, which is more heavily represented in many high yield bond indexes than it is in the S&P 500 SPX. As a result, a recovery in crude oil prices and the energy equity sector could help to lower high yield spreads.

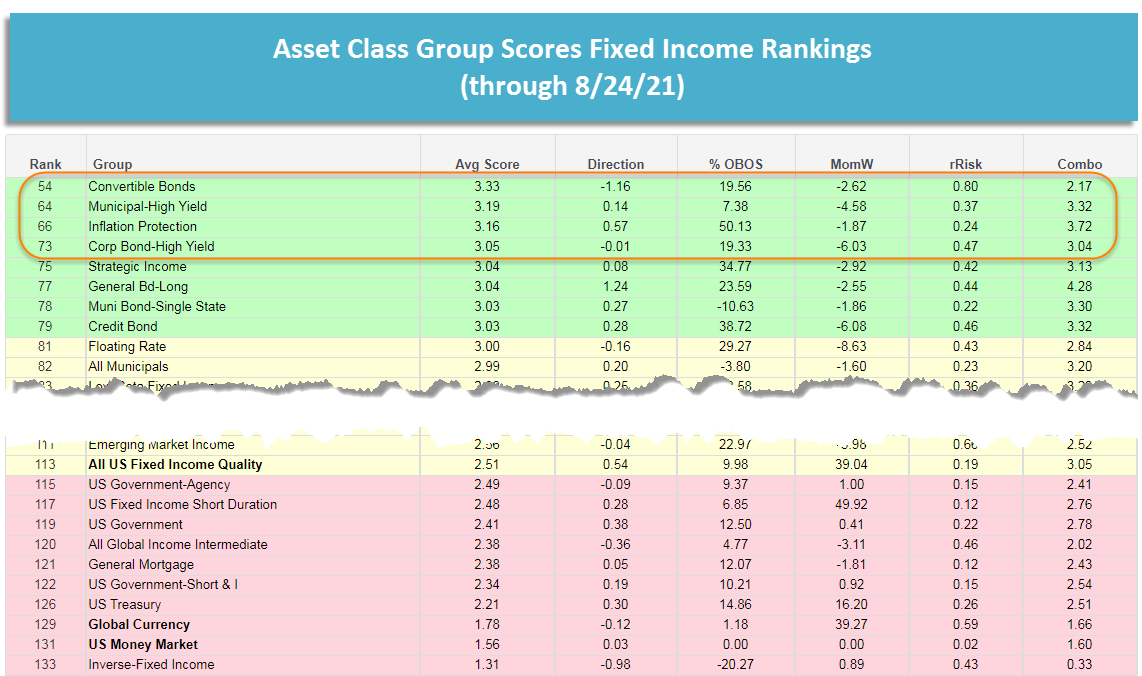

- The leadership within the fixed income groups in the Asset Class Group Scores remains largely unchanged over the last week. Convertible bonds, high yield bonds (both corporate and munis), and inflation protection remain areas of strength. The general bond-long group also sits near the top of the rankings, but this may change with the fairly large upward move in yields on Wednesday.