Bitcoin surged over the 20,000 mark for the first time ever today, gathering publicity and investor assets once again

Beginners Series Webinar: Join us on Friday, December 18th, at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is Individual Stock Idea Generation. Register Here.

We are excited to announce phase three of the Nasdaq Dorsey Wright Model Builder with the launch of Matrix and FSM-based Relative Strength (RS) Testing Service. As part of this launch, we are granting you free access to the Service for the remainder of 2020. The tool is designed to help you more easily design, test, implement, and monitor custom models powered by the Nasdaq Dorsey Wright methodology. Through the end of December, be sure to join us each Thursday at 1 pm EST for a custom modeler demo presented by the analyst team.

11/12/2020: Matrix Model Builder Demo Replay- Click here

11/5/2020: FSM Model Builder Demo Replay – Click here

Click here to register for future Nasdaq Dorsey Wright Model Builder Demos

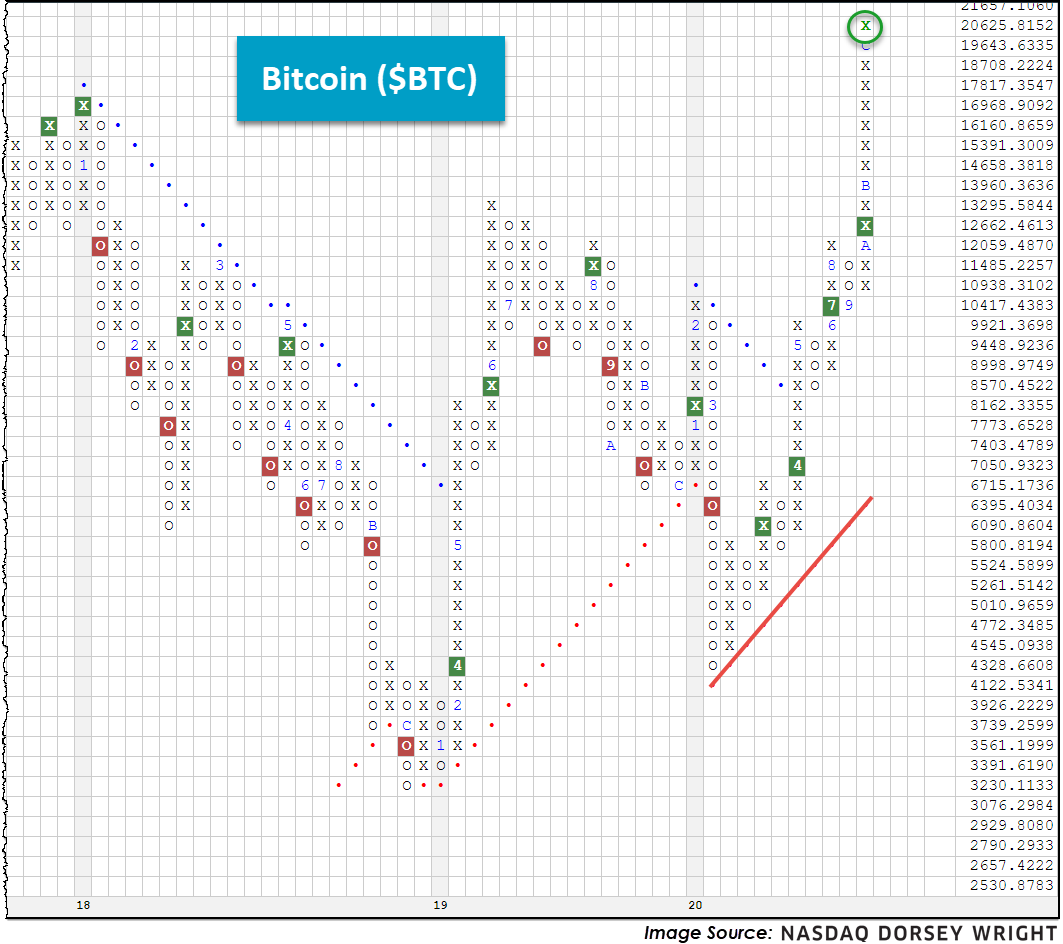

Bitcoin ($BTC) surged over the 20,000 mark for the first time ever today (12/17), gathering publicity and investor assets once again.

Individuals invested in the world’s largest cryptocurrency via the Bitcoin Investment Trust (GBTC) are enjoying a nice ride this year, as the ETF-like product is up over 200% through trading yesterday (12/31/2019 – 12/16/2020). The current run reminds some of Bitcoin’s previous charge in 2017, of which was shortly followed by a material drawdown, in excess of -80%, for the digital currency through December of 2018. However, crypto analysts seem to think that this year’s run is different because of an increased institutional presence, stating that prior surges were mainly driven by speculative retail flows. The accessibility of Bitcoin is also growing, as previously highlighted, evidenced by PayPal announcing that users could buy and sell the cryptocurrency, following suit of other large platforms like Square (SQ) and Robinhood.

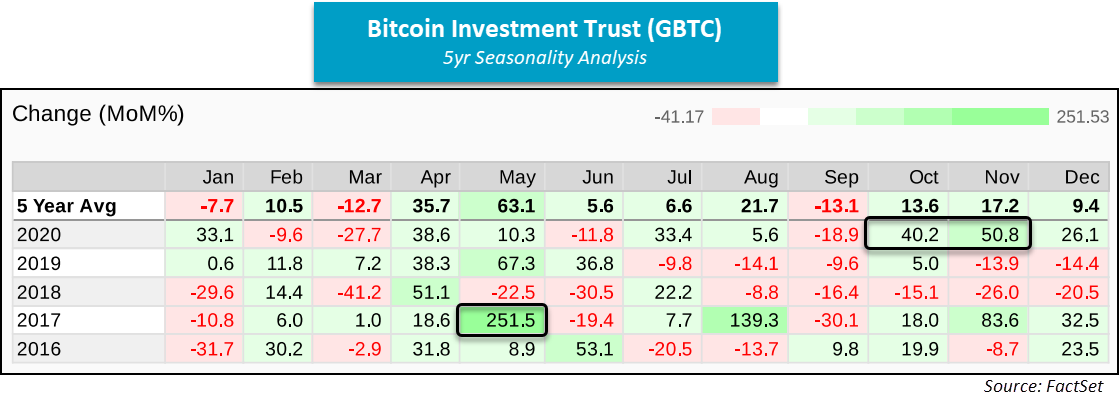

Bitcoin’s role in a portfolio remains up for debate, as findings about its correlation to other investments appears largely dependent on timeframe and/or asset class. Additionally, keep in mind that Bitcoin was officially launched only 11 years ago, a rather short history compared to other asset classes. Now we find GBTC with a 5.58 fund score and a strongly positive score direction of 3.96, speaking to its latest improvement; however, the space is known to be extremely volatile. To get a feel for such, see the FactSet seasonality analysis below, in addition to an expanded $BTC chart.

For a deeper dive on the cryptocurrency, see our latest feature from October of this year. To view all cryptocurrencies tracked on the NDW Research Platform, navigate to Security Selection > Chart Lists > Cryptocurrencies (bottom left).