It has been almost two months since Domestic Equities moved back up to the number one position within the DALI Asset Class rankings, and interestingly enough Domestic Equities is the only asset class to have gained more buy signals since it moved to number one on August 25th.

It has been almost two months since Domestic Equities moved back up to the number one position within the DALI Asset Class rankings, and interestingly enough Domestic Equities is the only asset class to have gained more buy signals since it moved to number one on August 25th. Domestic Equities has picked up 43 new buy signals while all other asset classes have seen a decline, Commodities leads the way on the downside with -22. While Small Caps have participated in the rally, especially over the past few months, we have not seen much wavering in the leadership trend of Large Cap Growth over Small Cap Value.

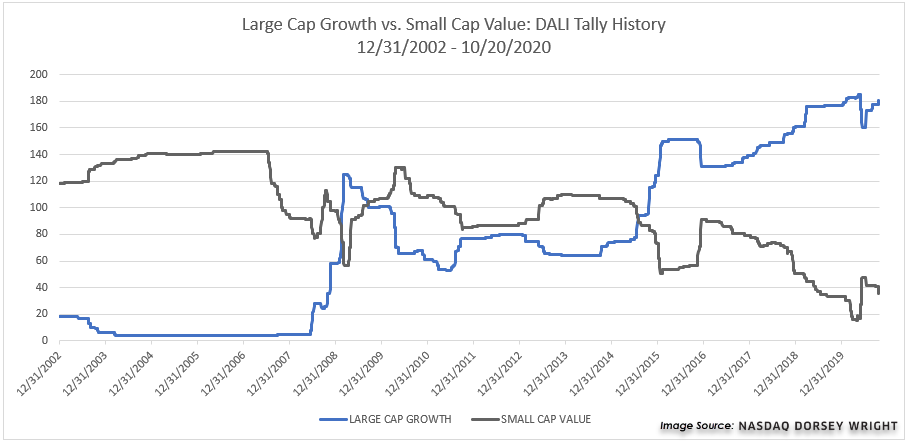

These two style boxes, Large Growth and Small Value, are on polar opposite ends of the spectrum as it relates to the current DALI rankings. Large Cap growth remains the highest-ranked US style box (out of nine) with a tally signal count of 181 while Small Cap Value is in last place with a count of just 36. After a bit of a recovery from Small Value in recent months, going from a low reading of 15 buy signals in April to a high of 48 by June. However, since late August when Domestic Equities took over the number one spot, Small Cap Value has lost the second most signals (6) while Large Cap Growth has gained the most signals (6). These two style boxes have been important over the year, just at different times, and those respective leadership trends have been prolonged. For instance, Large Cap Growth has been favored over Small Cap Value for more than 5 years now; however, prior to that Small Cap Value was favored for nearly six years (October 2009 to August 2015) and really Small Cap Value was favored for nearly 13 years outside of about seven months in 2009.

This is all to say that these leadership trends across Growth and Value, and specifically Large Growth and Small Value, can last for extended periods of time. Small Value began to close the gap back in the summer; however, Large Growth has recently expanded that lead back out. Both are important styles to monitor, and given the broad strength of US equities, Small Cap names have certainly participated to the upside since the market lows; however, overweighting Large Growth remains the leadership trend.