We take a look at the S&P 500 Volatility Index (VIX) and the actual daily movements of the index.

The CBOE S&P 500 Volatility Index VIX, which is often referred to as the ‘fear index’ is a measure of uncertainty or volatility in the US equity market. The VIX uses data from S&P 500 index options to project the expected volatility in the market as an annualized figure. So, when the VIX reached 85 in March amid the COVID19-induced sell-off, it implied an annualized volatility level of 85% and during that period we saw some of the most volatile trading days on record. Although the VIX is often referred to as the fear index, a high VIX is not bearish in and of itself. The index gauges expected volatility in either direction, up or down, as we have experienced over the last two months as the market has rallied strongly while the VIX has remained elevated. Of course, the VIX is a volatility expectation, it does not actually determine the level of volatility that is ultimately realized. Although market makers do use the VIX as input when analyzing how much liquidity to provide to the market, so we can’t say that it has no effect on actual volatility.

In any case, the heightened levels of volatility this year and the fact that the VIX remains above its long-term average made us curious how accurate the VIX estimate was in predicting the actual level of realized volatility. To answer this question, we looked at the daily VIX levels since the beginning of 2004 (when the index calculation was changed) and compared them to the daily movement of the S&P 500. As mentioned above, the VIX is an annualized number, so to convert it to a daily number we divided by the square root of 252 (the number of trading days in a year). We then compared the daily VIX number (from the prior’s day close) to the daily return of the S&P 500 (absolute value) and the day’s range ((high-low)/previous close). It is worth noting that the VIX is actually an estimate of expected 30-day volatility, but, the daily conversion we’ve described above is regularly used by traders and other market participants as a rule of thumb for gauging the magnitude of daily market moves. If you regularly watch CNBC or Bloomberg TV, on multiple occasions you have probably heard something like “the VIX is currently at 30, which implies a daily move of about 2%.”

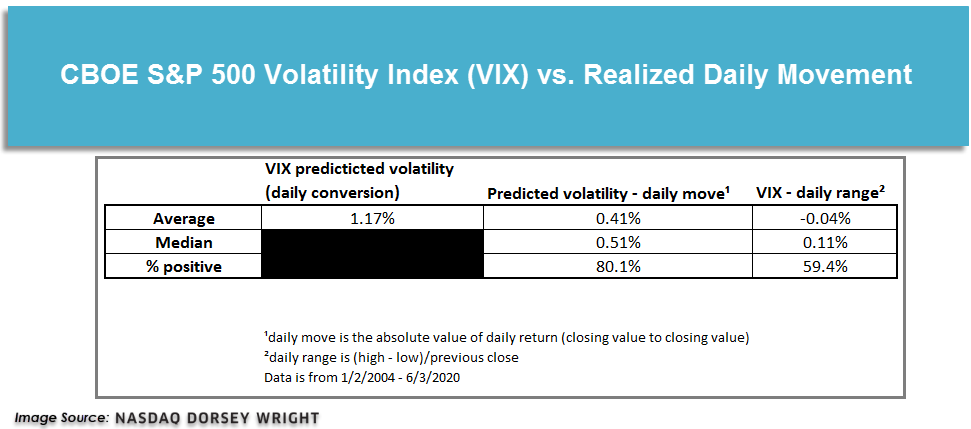

As the table above shows, since 2004, the VIX has had an average level of 18.6, which implies daily volatility of around 1.17%. which is 0.41% greater than the average daily move of the S&P 500. Interestingly, compared to the average daily range of the S&P 500, the VIX is almost spot on, undershooting by just 4 basis points (0.04%). We can also see that just over 80% of the time the daily VIX conversion less the actual daily move is positive, meaning that it overshoots the daily change in the index fairly consistently. Looking at the daily range comparison we see that even though the average difference is slightly negative, just the figure is positive 59% of the time, meaning that it also most often overestimates the daily range of the S&P 500. So, while the VIX is certainly a useful tool for judging the overall level of volatility we may encounter in the market, it tends to overestimate the actual movement of the S&P 500 on any given day.