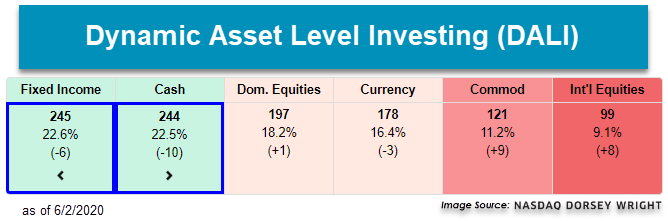

Over the course of the past week, we did see a change within the asset class ranking of DALI, with fixed income passing cash to take over the number one position by one signal following trading on Tuesday.

Over the course of the past week, we did see a change within the asset class ranking of DALI, with fixed income passing cash to take over the number one position by one signal following trading on Tuesday. The equity markets continued higher over the past week (5/27/2020 – 6/2/2020), and we did actually see the tally reading for fixed income and cash drop. Fixed Income lost six signals since this time a week ago and cash dropped ten signals. Domestic equity added one while international equity and commodity rose by eight signals and 13 signals, respectively.

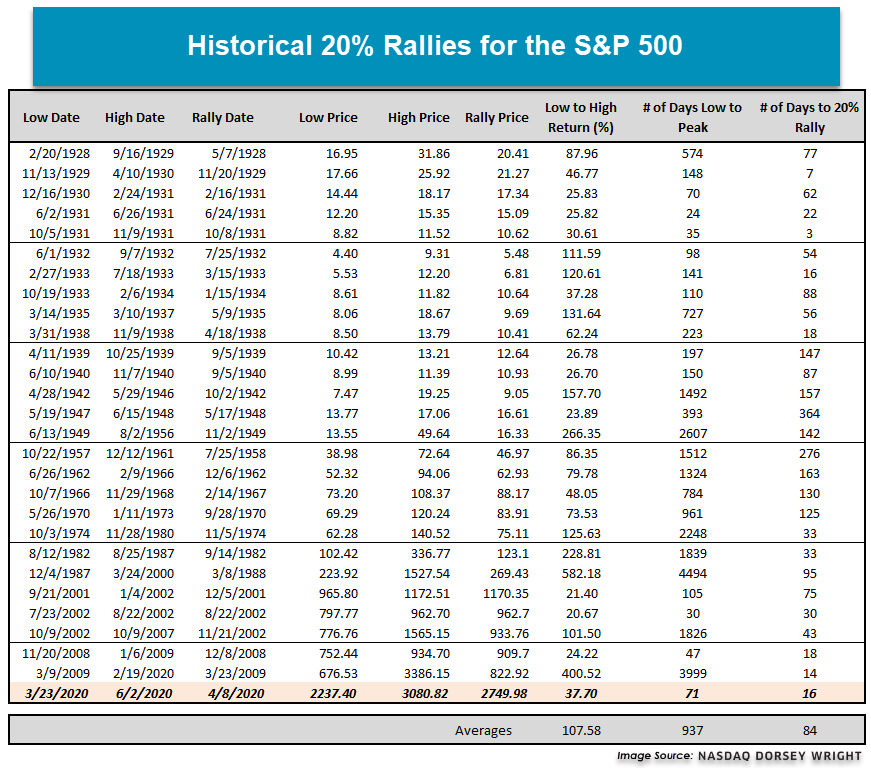

One thing that has been extremely difficult in this market has been the speed and velocity with which the market corrected and subsequently recovered, as well as the narrowness of the leadership. To put the speed of this pullback into perspective, it took the market just 22 days to fall 20% from the February 19th peak. This was the fastest correction of 20% we have ever seen (excluding the 1930s). In 2008, it took nine months for the market to correct 20% off the October 2007 high (October 2007 to July 2008). In 2002, it took 6 months to hit 20% down (January 2002 to July 2002).

This correction also came off a rather strong move higher in equity after the December 2018 low. The S&P 500 up 44% from 12/24/18 to 2/19/20, also during the run First Trust Focus 5 FV was up 45% and the Invesco DWA Momentum Portfolio PDP was up 55%. That explosive move higher, while great for the 2019 calendar year, left a number of relative strength charts up on stems; therefore, in order to generate sell signals they needed to fall more than 20%. Not unlike 2018, which was a benefit to the portfolios, although this time around it was not. This brings us to the “why hasn’t domestic equity moved back up in DALI” question. Well for very similar, yet completely opposite reasons. As quick as the move down was off the Feb peak, the rally back has been equally as explosive to the upside leaving relative strength charts, in some case, far away from buy signals upon the initial reversals up. The best-case scenario would have been to get some back and forth action off the bottom to set up a buy signal from a much lower level, however, that didn’t happen for many charts. This “V-shaped” recovery the market has experienced is a very difficult environment for relative strength or trend following of any kind and is not the common bottoming process for the market. The 2002 bottom and the 2008/09 bottom you got quite a bit of back and forth at the bottom so those bottoms were more of a process than an event like this year.

It took the S&P 500 just 16 days to rally 20% off the March 23rd low! If we go back and look at all the major bottoms in the market the average length of time before rallying 20% is 84 days or nearly three months. This move off the bottom has been equally as explosive as the 20+% rally from November 2008 to January 2009, as well as the move off of the March 2009 low.

With all that being said, as we stand today (or at least thru June 2nd) there are 47 buy signals separating domestic equity from the number two asset class. There are 14 domestic equity charts within DALI that are within 5% of returning to buy signals. A number of those are small caps and a number of signals would come at the expense of fixed income. So, if those were to happen that gap could get cut in half pretty quickly. This doesn’t account for the number of international equity and commodity charts that are close to moving back to buy signals against fixed income and cash. The combination of the speed of the sell-off and the speed of the recovery is the primary reason domestic equity hasn’t climbed higher and faster in DALI in this market environment. The initial move down was the fastest we have ever seen and the move off of the low is among the fastest the market has ever seen, taking just 20% of the duration of the average recovery period. The “averages” have been thrown out the window with this market on many different fronts, but in case you were wondering, the average return before hitting a peak during the previously mentioned recovery periods is 108% and the average duration from the low to the high is 937 days. The largest came off of the 1987 low when the market rallied 582% before peaking in March 2000 and the second largest was the 400% move off the March 2009 low. If the market continues it’s recovery, then we will see domestic equity return to one of the top-ranked asset classes. On the other hand, if this rally stalls out and pushes back lower then we are likely to see many of the individual relative strength charts reverse down which would then set up alternate potential buy signals. If you missed last week’s “Weekly DALI and US Equity Update” be sure to click here to review some more details on this subject as well as some specific relative strength chart examples.