Highlighting recent movers on the Asset Class Group Score rankings, and how to set up your own "model-of-models"

The recent market volatility has led to little change in the broader rankings of the Asset Class Group Scores (ACGS) system, with the US Equity Core Percentile rank still above 95% and the Money Market Percentile Rank still below 10% (through 5/16/19). The Group Score Report for all groups shows that recent improvements have come largely from fixed income, with six of the seven groups that have crossed above the 3 score line over the past 30 days coming from that space. The actual score improvement of these groups has been relatively muted, with no groups increasing in average score by more than a point over the trailing month. The upper end of the ACGS rankings still drastically favors domestic equities, leading this recent improvement in fixed income to be indicative of the recent pullback across equity markets. Nonetheless, it is still a point to monitor as we head towards the midpoint of the year.

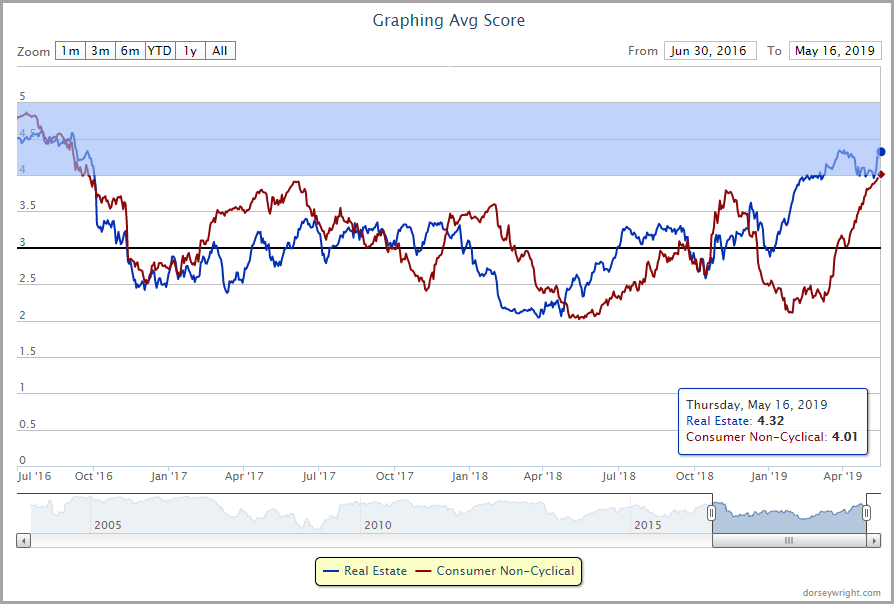

On the domestic equity side of the coin, you can see on the Group Scores Report that Consumer Non-Cyclical and Real Estate are among the most improved scores over the past 30 days, and are the only groups with an average score above 4.00 on that list. Real Estate’s recent average score of 4.32 and the 4.01 average posted by Consumer Non-Cyclical are both the highest average scores seen by either group since 2016. This improvement has not led to enough strength to move these sectors in favor on our relative strength based D.A.L.I. rankings, but this is another point to watch for further development.

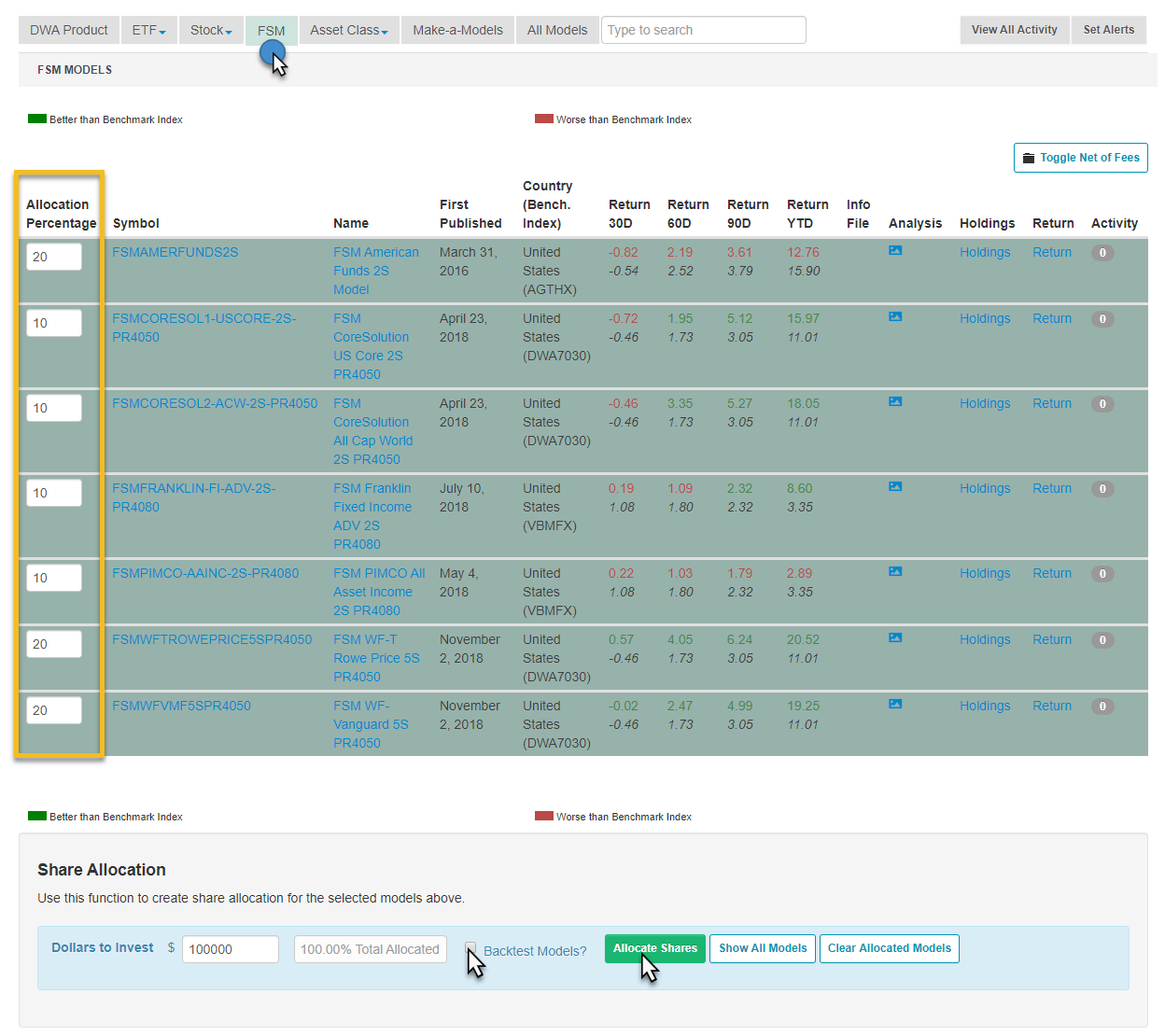

Earlier this week we launched a new Fund Score Method (FSM) Model, FSM The Tortoise & Hare 80-20, which we introduced in yesterday’s Fund Score Overview. As always, we appreciate all feedback on the new models or tools we make available and are always happy to answer questions on any strategy, old or new. Many of the questions we received over the past few days have dealt with applying the same “model-of-models” methodology to your own selection of FSM models, whether it be differing providers or more sensitive cash triggers. In order to set up your own guidelines, you can use the Allocation Percentage column found on the FSM models page, setting your own allocations for each of the models you would like to use. This would allow you to designate personal “sleeves” for each of the funds, and setting alerts on these models will let you know when to make a change. You can also delve deeper into the strategy by checking the “Backtest Models?” checkbox before allocating the strategy, which will run a hypothetical growth of how a portfolio would have done over time using the criteria you set. After choosing the models and the thresholds you find most appealing, you would make sure the alerts for each of these models are set and then simply wait for an email to make a change.