Introducing a new FSM Master Model: The Tortoise & Hare 80-20.

Running the Long Race with FSM Models

This business is often exposed to new products, new ideas, or new claims of being the “next best thing”. While innovation leads us forward, the promise of going where no fund, product, or manager has gone before is an oft-repeated one. You’ve been there before. Things are “as presented” until they are not, at which point the same wholesaler (who might be at a new firm by now) calls you with the new “next best thing”. Who can blame them? There are very few shortcuts in this business and in life. As the fable goes, slow and steady wins the race.

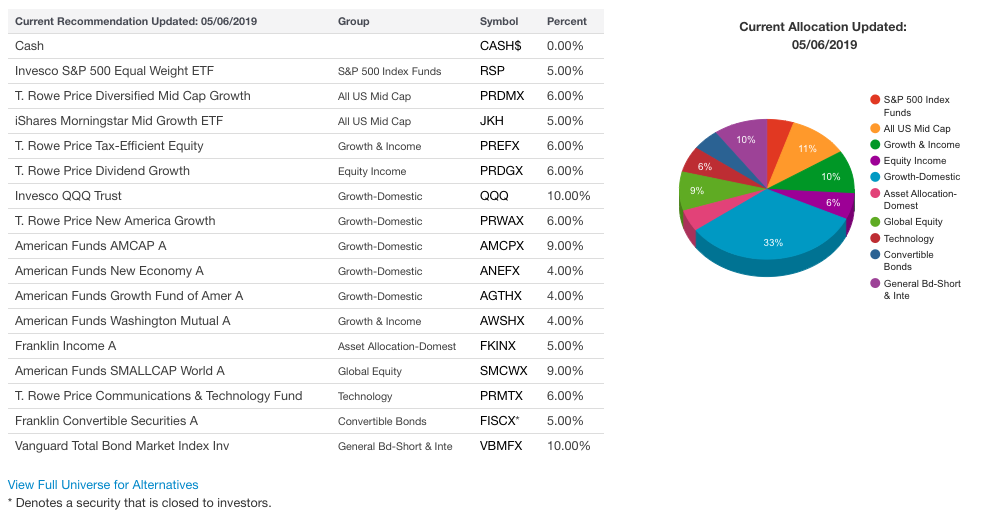

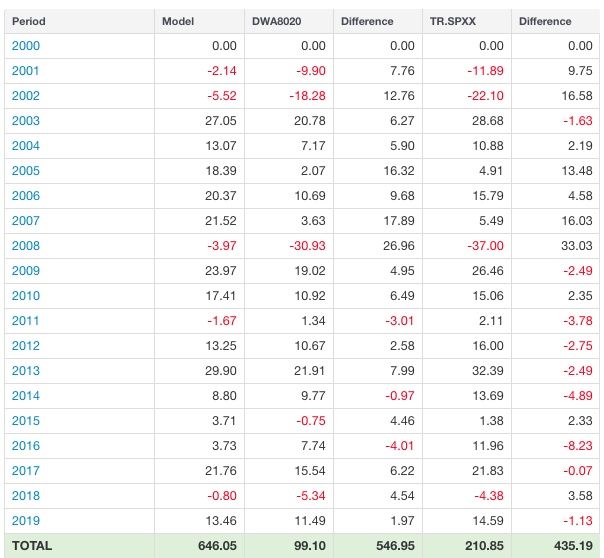

We’re pleased to announce the addition of a new Fund Score Method (FSM) model: The Tortoise & Hare 80-20. Our “next big thing” introduces a Multi-Sleeve component to the FSM models, including the ability to maintain a strategic and dynamic asset allocation that fits in with your firm’s expectations. Many of you have incorporated FSM models into your own “sleeves”, which by all accounts is still a winning strategy. Tortoise & Hare creates guardrails by establishing minimum and maximum equity/fixed income allocations during “normal” markets, with a 20% allocation specifically reserved for both equity and fixed income exposure. The CoreSolution Models, both US Core and All Cap World, serve as the designated allocation towards equities, with 10% of your total allocation going towards each model. The Franklin Fixed Income Model and Vanguard Bond Market Fund VBMFX each get 10% of the total allocation as well to round out the 20% reserved for fixed income. The dynamic aspect of the model involves being fluid to reflect market conditions, as the flexible nature of the FSM models will overweighting equities or fixed income to fill the remaining 60%. Additionally, the model sleeves have the ability to move entirely to cash by using the risk-triggers based on the US Equity Core Percentile and Money Market Percentile Rankings.

Master Model of:

- FSM CoreSolution US Core 2S PR4050: 10%

- FSM CoreSolution All Cap World 2S PR4050: 10%

- FSM American Funds 5S PR4050: 20%

- FSM American Funds 2S Model: 10%

- FSM WF-T Rowe Price 5S PR4050: 30%

- FSM Franklin Fixed Income ADV 2S PR4080: 10%

- VBMFX Vanguard Bond Market: 10%

By pairing multiple steadfast shop cultures, as well as the Core ETF selection, the Tortoise and Hare Model brings active and passive together into one deliverable and easy-to-implement package. Diversification with a focused tilt creates the perfect vehicle for running the long race so that your new "next big thing" doesn't become your last.