Hedged or Unhedged? Let relative strength figure it out.

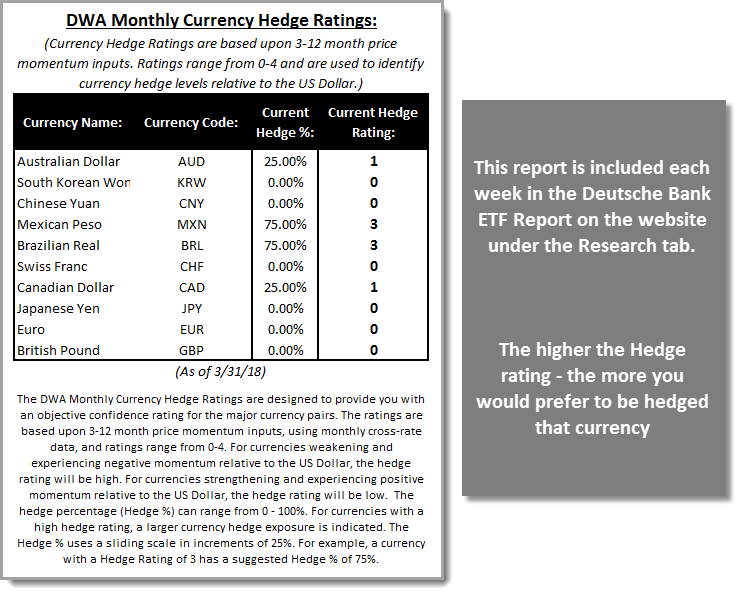

Each week (Tuesdays) we publish a Deutsche Bank ETF Report, which is located under the Research tab on the website. Included in that report is the exclusive DWA Monthly Currency Hedge Ratings. This report is designed to analyze 10 major currencies around the world and indicate whether or not you would rather be invested in pure equity exposure to that country or if you would be better off hedging your exposure. We use a scale from 0-4 to judge this relationship, a higher number indicates that a higher percentage of exposure to that currency should be hedged. These ratings are updated on a monthly basis and serve as a useful guide to those of you investing internationally. For example, the Brazilian Real (BRL) comes with a Hedge Rating of 3, suggesting that we should currently be hedging the majority of exposure to this currency.

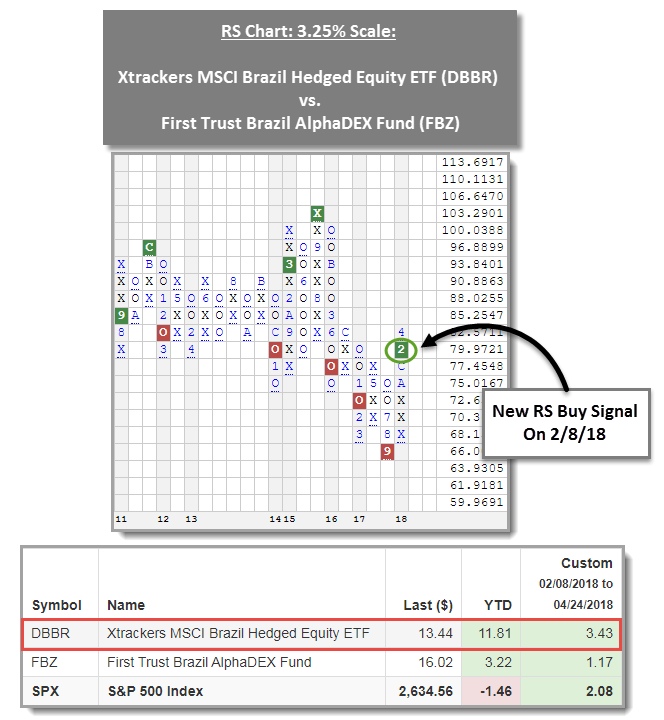

When we turn to relative strength to assist us with making the decision whether or not to be hedged or unhedged, we are presented with further confirmation of the hedge rating for Brazil shown above. Take for example the Xtrackers MSCI Brazil Hedged Equity ETF DBBR versus the First Trust Brazil AlphaDEX Fund FBZ. When plotting this relationship on a relative strength Point & Figure chart (shown below) we can see this chart gave a buy signal on February 8th this year favoring DBBR (since it is the numerator in the equation). This buy signal indicates we would rather be invested in DBBR versus FBZ. Since this relative strength buy signal, DBBR has gained 3.43% while FBZ is up 1.17%. On a year-to-date basis, DBBR’s lead has extended, as it has gained 11.81% compared to just 3.22% for FBZ. Those with exposure to Brazil may wish to consider allocating this part of the portfolio to a hedged solution like DBBR at this time. When we look at its trend chart, we can see it has given three consecutive buy signals, offers a fund score in excess of 4, and currently trades at a multi-year high.