The State Street Fixed Income Model (SSFIXED) turns seven next week. We take a look at the current make up of the model and how it has performed over the years.

The State Street Fixed Income Model SSFIXED will turn seven years old next week – the model went live on our site on April 27, 2011 – therefore we thought this would be an opportune time to take a look at the current makeup of the model and how it has performed over the years.

SSFIXED is based on a relative strength matrix – the 20 ETF universe is ranked according to relative strength and the model selects the top four funds. If an ETF falls sufficiently in the matrix, it is removed from the model and replaced by the highest ranked fund that is not already a model holding. Through this process, the model seeks to take advantage of current themes and allocate towards areas of strength in the market. The model is currently allocated 75% to foreign bond funds and 25% to convertible bonds, which is in-line with the recent themes of a weak U.S. dollar and strong equity market. It also allocated away from rate-sensitive instruments, e.g. U.S. Treasuries, which have recently shown weakness as a result of rising rates in late 2017 and early 2018.

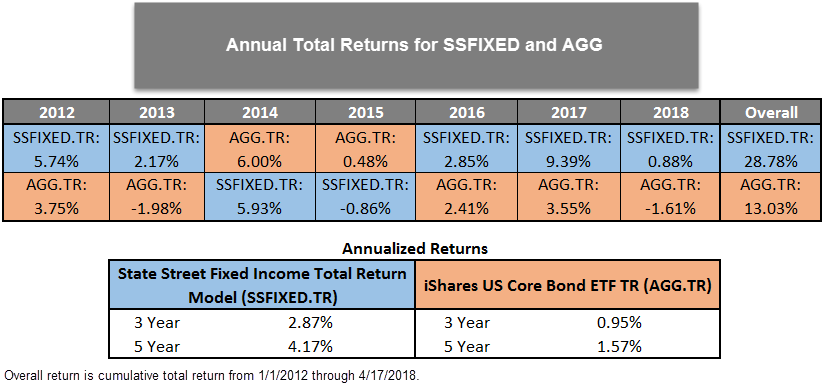

As you can see in the image below, SSFIXED has outperformed the iShares US Core Bond ETF AGG in four out of the six full calendar years since its inception and on an annualized basis has more than doubled the performance of AGG over the trailing one- and five-year periods.

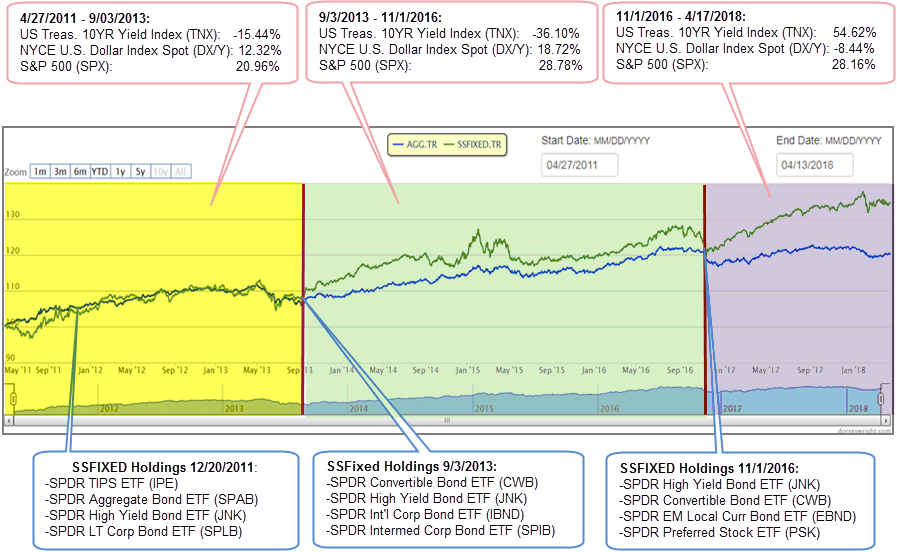

At times, the performance of SSFIXED can look very much like that of AGG, as it did from its inception through September 2013. Over that period, the US Treasury 10YR Yield Index TNX declined by about 15% - a generally positive environment for U.S.-rate-sensitive securities, such as Treasuries and investment grade corporates. As you can see from our snapshot during that period, the makeup of SSFIXED was similar to what we would expect to find in AGG, including Treasuries, SPDR’s U.S. aggregate index tracking fund, and investment grade corporates.

Around September 2013, we begin to see some dispersion between SSFIXED and AGG. The 9/3/13 snapshot shows SSFIXED had exposure to convertible bonds, high yield bonds, int'l corporate bonds, and intermediate corporate bonds. At this point, SSFIXED's exposure looks very different than that of AGG, which would have been dominated by U.S. Treasuries and U.S. investment grade corporates. SSFIXED's holdings in high yield bonds and convertibles wound have positioned it to benefit from the strong equity market that was then in place. Later in the period, we see that although the absolute level of SSFIXED is higher, its movement looks very similar to AGG. At that point, SSFIXED had rotated back to rate-sensitive funds as falling rates rewarded interest rate exposure, leading to relative strength gains in those segments of the fixed income market.

In the final period of our analysis, 11/1/2016 – 4/17/18, we see significant dispersion between AGG the SSFIXED model. Over this period, TNX rose by more than 54%, a difficult environment for a rate-sensitive fund like AGG. Unlike AGG, however, SSFIXED was able to pivot away from rate-sensitive exposure. In the final snapshot, we see that SSFIXED held high yield bonds, convertible bonds, local currency denominated foreign bonds, and preferred stock. Which made it relatively insensitive to rising rates and also made it well-positioned to benefit from the weakening U.S. dollar and robust equity market over that period.

One of SSFIXED's primary advantages is its adaptability. It has the ability to look like a rate-sensitive fund, like AGG, when rates are falling and that is where strength lies within the market. On the other hand, however, unlike AGG, it has the ability to modify its allocation to areas such as foreign bonds and convertibles in order to reduce its rate sensitivity in a rising rate environment and take advantage of other themes a la a weakness in the U.S. dollar or a strong equity market.

On June 01, 2016 SPDR ETFs launched the SPDR Dorsey Wright Fixed Income ETF DWFI that seeks to track the Dorsey Wright Fixed Income Allocation Index DWAFIR, which is based on the State Street Fixed Income Model strategy. For more information on the ETF, visit the SPDR ETFs website here.