As retail continues to adjust to the new norm of higher online sales and lower foot traffic to brick and mortar stores, the question for public and private REITs will be, what category do you fit in?

Investments continue to become increasingly more complicated as companies expand global reach and new alphabet soup strategies are being released that have the latest portfolio tilt. Investing in real estate is one of the longest standing investment traditions in the US and continues to be one of the most popular, because it is simple. Buy a building(s) hopefully at a fair price and hold them until you are ready to sell and collect rents along the way. No matter if it is one building or multiple, the concept stays the same. If you own Simon Property Group (SPG) one of the largest operators of malls in the US, a quick drive from our Pasadena office will take you to one of four malls they have in the area. Last weekend I had to venture to the mall for the first time in several months for a last minute gift. I along with 80 million other Americans have Amazon prime, allowing us to forgo the dreaded Saturday mall trip in exchange for the warm glow of a screen when gift shopping.

Malls and large shopping centers are feeling the effects of this change and are in a moment of flux as technology continues to shape the landscape of retail. JC Penny, Sears and Macy's have continued to announce store closures as consumers utilize large department stores less and online shopping continues to grow. A quick Google search shows numerous articles back to 2014 predicting the death of the American mall. While hundreds of malls have closed over the past decade many have continued to take steps to ensure their survival. In response to the growing vacancies mall owners are adapting and changing the landscape of the once vibrant centers of commerce and teenage angst. Large vacated space are getting new life as entertainment centers, grocery stores and fitness centers among other mixed use development.

“Sales of apparel tenants at GGP’s properties declined by 1.8% in the most recent quarter, compared with gains in electronics, food, home furnishing, health and personal care segments. Theaters, mall entertainment, supermarkets and other categories GGP counts under "miscellaneous" were among the top performers, with sales up 6.7%.”

Source: https://retail.emarketer.com/article/changing-face-of-american-malls/590ce365ebd400097ccd5f99

One of the more surprising additions has been the addition office space and medical offices. The Wall street Journal profiled a mall in Michigan that has a new tenant, Ford Motor Company.

“In April, Ford moved its entire engineering and purchasing staff into space once inhabited by department-store chain Lord & Taylor. Ford is now the mall’s largest tenant, with 240,000 square feet of space.”

As retail continues to adjust to the new norm of higher online sales and lower foot traffic to brick and mortar stores, the question for public and private REITs will be, what category do you fit in? Are malls that are introducing office space no longer classified as retail or are we entering an era of a new hybrid? If like most advisors real estate is a part of your allocations this may be a time to reexamine your holdings.

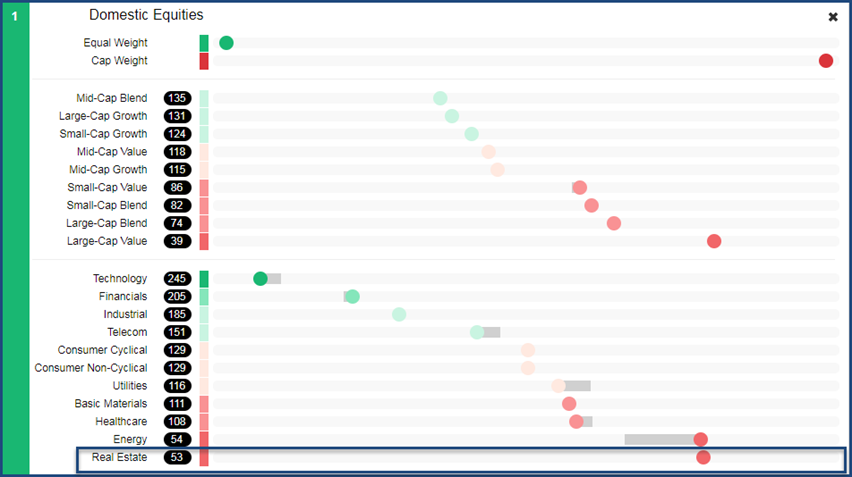

While in D.A.L.I. Domestic Equities are still in the number one position, real estate possesses the weakest relative strength compared to the other ten broad sectors.

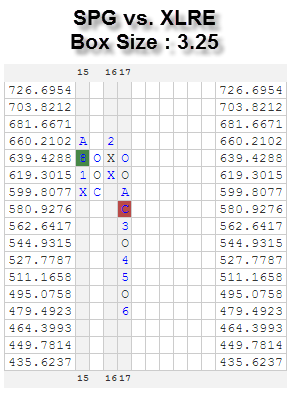

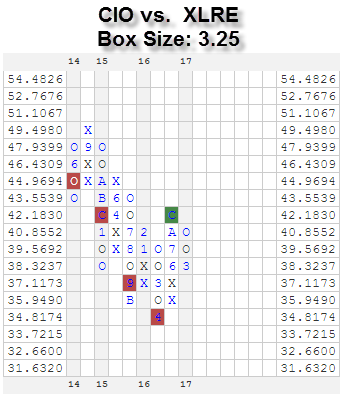

However as changes continue to take place in the retail space we may see new life from names that have been beaten up over the past few years. Below is the RS chart for the retail REIT giant Simon Property Group SPG and the office space focused City Office REIT CIO vs the broad REIT sector (Real Estate Select Sector SPDR Fund XLRE).

While both have had a hard time over the last couple of years, SPG continues to be on a sell signal while CIO has returned to a buy signal last December. While the chart is not particularly compelling, it shows what many investors have seen coming for the past several years, retail is in trouble.

We wrote several weeks ago about the importance of having a well-defined universe and knowing the role that each security has in the portfolio. If you still view real estate as a source of continued positive performance and healthy dividends in this low rate environment, this may be the time to do a checkup on your holdings. We looked at several real estate ETF’s including IYR, RWR and VNQ. We found that all have a significant holding in retail REIT’s. If you are concerned with exposure to retail and are looking for an ETF that does not have exposure to retail you may want to consider REZ. While in our Global Macro strategy we have the ability to own REITS, we currently do not have exposure to the asset class. We instead are looking to other US and International equities to drive the portfolio forward.

For more information on any of our SMA strategies please contact Andy Hyer, Andyh@dorseymm.com

Each investor should carefully consider the investment objectives, risks and expenses of any Exchange-Traded Fund (“ETF”) prior to investing. Before investing in an ETF investors should obtain and carefully read the relevant prospectus and documents the issuer has filed with the SEC. ETFs may result in the layering of fees as ETFs impose their own advisory and other fees. To obtain more complete information about the product the documents are publicly available for free via EDGAR on the SEC website (http://www.sec.gov) There are risks inherent in international investments, which may make such investments unsuitable for certain clients. These include, for example, economic, political, currency exchange, rate fluctuations, and limited availability of information on international securities. Past performance does not guarantee future results. In all securities trading, there is a potential for loss as well as profit. It should not be assumed that recommendations made in the future will be profitable or will equal the performance as shown. Investors should have long-term financial objectives when working with Dorsey, Wright & Associates.