Today we review the "check-a-month" strategy to consider for clients seeking income is the “check-a-month” concept that provides monthly income for investors, helping to enhance any income they may be receiving from other sources.

After a near term peak in Q1 of this year, interest rates have resumed a downward trajectory. Both the US Treasury 10-Year Yield Index TNX and the US Treasury 20-Year Yield Index TYX have fallen into negative trends and completed new sell signals earlier this week, at 21.25 (2.125%) and 27.75 (2.775%), respectively. While these are certainly not the lowest levels we've witnessed in recent years, it is fair to say that the low rate environment persists. As a result, the door remains open for high dividend paying stocks as an alternative.

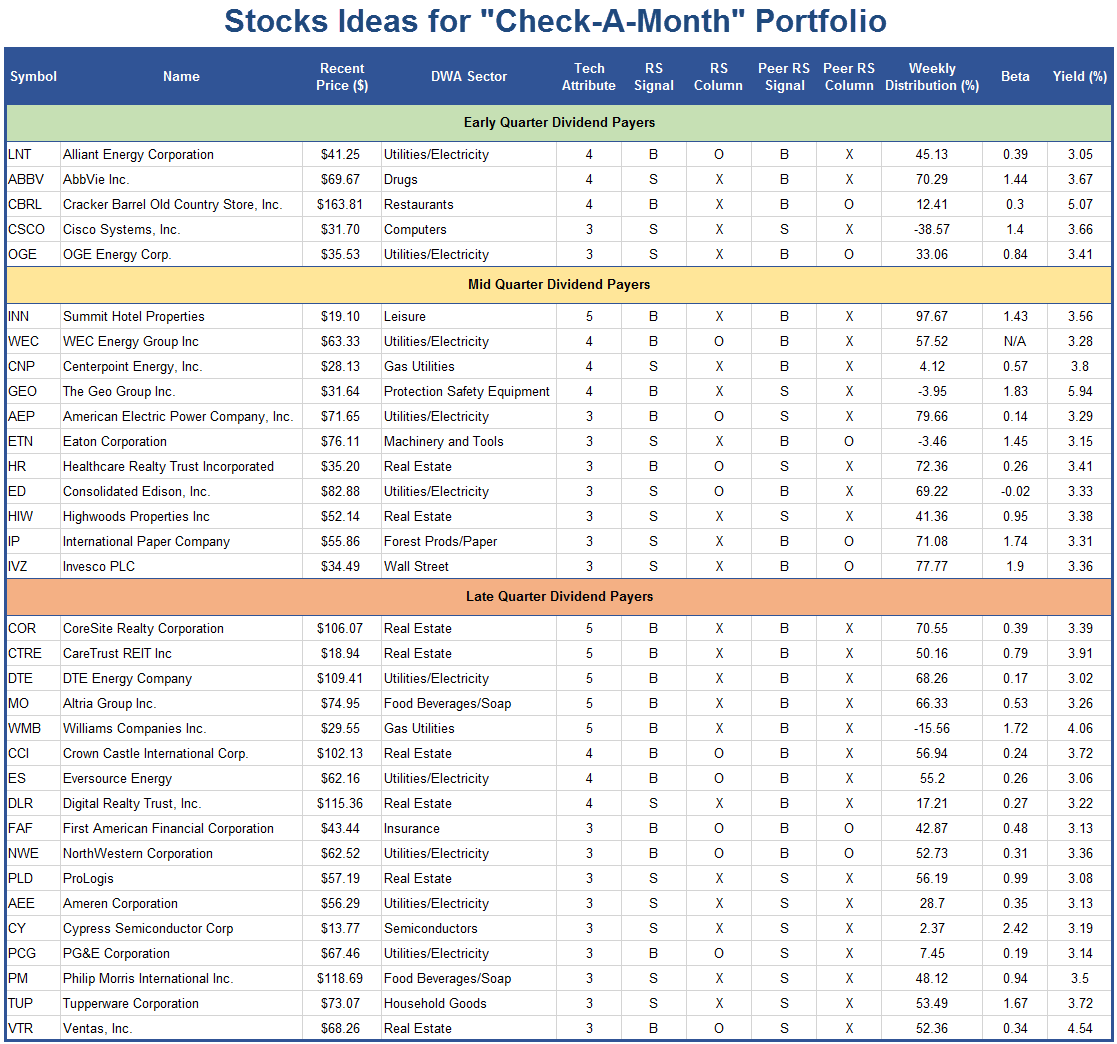

One strategy to consider for clients seeking income is the “check-a-month” concept that provides monthly income for investors, helping to enhance any income they may be receiving from other sources. When putting together the list of ideas, it is important to find high yielding stocks that also have a positive technical picture, allowing both for income and capital appreciation. After all, the dividend yield of 3% for a stock becomes almost meaningless when the share price drops 20%. We can leverage the tools on the DWA research platform to help us identify positions that meet both criteria. For instance, using the Query function we can identify 242 stocks in the S&P 1500 universe that have a dividend yield of 3.0% or greater. However, only 65 of those stocks are currently in a positive trend with at least three positive technical attributes. So, while there are a number of potential ideas for stocks to include in a yield portfolio (strictly on dividend yield alone), you can add value by identifying those with the characteristics that make viable investment choices as well.

Below is a list of the basic criteria that we used in the Query Function:

- S&P 1500 Universe

- Price = $10 or greater

- Optionable

- In a Positive Trend (Above its bullish support line)

- Chart on PnF Buy Signal

- Technical Attributes = 3, 4 or 5 for 5'er

- Dividend Yield = 3.0% or greater

- Average Daily Volume = 200,000

The screen above left us with 44 results, which we whittled down to our final list of 33 actionable ideas. From there, we categorized each of the stocks into one of three groups based one when they typically pay their dividend.

- Early Quarter Dividend Payout (January, April, July, and October)

- Mid Quarter Dividend Payout (February, May, August, November)

- Late Quarter Dividend Payout (March, June, September, December)

The idea behind the construction of this portfolio is to provide a steady stream of income throughout the year in your client's portfolio (ideally with a check each month of the year).

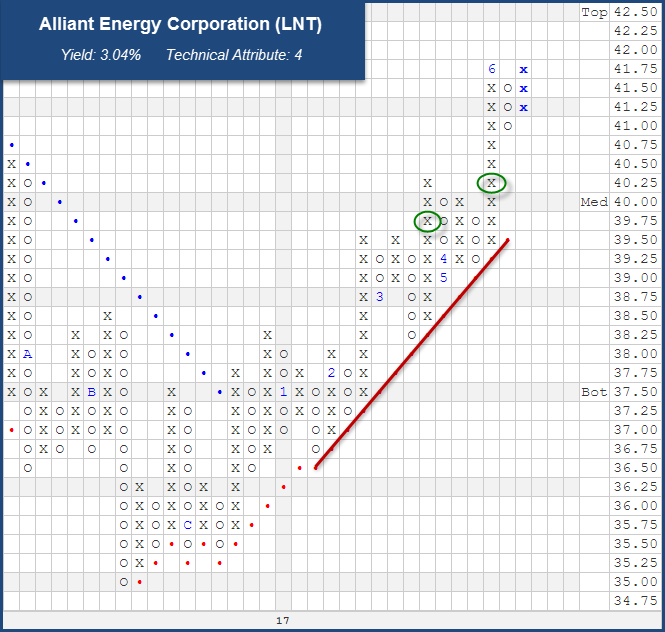

LNT Alliant Energy Corporation ($41.56) - Utilities/Electricity - LNT is a name from the "Early Quarter Payers" that offers a yield just north of 3%. The stock is a 4 for 5'er within the favored Electric Utilities sector and currently ranks in the top half of the sector matrix, ranking 19th out of 52 stocks. Over the course of the last few months it has completed consecutive buy signals (a shakeout in March, followed by a bullish triangle in May), and is now within one box of completing a potential double top at $42 on its 0.25-point chart. New positions can be taken on in the low $40's, while $38 can be used as a potential stop, which would take out its near term positive trend line and its March pullback low.

ETN Eaton Corporation ($76.00) - Machinery and Tools - From the list of "Mid Quarter Payers" ETN is a name that caught our eye for a few reasons. It made our list due to its 3.2% yield that is paired with a positive trend and buy signal. It managed a new high at $79 in May and has since pulled back to the middle of its 10-week trading band. New positions can be taken on in the low-mid $70's, while a violation of its trend line at $63 offers a reasonable stop.

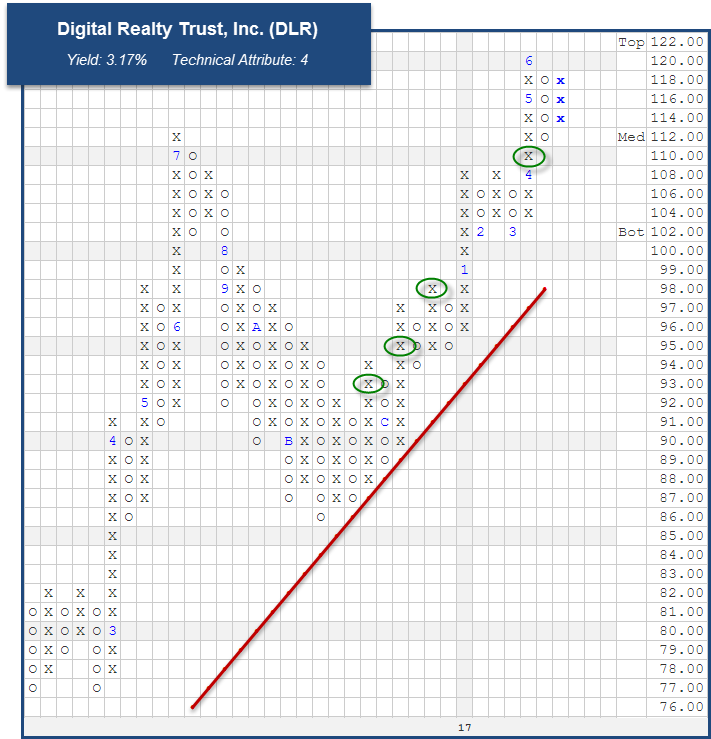

DLR Digital Realty Trust, Inc. ($118.28) - Real Estate - Out of the three categories, we had the most names in the "Late Quarter Payers" group. DLR is among those in that group, offering a technical attribute rating of 4 and a yield of 3.17%. It sits in the top quartile of the favored Real Estate sector RS matrix, which is a group that is well represented in the table above. So far this year it has been consistent with a steady climb higher, providing consolidation phases along the way which now serve as support levels. New positions can be initiated at current levels, with a stop provided at $99, a potential trend violation.