OEX Matrix Developments

The S&P 100 Index OEX Matrix is comprised of roughly the 100 largest names in the S&P 500 Index SPX as defined by market capitalization. It is one we watch regularly since it keeps the pulse of some of the most widely held names within the US stock market. Today, we wanted to compare the top ten stocks in the OEX matrix to six months ago (6/12/2017 compared to 12/12/2016). You may access these rankings at any time by viewing the Premade Matrices under Database Tools. Over the past six months of trading, four of the members have rotated out, while six remain. We have highlighted those six to show their movement within over the past six months. New members in the top ten include: Apple AAPL, Amazon.com In. AMZN, Priceline Group Inc. PCLN, and General Dynamics Corporation GD.

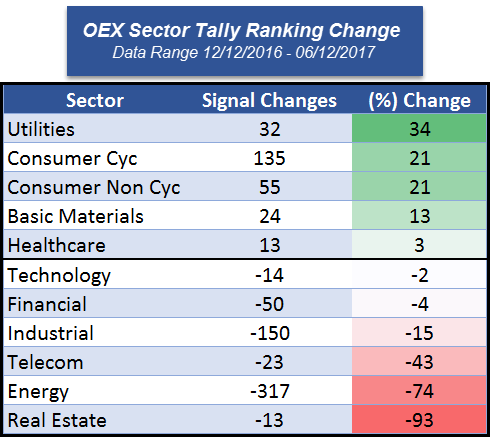

We wanted to drill down into the full OEX matrix a bit further to see what, if any, material shifts in sector leadership have taken place over the past six months. To do this, we looked to the Sector Tally Ranking, which simply ranks each sector by the total number of buy signals it has given. To do this, we split the OEX inventory into the 11 US Broad Sectors. We then totaled up the number of RS buy signals for each sector and tracked the number of signal and percent changes over the past six months.

Five sectors saw an increase in RS buy signals while six declined. Utilities experienced the largest improvement on a percentage basis, up 34% thanks to the likes of Exelon Corporation EXC and NextEra Energy Inc. NEE. Both Consumer Cyclical and Consumer Non-Cyclical saw an increase of 21% while Basic Materials saw a 13% increase. Technology remains relatively unchanged, as its buy signal tally is down just 2% over the past six months. Apple Inc. AAPL, which now ranks #1 in the OEX matrix, and Paypal Holdings Inc PYPL gained a combined 74 signals for the Tech sector. However, QUALCOMM Incorporated QCOM lost 64 signals. The Real Estate sector saw the biggest drop in percentage down -93%, but Energy lost the most signals (-317) and was down -74%. Telecom (-43%), Industrial (-15%), and Financials (-4%) also saw a decrease over the last six months.