Today we discuss the rules and methodology behind the ALPS Target Income Model (ALPSINCOME.TR)

On April 13th, 2017, we launched the ALPS Target Income Model ALPSINCOME.TR, and we wanted to spend time today discussing the methodology and rules of the Model. As the name of the Model suggests, it is designed to be income-generating while also looking to provide capital appreciation through an allocation to a line-up of ETFs. In addition to the Model methodology and rules, we will also discuss how the strategy has performed since inception and also take a look at performance relative to yield. We’ll wrap things up by touching on how the Model can be implemented within an equity allocation.

Methodology & Rules

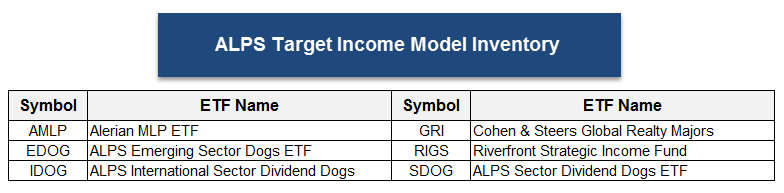

So, how does the ALPS Target Income Model determine which ETFs to own in the portfolio? Well, as is the case with pretty much all of our strategies, relative strength is the driver behind the decision making process. Relative strength offers a logical, organized method for identifying leadership and the potential for relative outperformance. By utilizing a relative strength matrix we are able to compare and then rank the ETFs within the ALPS Model line-up. The top three ETFs within the line-up are bought and only sold when the fall sufficiently out of favor within the relative strength matrix. Additionally, an ETF is only added when another ETF is removed. At that point, the highest ranking ETF that is not already own is added to the portfolio. The portfolio will remain 100% invested at all times, and the strategy is evaluated on a monthly basis. At each evaluation the portfolio is rebalanced regardless if there is a change so that each position is equally-weighted. Additionally, the portfolio must have a yield of at least 4%. If the portfolio’s yield is less than 4% it will increase the number of positions in the portfolio in increments of 5% until the yield requirement is reached. In the bullet points below, we have outlined the rules for the strategy, and the Model Inventory can be found below.

Systematic Portfolio Rules:

- The Model’s inventory consists of six ALPS income-focused ETFs, which include US Equity ETFs, International Equity ETFs, and MLPs; see potential members in the list below.

- Remains 100% invested at all times.

- A relative strength matrix is created to compare members of the inventory to one another.

- The top three ETFs are bought and are only sold when they fall sufficiently out of favor versus the other potential members on a relative strength basis.

- A new ETF is only added when one sector falls out of favor.

- Model is evaluated and rebalanced on a monthly basis whether there is a change or not so each position is equally-weighted.

- The Portfolio must have a yield of at least 4%. If the Portfolio yield is less than 4% it will increase the number of positions in the portfolio in increments of 5% until the yield requirement is reached.

Model Performance

The rules-based approach employed by the ALPS Target Income Model allowed us to create a hypothetical back-test of the Model strategy. Using the daily return of the underlying indices, we were able to extrapolate back in time where the ETF components would have approximately been trading historically assuming they tracked the underlying index. From that information, relative strength charts were created for each ETF within the inventory and evaluated based upon the portfolio rules explained above.

Since inception, the ALPS Target Income Model has cumulatively gained 58.34%, including dividends (12/30/2011 to 5/15/2017). For further perspective on how the model has performed, we took a slightly different approach from our normal hypothetical growth of $100,000. In the graph below we have shown the yield for the Model going back to inception at the beginning of 2012, as well as the 12-month rolling total return for the strategy itself (represented by the shade region). The way we have shaded the graph below is meant to represent the capital appreciation (or depreciation) above the yield that the strategy offers. In other words, it is a way to convey returns above (or below) just the income stream that the strategy provides us. As we can see, the 12-month rolling total returns indicated that the strategy provide appreciation above just the yield from roughly December 2012 to December 2014. After depreciating from that time until June of 2016, we have since seen the strategy again provide appreciation above just the yield.

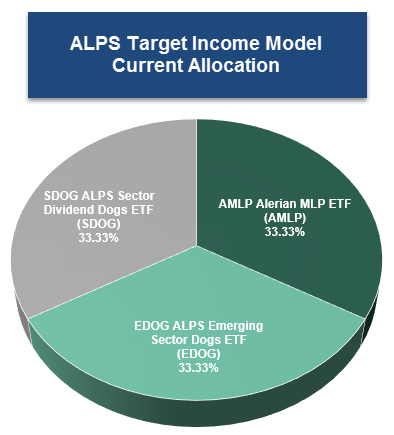

Current Allocation

Below we have the current holdings of the ALPS Target Income Model. At this time, the Model is well positioned and maintains exposure to the Alerian MLP ETF AMLP, the ALPS Emerging Sector Dogs ETF EDOG, and the ALPS Sector Dividend Dogs ETF SDOG. It is worth noting that we have not seen a change to the Model since its launch back in April.

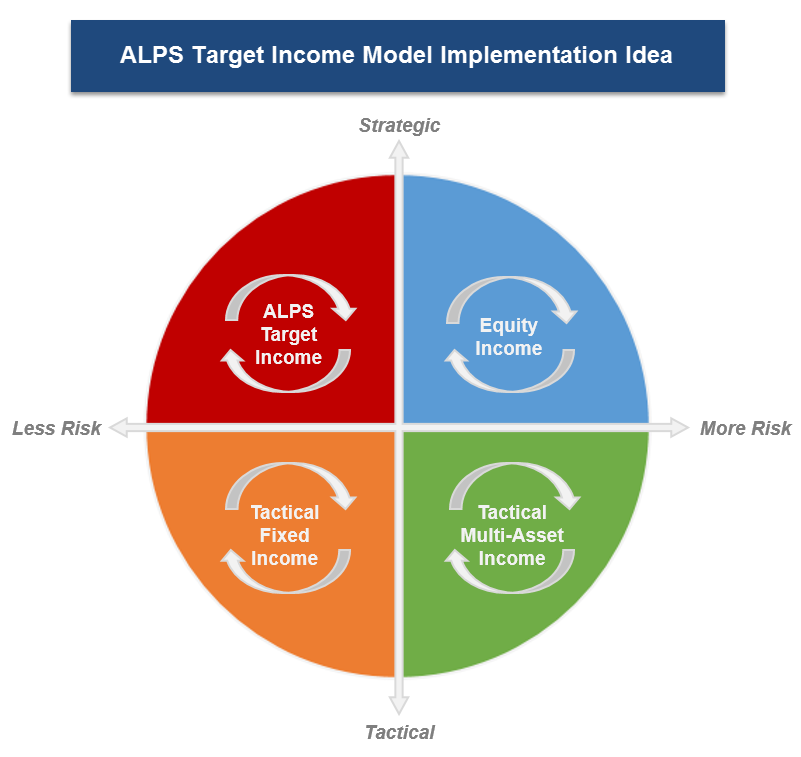

Implementation Ideas

We wanted to wrap up our discussion today by touching on ways that we can utilize the ALPS Target Income Model within an allocation. Before we delve into the image below, we wanted to first note that the ALPS Target Income Model could be positioned as the income-generating sleeve of an equity allocation. One option could be to use a core-satellite approach in which the core could be a broad based strategy or fund, while the satellite could potentially be a combination of a sector rotation strategy and the ALPS Target Income Model. In the image below, we have shown a second way that the ALPS Target Income Model could be utilized. In this case we have shown an income portfolio in which each of the income sleeves represents 25% of the allocation. Along with an equity income strategy, a tactical fixed income strategy, and a tactical multi-asset strategy, the ALPS Target Income Model can be plugged into an income portfolio and provide tactical rotation along with an income stream. For other ways to utilize the ALPS Target Income Model, be sure to consult an analyst.