Some perspective on the environment for tactical asset allocation over the last couple years and a review of the role that this category can play for investors.

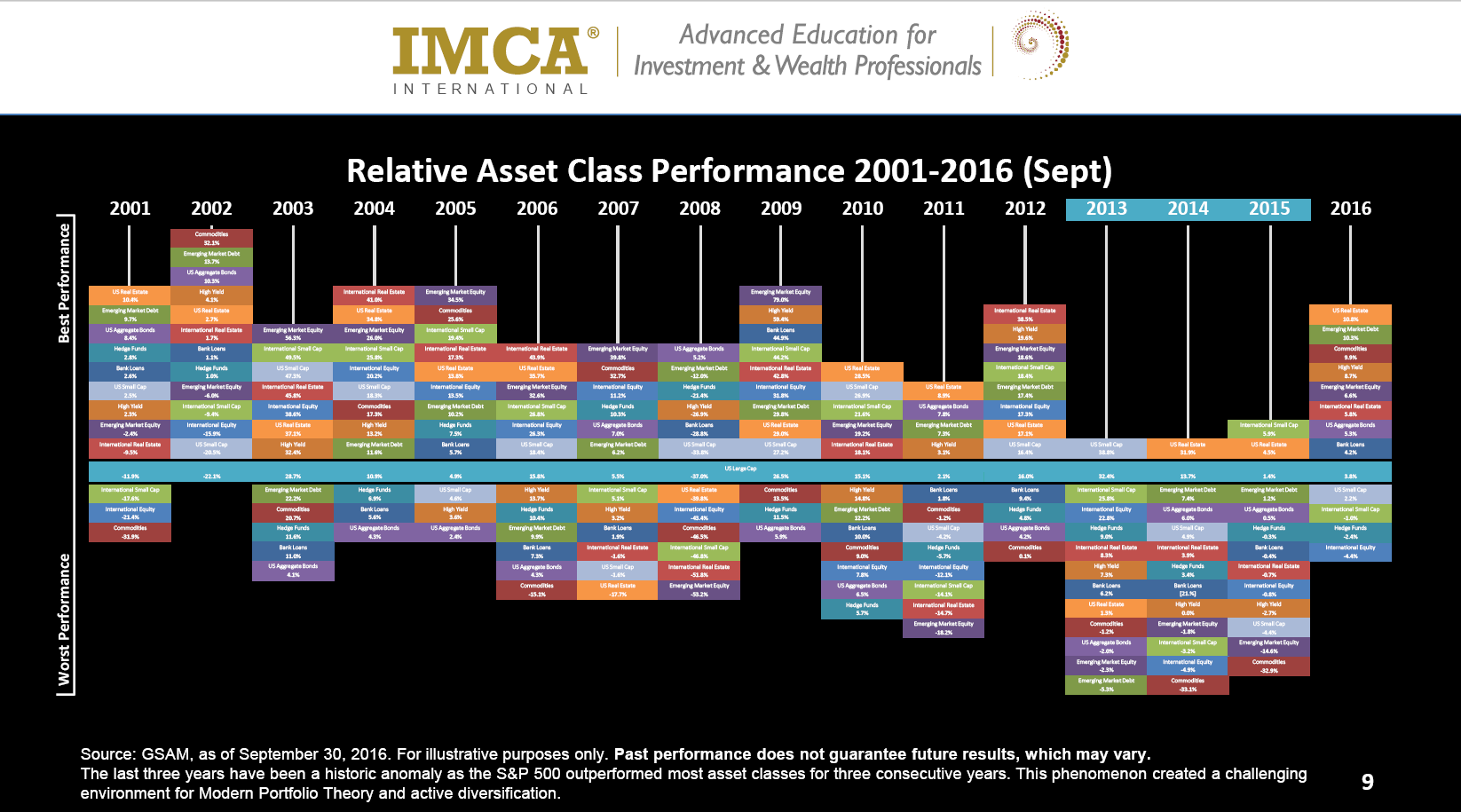

I recently saw a presentation by Nadia Papagiannis, CFA, of Goldman Sachs Asset Management that provided some important insights into the landscape for asset allocation. Consider the table below, which compares the performance of a number of asset classes (Commodities, Emerging Market Debt, U.S. Bonds, High Yield, U.S. Real Estate, International Real Estate, Bank Loans, Hedge Funds, Emerging Market Equities, International Equities, International Small Cap, U.S Small Cap) to the performance of U.S. Large Cap Equities.

What stands out about the years 2013-2015? Very few asset classes outperformed U.S. Large Cap Equities during those years. This goes a long ways towards explaining why most people who have employed some form of asset allocation (anything that diversified away from Large Cap US Equities) have probably been left underwhelmed with their performance during those three years.

True to the human condition, recency bias has been in full effect in recent years as it applies to tactical allocation with people questioning the category's merits. However, I would suggest that clients may benefit from reviewing a table like that shown above to remember that not all years are like 2013-2015 (if they were there wouldn't be much need to own anything besides U.S. Large Cap Equities).

To me, there are five key reasons why investors would do well to consider making tactical asset allocation part of the mix:

- Asset classes go through bull and bear markets. A relative strength-driven tactical asset allocation strategy can seek to overweight those asset classes in favor and underweight those asset classes that are out of favor.

- Many investors can't handle the volatility associated with a buy and hold approach of investing solely in U.S. Large Cap Equities. Tactical Asset Allocation has the potential to provide some diversification and help smooth out the ride.

- After seeing a couple year environment in which tactical asset allocation struggled, now may be a very good time to beef up that exposure or to make new allocation to tactical asset allocation.

- From a client management standpoint, my experience is that clients love to talk about the tactical portion of their overall asset allocation. Clients like to see how their portfolio is adapting to the current environment. Give them something they want (flexibility). This is very different than just giving into their emotional investment desires because a relative strength-driven asset allocation strategy objectively responds to market trends.

- Tactical Asset Allocation can be the glue that keeps a clients' hands off the more aggressive portions of their allocation that may be fully invested in Equities.

Dorsey Wright provides a full suite of tactical asset allocation tools and solutions such as our Global Macro SMA/UMA, The Arrow DWA Tactical and Balanced Funds, The Arrow DWA Tactical ETF, DALI, Tactical Tilt Models, and more. If you would like to discuss different tools and solutions in this area, please call Andy Hyer at 626-535-0630 or andyh@dorseymm.com.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value.

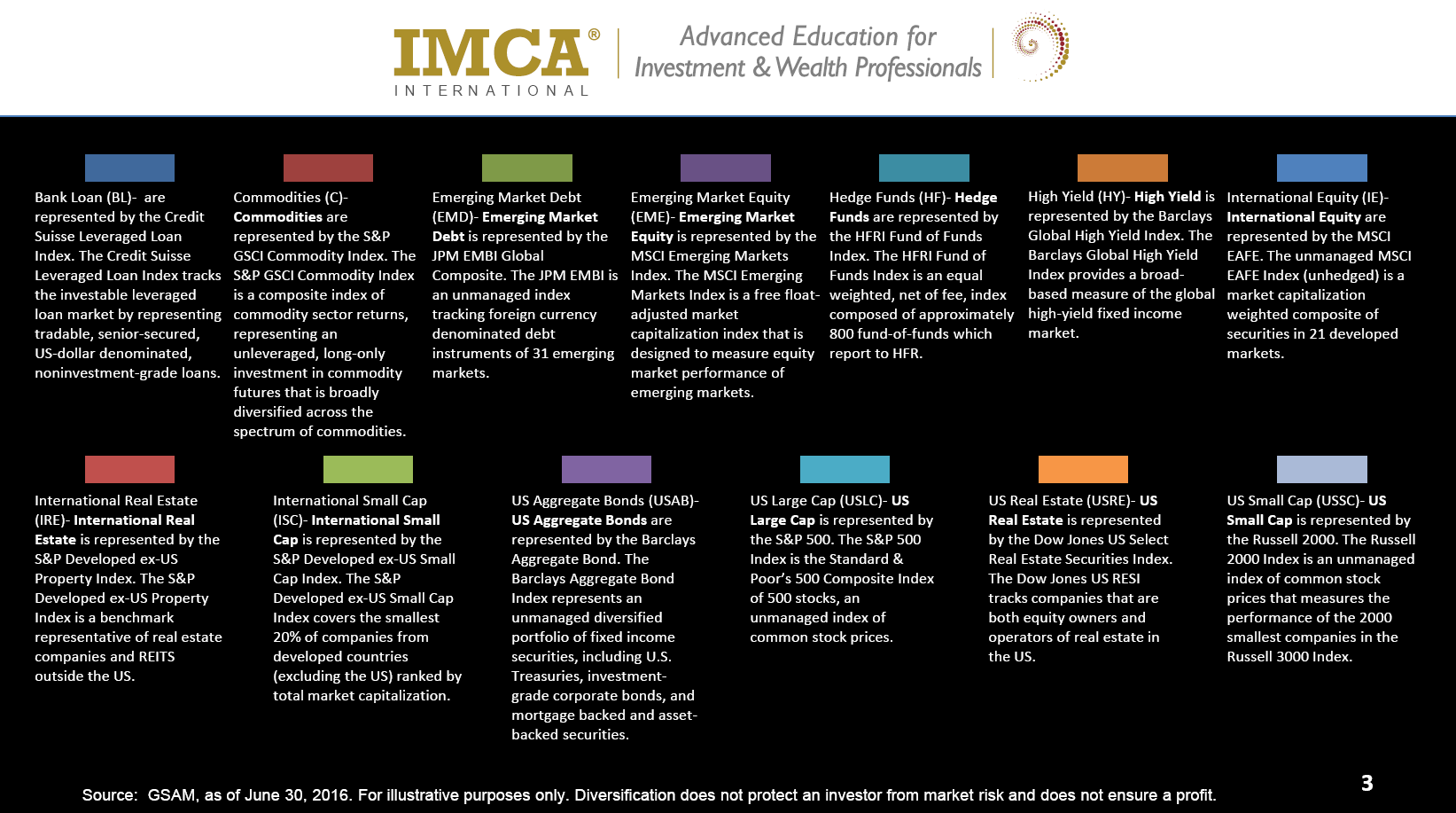

Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices. The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that the Investment Manager believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein. The exclusion of "failed" or closed hedge funds may mean that each index overstates the performance of hedge funds generally. Starting point selected given longest common index inception. HFRI FoF = HFRI Fund of Funds Composite Index; HFRI and related indices are trademarks and service marks of Hedge Fund Research, Inc. ("HFR") which has no affiliation with GSAM. Information regarding HFR indices was obtained from HFR's website and other public sources and is provided for comparison purposes only. HFR does not endorse or approve any of the statements made herein.