Please note that as of today, October 25th, the ALPS Target Income Model and report will be discontinued. Below we provide you with the model inventory and methodology so that you may keep running the model in the future yourself if you wish. Note the model symbol "ALPSINCOME.TR" will no longer be available. To download a PDF of the model rules and inventory, click here.

Model Name: ALPs Targeted Sector Rotation Model

Model Objective: Aims to own the highest RS names within the model universe while maintaining a targeted portfolio yield of at least 4.0%.

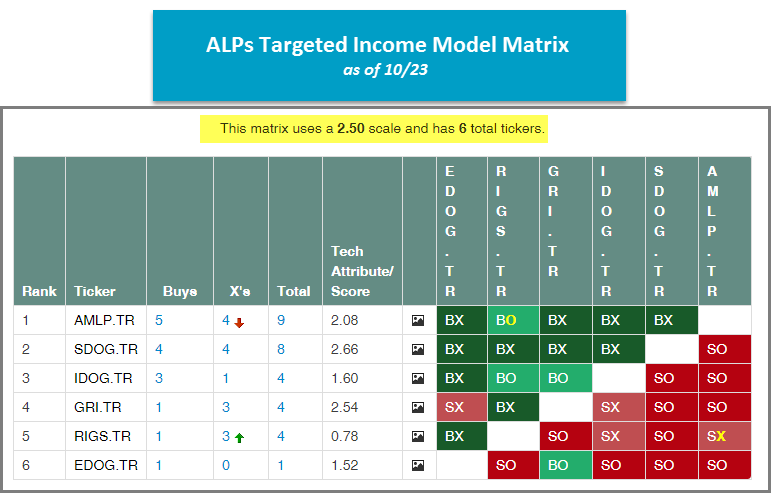

Matrix Scale: 2.50%

Matrix/Model Inventory:

- AMLP.TR

- SDOG.TR

- IDOG.TR

- GRI.TR

- RIGS.TR

- EDOG.TR

Review Schedule: The night before the first Wednesday of every month

Next Evaluation Date: Thursday, November 1st

Rules:

- Model owns the top 3 funds each month at 33% each in the model matrix as long as the Portfolio’s yield is >= 4.0%.

- If the total portfolio yield is less than 4.0%, the model will purchase the next highest ranked fund in the model matrix not currently owned in the model with a yield >=4.0% and will buy it in 5% increments until the portfolio yield is >=4.0%. The 5% is taken equally from the top three ranked funds.

Current Holdings and Weightings as of 10/23:

- AMLP.TR - 33.33%

- IDOG.TR - 33.33%

- SDOG.TR - 33.33%

Total Portfolio Yield as of 10/23: 5.19%

Model Benchmark: Total Return S&P 500 Index TR.SPXX

YTD Performance through 10/23:

- ALPS Targeted Income Model: -4.01%

- Total Return S&P 500: 4.09%

The ETFs with the most relative strength buy signals (suggesting outperformance) versus the others in the group are listed at the top. These ETFs should be overweighted in the portfolio. Those ETFs with the least amount of relative strength buy signals versus the others in the group are listed at the bottom. These ETFs should be underweighted in the portfolio.

ALPS Target Income Matrix

| Ticker | Name | Buys | Xs | Tech Attribute/ Score |

|---|---|---|---|---|

| SBIO | ALPS Medical Breakthroughs ETF | 14 | 3 | 3.71 |

| DTEC | ALPS Disruptive Technologies ETF | 13 | 6 | 4.54 |

| 11 | 6 | N/A | ||

| BFOR | Barron's 400 ETF | 11 | 4 | 3.93 |

| ENFR | Alerian Energy Infrastructure ETF | 9 | 10 | 3.07 |

| BUZ | Buzz US Sentiment Leaders ETF | 9 | 10 | 4.97 |

| EQL | Alps Equal Sector Weight ETF | 9 | 8 | 3.08 |

| SDOG | ALPS Sector Dividend Dogs | 9 | 5 | 2.65 |

| IDOG | ALPS International Sector Dividend Dogs ETF | 6 | 2 | 1.62 |

| AMLP | Alerian MLP ETF | 5 | 10 | 1.97 |

| USCI | United States Commodity Index Fund | 5 | 9 | 2.90 |

| RIGS | Riverfront Strategic Income Fund | 3 | 10 | 1.51 |

| GRI | Cohen & Steers Global Realty Majors | 3 | 8 | 2.62 |

| EDOG | ALPS Emerging Sector Dogs ETF | 3 | 3 | 1.59 |

| SGDM | Sprott Gold Miners ETF | 2 | 15 | 1.64 |

| SGDJ | Sprott Junior Gold Miners ETF | 0 | 12 | 1.35 |

The table below is a review of important technical data on a select group of ALPS ETFs. Significant changes within the past week are highlighted in Green if positive or Red if negative. This portfolio is designed to be used as a "radar" screen to bring your attention to potentially important technical changes that may require your attention and potential action. When evaluating the Fund Score, the strongest issues have scores of 4 or higher while those ETFs with scores below a 3 are no longer considered solid citizens.

| Symbol | Name | Price | Yield (%) | Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom | OBOS (Weekly) | ||

| AMLP | Alerian MLP ETF | 9.96 | 8.28 | Positive | Sell | O | 10.52 | -8W |

|

||

| BFOR | Barron's 400 ETF | 39.02 | 0.64 | Positive | X | 43.33 | -6W |

|

|||

| BUZ | Buzz US Sentiment Leaders ETF | 34.34 | 0.42 | Positive | X | 35.71 | -4W |

|

|||

| DTEC | ALPS Disruptive Technologies ETF | 25.24 | 0.00 | Positive | X | 27.76 | -5W |

|

|||

| EDOG | ALPS Emerging Sector Dogs ETF | 20.17 | 4.21 | Positive | O | 23.21 | -1W |

|

|||

| ENFR | Alerian Energy Infrastructure ETF | 20.59 | 2.84 | Positive | Sell | O | 21.93 | -9W |

|

||

| EQL | Alps Equal Sector Weight ETF | 67.82 | 2.15 | Positive | X | 70.32 | -5W |

|

|||

| GRI | Cohen & Steers Global Realty Majors | 42.00 | 4.36 | Negative | Sell | O | 43.40 | -6W |

|

||

| IDOG | ALPS International Sector Dividend Dogs ETF | 24.85 | 4.38 | Positive | Sell | O | 27.73 | -1W |

|

||

| RIGS | Riverfront Strategic Income Fund | 24.29 | 4.54 | O | 24.58 | -6W |

|

||||

| SBIO | ALPS Medical Breakthroughs ETF | 32.71 | 1.77 | Negative | Buy | X | 36.47 | -4W |

|

||

| SDOG | ALPS Sector Dividend Dogs | 42.89 | 3.69 | Positive | O | 45.34 | -6W |

|

|||

| SGDJ | Sprott Junior Gold Miners ETF | 24.85 | 0.19 | Negative | Sell | O | 28.71 | +6W |

|

||

| SGDM | Sprott Gold Miners ETF | 16.73 | 0.71 | Negative | Sell | O | 18.65 | +6W |

|

||

| USCI | United States Commodity Index Fund | 41.46 | 0.00 | Negative | O | 42.81 | +10W |

|

| Links to Additional Summaries |

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time to give us a general picture of whether the ALPS ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong relative strength ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness. Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell.

Legend:

- UPPERCASE indicates that the RS chart is on a buy signal.

- lowercase indicates that the RS chart is in a sell signal.

- GREEN lettering indicates the ETFs trend chart is on a buy signal.

- RED lettering indicates the ETF is on a sell signal.

- Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.

The ALPS ETF Portfolio is designed to identify major themes in the market place through the use of the Point & Figure relative strength tools. For more information on the portfolio construction and back testing, see the model info file on the models page.

ALPS Target Income Model ALPSINCOME.TR