Please note that as of today, October 25th, the ALPS Target Income Model and report will be discontinued. Below we provide you with the model inventory and methodology so that you may keep running the model in the future yourself if you wish.

Please note that as of today, October 25th, the ALPS Target Income Model and report will be discontinued. Below we provide you with the model inventory and methodology so that you may keep running the model in the future yourself if you wish. Note the model symbol "ALPSINCOME.TR" will no longer be available. To download a PDF of the model rules and inventory, click here.

Model Name: ALPs Targeted Sector Rotation Model

Model Objective: Aims to own the highest RS names within the model universe while maintaining a targeted portfolio yield of at least 4.0%.

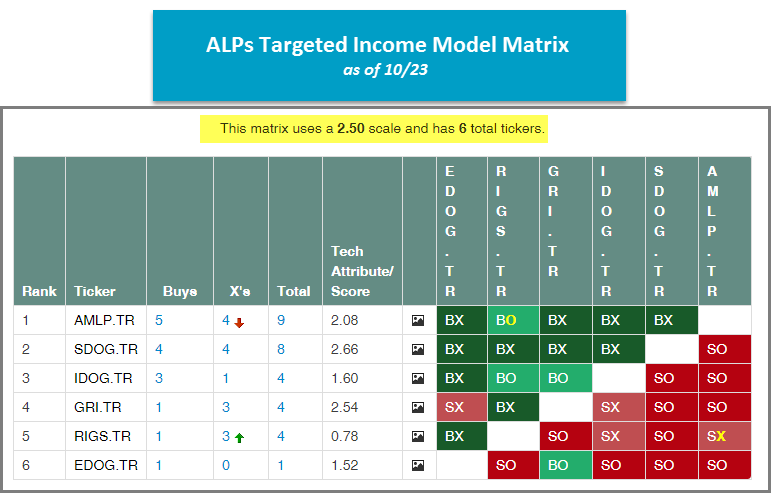

Matrix Scale: 2.50%

Matrix/Model Inventory:

- AMLP.TR

- SDOG.TR

- IDOG.TR

- GRI.TR

- RIGS.TR

- EDOG.TR

Review Schedule: The night before the first Wednesday of every month

Next Evaluation Date: Thursday, November 1st

Rules:

- Model owns the top 3 funds each month at 33% each in the model matrix as long as the Portfolio’s yield is >= 4.0%.

- If the total portfolio yield is less than 4.0%, the model will purchase the next highest ranked fund in the model matrix not currently owned in the model with a yield >=4.0% and will buy it in 5% increments until the portfolio yield is >=4.0%. The 5% is taken equally from the top three ranked funds.

Current Holdings and Weightings as of 10/23:

- AMLP.TR - 33.33%

- IDOG.TR - 33.33%

- SDOG.TR - 33.33%

Total Portfolio Yield as of 10/23: 5.19%

Model Benchmark: Total Return S&P 500 Index TR.SPXX

YTD Performance through 10/23:

- ALPS Targeted Income Model: -4.01%

- Total Return S&P 500: 4.09%