There are no changes to the ALPS Target Income Model this week. Please note that as of October 25th, this model and report will be discontinued. Over the last couple of weeks, both US and International Equities have come under some selling pressure. This is evident by the fact that much of the market has moved into oversold territory.

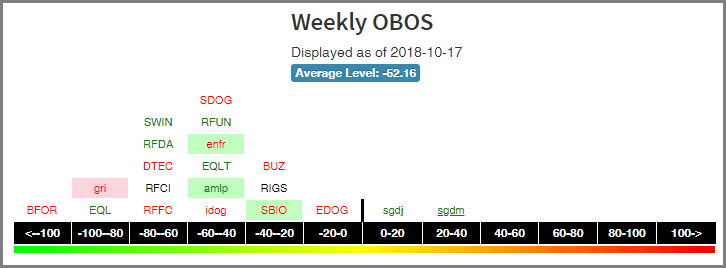

There are no changes to the ALPS Target Income Model this week. Please note that as of October 25th, this model and report will be discontinued. Over the last couple of weeks, both US and International Equities have come under some selling pressure. This is evident by the fact that much of the market has moved into oversold territory. We track the overbought and oversold characteristics of a security by calculating a security's weekly distribution using a 10-week trading band. When a security is above the middle of the band, then it's considered to be in overbought territory, and when it's below the middle, it's in oversold territory. When you aggregate this data and plot the securities on a curve, the Weekly Distribution Curve provides broader context and perspective about the overbought and oversold nature of the market. On the curve, the middle of the bell curve represents areas of the market that are "normally" distributed, with the far right being 100% overbought on a weekly distribution and the far left being 100% oversold on a weekly distribution.

With the exception of the Sprott Junior Minors Gold ETF SGDJ and the Sprott Gold Miners ETF SGDM, all of the Alps ETFs are in oversold territory with the average level being 52.16%. Most of the Alps Funds occupy the -60 to -40% area. The most oversold fund at this time is the Barron’s 400 ETF BFOR extreme reading of -118%. The least oversold fund at this time is the SGDM with an OBOS% reading of +34%. That said, investors can use this time to work into positions, especially those that are oversold yet still possess strength and are holding up on a technical basis.