Since there are no changes, we went through the thumbnails of the ALPS ETFs and the ALPS Equal Sector Weight ETF (EQL) caught our eye.

There are no changes to be made in the ALPS Target Income Model ALPSINCOME.TR.

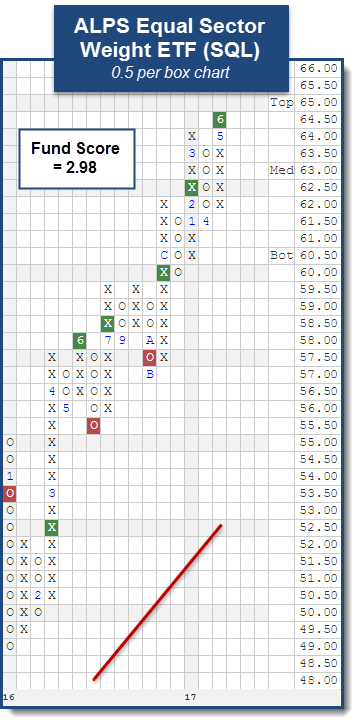

This week the ALPS Equal Sector Weight ETF EQL caught our attention. This fund seeks to own Large Capitalization equities within the 10 Select Sector SPDRs and the fund ebalances on a quarterly basis. When looking at its 0.5 per box chart, we can see a shakeout pattern began after it formed a double top at $59.50 between July and September before breaking a double bottom at $57.50 in October. The shakeout was initiated upon the reversal up into X’s following the election and was completed when EQL broke a triple top at $60. Demand continued to exhibit strength, as the ETF rallied to $62, made a higher bottom at $60 and completed a bullish catapult formation with a double top break in February at $62.50. The fund now trades at all-time highs in the mid $60’s after breaking its most recent double top on 6/2 at $64.50. The 0.5 per box chart shows a bullish price objective of $72.50 and a reward to risk ratio in excess of 2-to-1, if using $61 as a stop. EQL also comes with an attractive yield at roughly 2.70%. New positions are best served on a pullback from here with support coming at $61.50 and $60.