There are no model changes to report this week. We formally announce the closure of the VictoryShares ETF models.

As of March 30th, we will no longer publish the weekly VictoryShares ETF report. Additionally, the VictoryShares Equity Rotation Model (VSROTATION) and VictoryShares Equity Select Model (VSSELECT) will no longer exist on the NDW Research Platform. The models successfully remained on our platform for over two years and were designed to seek a variety of outcomes, including maximum diversification, dividend income, and downside mitigation, so for those currently following or seeking to follow either of the strategies, see below for an outlined review of the underlying methodology.

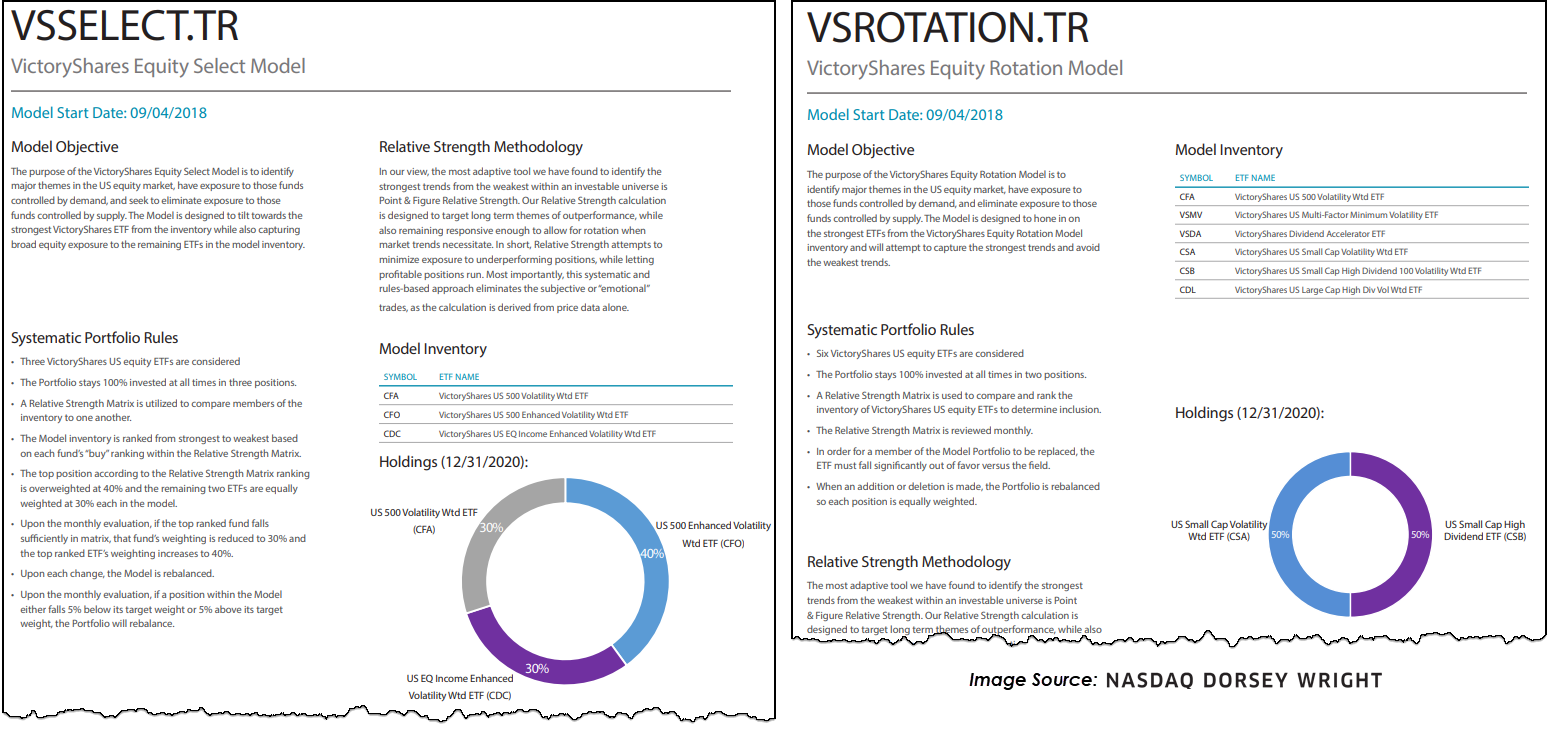

VSROTATION always seeks to identify major themes in the US equity market by staying fully invested in two of the six VictoryShares ETFs. A relative strength matrix (2.00 scale) is used to compare and rank the inventory of ETFs to determine inclusion. The strategy is reviewed at the beginning of every month and positions are only sold when they fall sufficiently out of favor (third or lower). The last trade for this portfolio happened in November of 2020, where the VictoryShares US Small Cap Volatility Wtd ETF (CSA) reentered the model to join the VictoryShares US Small Cap High Dividend 100 Volatility Wtd ETF (CSB). VSROTATION returned just shy of 28% in 2020, outperforming SPX by about 9.5%. VSROTATION is also off to a strong start in 2021 with a YTD return of 23.45% (through 3/15). Click here for the full info file.

VSSELECT also seeks to identify major themes in the US equity market by staying fully invested in three VictoryShares ETFs. A relative strength matrix is used to rank the inventory members, but unlike VSROTATION, VSSELECT overweights the top position at 40% and the remaining two receive an equal weighting of 30%. Upon a monthly evaluation, if a position within the model falls or appreciates more than 5% beyond its target weight, the portfolio will rebalance. The last trade for this strategy happened in November of 2020 when the VictoryShares US 500 Enhanced Volatility Wtd ETF (CFO) received the overweight. VSSELECT returned 13.73% in 2020 and currently posts a YTD return of 9.91%, outpacing the S&P 500 (SPX) by over 3.5%. Click here for the full info file.

If you have any questions or concerns on these models, please give us a call at 804-320-8511 or email us at dwa@dorseywright.com.