In absence of model changes this week we highlight two more VictoryShares ETFs printing new ATHs, along with income generation in a low rate environment

Although rates have risen recently, they continue to trade at historically low levels, making it difficult for investors to generate income through traditional sources like fixed income. Said differently, with the 10-Year US Treasury Yield Index (TNX) hovering around 1.175%, the current environment is not one that is particularly favorable to investors with a requirement for steady income. As a result, we can look to equity market products like the US EQ Income Enhanced Volatility Wtd ETF (CDC) and US Small Cap High Dividend 100 Volatility Wtd ETF (CSB), each from VictoryShares.

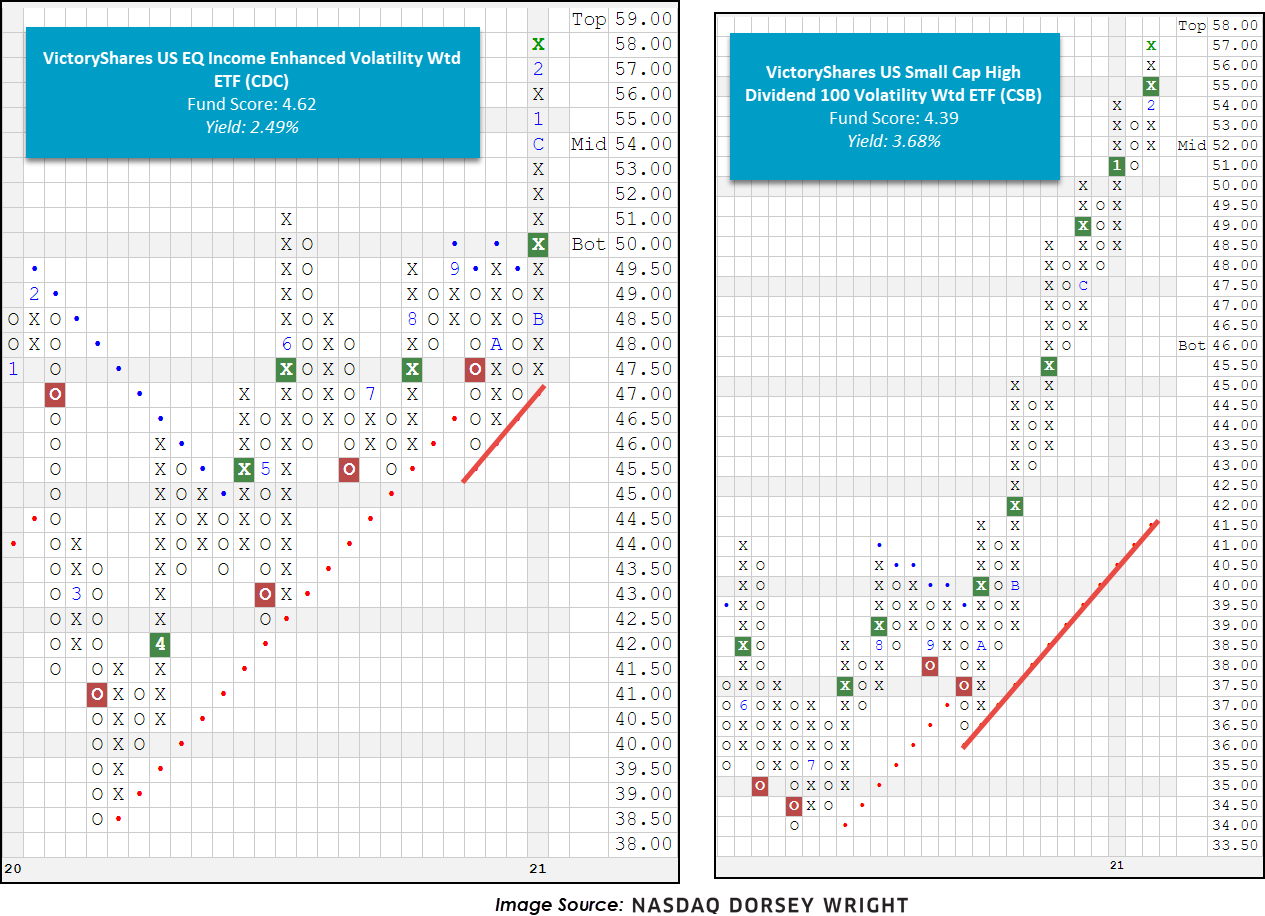

CDC seeks to provide income, along with capital appreciation and preservation, by investing in the highest 100 dividend-yielding stocks in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index. To be included in the index, companies must clear profitability hurdles and meet certain market capitalization requirements but once constructed, the index weights stocks based on their respective risk/volatility. CDC also employs a tactical cash-raising strategy, further outlined here. From a technical perspective, CDC appears favorable with an optimal fund score of 4.62, a strong score direction of 1.39, and a recent flip to positive weekly momentum. In addition, CDC trades on a Point and Figure buy signal and printed a fresh all-time high yesterday (2/22) at $58. The weight of the evidence is positive yet those looking to add new exposure may consider entering on a pullback or dollar-cost-averaging in at current levels as the stock is nearing the top of its trading band. Note initial support is not offered until $47. CDC currently offers a yield of 2.5%.

As for CSB, it employs a very similar index construction and weighting schema to CDC but instead primarily allocates to small cap securities. That said, with the increasing demand for smaller sizes across the capital markets, CSB offers a way to generate income while still allocating toward areas of highest relative strength. Like CDC, CSB carries a stellar fund score of 4.39 and a positive score direction of 2.30 but is also nearing overbought territory as it printed a fresh all-time high yesterday (2/22). Those looking to build new positions here may wish to enter on a pullback or dollar-cost-averaging at current levels. Initial support is offered around $51. CSB currently offers a yield of 3.68%.