There was a change in the PowerShares Commodity Model (POWRSHARES) this week: buy Gold (DGL) and sell Commodity Tracking (DBC).

It is no secret that Commodities as an asset class have struggled this year. Coming into 2017, the asset class was ranked second in DALI but has since fallen to fifth, falling below Cash last week. The sub-sector rankings have been changing too. Industrial Metals continue to rank first among the four sub-sectors while Precious Metals have risen from last to second place due to their improved relative strength and the weakness in Energy at the end of Q1. The PowerShares Commodity Model POWRSHARES seeks to own two of the highest relative strength ETFs out of an inventory of eight. Since Precious Metals continue to garner more relative strength (Gold in this case), the POWRSHARES Model will undergo its second change of the year. With last week's action, the PowerShares DB Commodity Index Tracking DBC fell sufficiently within the matrix rankings to warrant its removal from the portfolio. As a result. the PowerShares DB Gold Fund DGL will take its place since it is the highest ranking ETF that is not already owned.

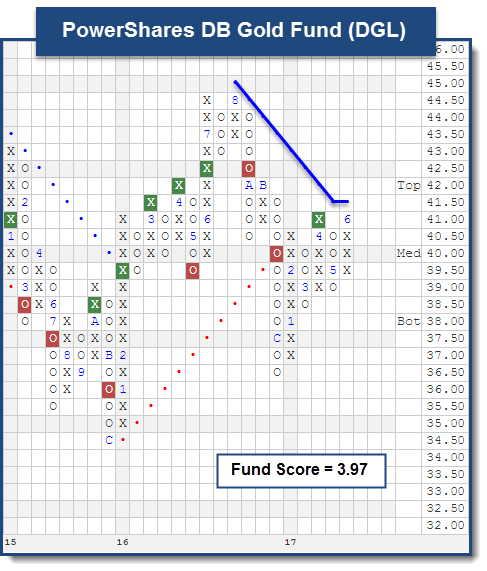

Since bottoming in December at $36.50, DGL has returned to a buy signal at $41 in April and is now currently testing its bearish resistance line. A double top break at $41.50 would flip the trend back to positive. DGL offers a fund score of 3.97, which is paired with a score direction of 2.36 speaking to its improvement over the past six months. Its high fund score tops all of its benchmarks’ average scores: Precious Metals (2.12), All US (3.52), and Commodities (1.29). In addition, its weekly momentum recently flipped positive indicating the potential for higher prices over the next several weeks. DGL comes with a bullish price objective of $46.50, which also indicates the potential for further price appreciation from current levels. All of these positive technical developments has led to DGL returning 9.40% year-to-date (through 6/9) compared to the market (S&P 500 Index SPX) up 8.62%. Those interested in gaining exposure to Gold may initiate positions at current levels. Support comes in the upper $30’s from here. For those already long, the next resistance levels are at $42 and $44.50. The Model will be rebalanced and offers exposure to Base Metals DBB (50%) and Gold DGL (50%).