The last quarter of 2016 helped to pull the US equity benchmarks further into the green, being carried by Energy, Financials and Industrials in a strong post-election rally. However, these gains did not translate over to the iShares sector rotation models, as we continued to see Q4 plagued with similar turnover as the rest of the year, causing a lag in the portfolios. As a whole, the calendar year of 2016 will likely not be remembered fondly by most who weathered the markets of 2014 and 2015 with any success. US Equities, which had rewarded investors in the past few years, turned volatile early 2016 and recorded one of its worst January's in history. While US Equities recovered to post respectable gains for the year, it did so with style and sector leadership that was quite different than that of 2014 and 2015. The Healthcare (specifically Biotech) trends that previously benefited investors, gave way to emerging leadership from outcast investment sectors and styles like Energy and US Small Cap.

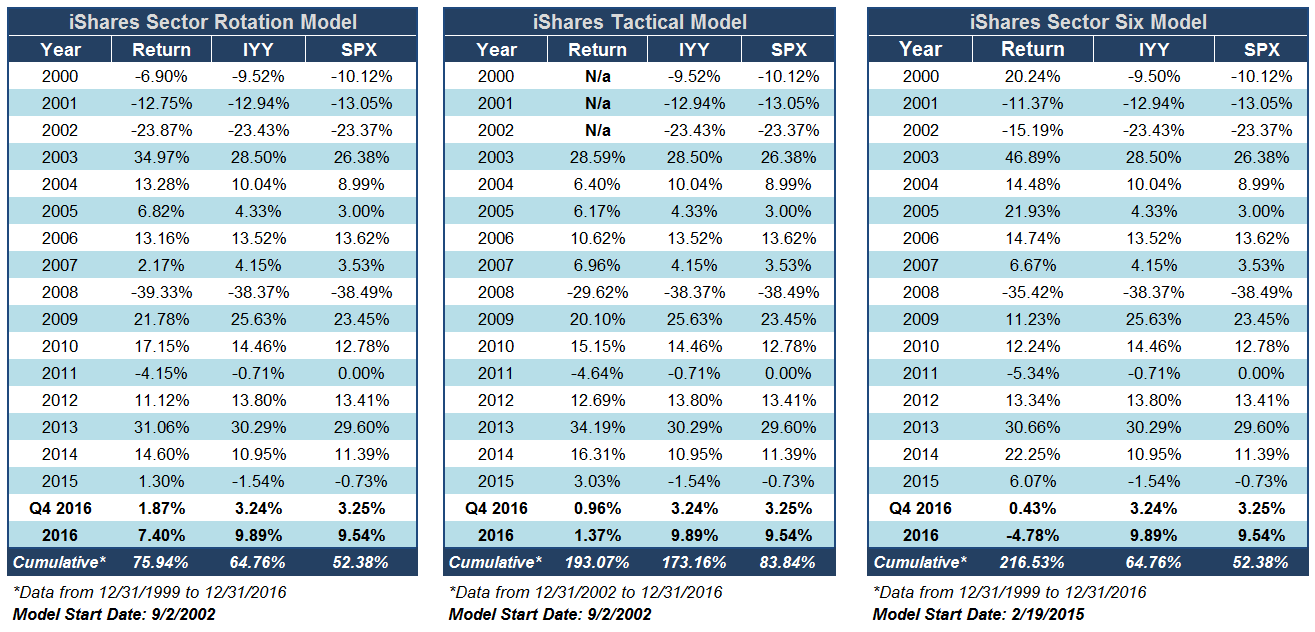

All in all, the investments that performed the best in 2016 were largely things that hadn't been too useful in the two years prior. Conversely, the worst returns of 2016 came from some of the strongest investments in years prior. As relative strength driven strategies adapted to this changing leadership (and continue to do so), we witnessed a considerable drag on performance caused by heightened turnover. The tables below offer a performance summary for the iShares sector rotation models for Q4 and the year as whole. We have also provided a breakdown of trades that occurred within the last 3 months.

iShares Sector Rotation Model ISHRSECT Q4 Changes:

iShares Tactical Model ISHRTACTICAL Q4 Changes:

iShares Sector Six Model ISHRSECT6 Q4 Changes:

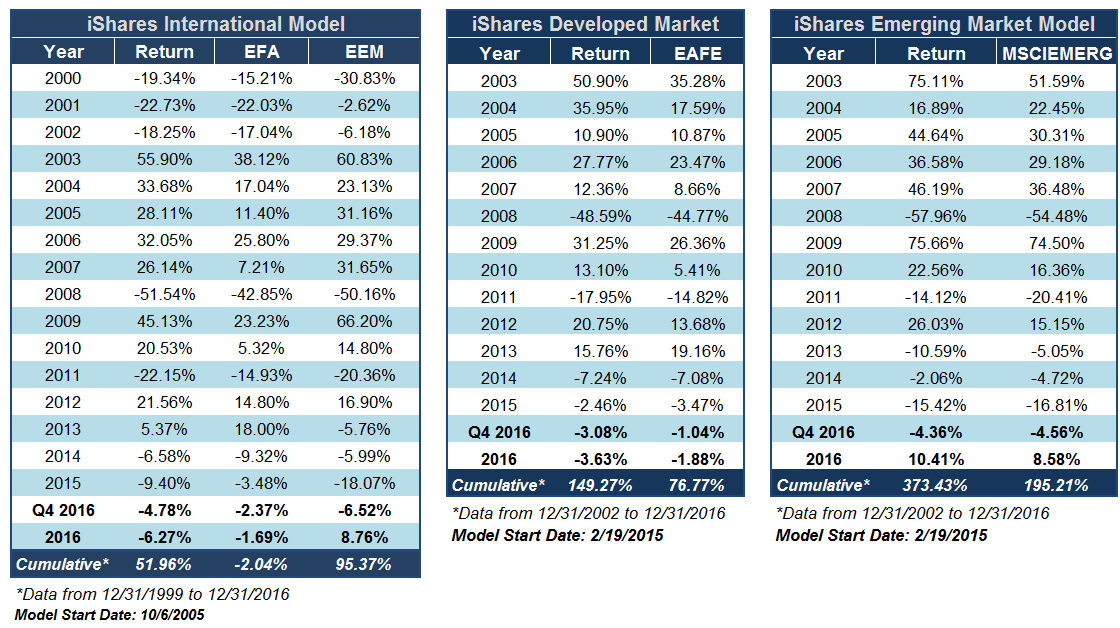

With respect to the International Equity asset class, Q4 was negative for both the emerging market and developed market segments. While this caused the developed market benchmark EFA to fall into the red for the year, the emerging market benchmark, EEM, was able to maintain attractive gains for the year in excess of 8%. This was in large part thanks for fairly sustainable leadership from the Emerging Latin America group, a theme that the iShares Emerging Market Model was able to participate in, as it was up more than 10% for the year, making it the single best performing iShares model in 2016. Below is a complete performance review for each of the iShares international equity models.

iShares International Model ISHRINTL Q4 Changes:

- No Changes

iShares Developed Market Model ISHRDEV Q4 Changes:

- No Changes

iShares Emerging Market Model ISHREMERG Q4 Changes:

Early in Q4, we launched a new iShares models, the iShares Smart Beta Model ISHRSMART. Below is a complete performance table for the model, including the model backtest (prior to 10/6/2016). While live, the model managed to outpace the S&P 500 Index SPX, rallying 4.56% from 10/6 - 12/30. There were no changes to this model during Q4.

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time with an "average level" to give us a general picture of whether the iShare ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong market ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness.

Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell. The Distribution Curve below displays those ETFs with positive RS in uppercase letters and those ETFs with poor RS versus the market in lowercase letters. As well, those ETFs that are on a Point & Figure Buy signal appear in Green letters, while those on Sell signals can appear in Red letters.

The average Bullish Percent reading this week is 60.49% up 0.04% from the previous week

| <--100 | -100--80 | -80--60 | -60--40 | -40--20 | -20-0 | 0-20 | 20-40 | 40-60 | 60-80 | 80-100 | 100-> | |||

|

||||||||||||||

This section of the report categorizes select iShares ETFs by their respective broad group. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those iShares ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

| Small Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 4.3 | IJS | iShares S&P SmallCap 600 Value ETF | 5.81 |

| IJR | iShares S&P SmallCap 600 Index Fund | 5.72 | |

| IJT | iShares S&P SmallCap 600 Growth ETF | 5.66 | |

| IWN | iShares Russell 2000 Value ETF | 4.81 | |

| IWM | iShares Russell 2000 ETF | 4.44 | |

| IWO | iShares Russell 2000 Growth ETF | 3.37 |

| Sector Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.4 | SOXX | iShares PHLX Semiconductor ETF | 5.83 |

| IEZ | iShares U.S. Oil Equip. & Svcs. ETF | 5.83 | |

| IAI | iShares U.S. Broker Dealers & Securities Exchanges ETF | 5.79 | |

| IAI | iShares U.S. Broker Dealers & Securities Exchanges ETF | 5.79 | |

| IAT | iShares U.S. Regional Banks ETF | 5.69 | |

| IGN | iShares North American Tech-Multimedia Networking ETF | 5.63 | |

| ITA | iShares U.S. Aerospace & Defense ETF | 5.56 | |

| IEO | iShares U.S. Oil & Gas Exploration & Production ETF | 5.54 | |

| IYC | iShares U.S. Consumer Services ETF | 5.11 | |

| IYZ | iShares U.S. Telecom ETF | 4.88 | |

| IGV | iShares North American Tech-Software ETF | 4.72 | |

| IYT | iShares U.S. Transportation ETF | 4.65 | |

| IGE | iShares North American Natural Resources ETF | 4.64 | |

| IYE | iShares U.S. Energy ETF | 4.53 | |

| IYF | iShares U.S. Financial ETF | 4.51 | |

| IAK | iShares U.S. Insurance ETF | 4.49 | |

| IYM | iShares U.S. Basic Materials ETF | 4.49 | |

| IYW | iShares U.S. Tech. ETF | 4.25 | |

| IYJ | iShares U.S. Industrial ETF | 3.71 | |

| IHI | iShares U.S. Medical Devices ETF | 3.55 | |

| ITB | iShares U.S. Home Construction ETF | 3.54 | |

| ICF | iShares Cohen & Steers Realty ETF | 3.08 | |

| IYH | iShares U.S. Healthcare ETF | 2.75 | |

| IHF | iShares U.S. Healthcare Providers ETF | 2.46 | |

| IYK | iShares U.S. Consumer Goods ETF | 2.24 | |

| IDU | iShares U.S. Utilities ETF | 2.05 | |

| IBB | iShares NASDAQ Biotech ETF | 1.82 | |

| IHE | iShares U.S. Pharmaceuticals ETF | 1.72 |

| Mid Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.3 | IJJ | iShares S&P MidCap 400 Value ETF | 5.82 |

| IJH | iShares S&P MidCap 400 Index Fund | 4.86 | |

| IWS | iShares Russell Midcap Value ETF | 4.70 | |

| IJK | iShares S&P MidCap 400 Growth ETF | 4.67 | |

| IWR | iShares Russell Midcap ETF | 4.47 | |

| IWP | iShares Russell Midcap Growth ETF | 4.09 |

| Large Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.2 | IWY | iShares Russell Top 200 Growth ETF | 4.01 |

| IVW | iShares S&P 500 Growth ETF | 3.82 | |

| IVE | iShares S&P 500 Value ETF | 3.74 | |

| IWD | iShares Russell 1000 Value ETF | 3.65 | |

| IWX | iShares Russell Top 200 Value ETF | 3.61 | |

| IWB | iShares Russell 1000 ETF | 3.60 | |

| IWL | iShares Russell Top 200 ETF | 3.53 | |

| OEF | iShares S&P 100 ETF | 3.52 | |

| IYY | iShares Dow Jones U.S. ETF | 3.50 | |

| IVV | iShares S&P 500 Index | 3.37 |

| Global Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.8 | ILF | iShares S&P Latin America 40 ETF | 4.38 |

| BKF | iShares MSCI BRIC ETF | 3.07 | |

| EEM | iShares MSCI Emerging Markets ETF | 2.85 | |

| JPXN | iShares JPX-Nikkei 400 ETF | 2.78 | |

| EPP | iShares MSCI Pacific ex-Japan Index Fund | 2.72 | |

| EFA | iShares MSCI EAFE ETF | 2.18 | |

| IEV | iShares Europe ETF | 2.10 |

Weekly Updates:

iShares Sector Rotation Model ISHRSECT

| ETF Name | Symbol | DWA Suggested Weighting | Date Added |

|---|---|---|---|

| iShares Cohen & Steers Realty ETF | ICF | 10.000% | 01/07/2015 |

| iShares North American Natural Resources ETF | IGE | 10.000% | 05/04/2016 |

| iShares S&P GSTI (TM) Technology ETF | IGM | 10.000% | 01/07/2015 |

| iShares North American Tech-Software ETF | IGV | 10.000% | 01/07/2015 |

| iShares U.S. Consumer Services ETF | IYC | 10.000% | 01/07/2015 |

| iShares Dow Jones U.S. Financial Service ETF | IYG | 10.000% | 01/07/2015 |

| iShares U.S. Industrial ETF | IYJ | 10.000% | 01/07/2015 |

| iShares U.S. Consumer Goods ETF | IYK | 10.000% | 01/07/2015 |

| iShares U.S. Tech. ETF | IYW | 10.000% | 01/07/2015 |

| iShares PHLX Semiconductor ETF | SOXX | 10.000% | 01/07/2015 |

iShares Sector Six Model ISHRSECT6

ETF Name

Symbol

DWA Suggested Weighting

Date Added

iShares North American Tech-Software ETF

IGV

16.667%

10/19/2016

iShares U.S. Consumer Services ETF

IYC

16.667%

03/13/2013

iShares U.S. Tech. ETF

IYW

16.667%

11/02/2016

iShares U.S. Medical Devices ETF

IHI

16.667%

09/21/2016

iShares U.S. Aerospace & Defense ETF

ITA

16.667%

10/16/2013

iShares PHLX Semiconductor ETF

SOXX

16.667%

10/05/2016

iShares Tactical Model ISHRTACTICAL

| ETF Name | Symbol | DWA Suggested Weighting | Date Added |

|---|---|---|---|

| iShares North American Tech-Software ETF | IGV | 12.500% | 01/27/2016 |

| iShares S&P SmallCap 600 Index Fund | IJR | 12.500% | 06/19/2013 |

| iShares U.S. Consumer Services ETF | IYC | 12.500% | 04/29/2010 |

| iShares U.S. Medical Devices ETF | IHI | 12.500% | 01/20/2016 |

| iShares U.S. Insurance ETF | IAK | 12.500% | 11/16/2016 |

| iShares U.S. Regional Banks ETF | IAT | 12.500% | 11/16/2016 |

| iShares U.S. Aerospace & Defense ETF | ITA | 12.500% | 08/14/2013 |

| iShares PHLX Semiconductor ETF | SOXX | 12.500% | 10/05/2016 |

iShares Developed Market Model ISHRDEV

| ETF Name | Symbol | DWA Suggested Weighting | Date Added |

|---|---|---|---|

| iShares MSCI Germany ETF | EWG | 16.667% | 02/18/2015 |

| iShares MSCI Belgium ETF | EWK | 16.667% | 06/24/2015 |

| iShares MSCI Switzerland ETF | EWL | 16.667% | 02/18/2015 |

| iShares MSCI Netherlands ETF | EWN | 16.667% | 02/18/2015 |

| iShares MSCI Israel Capped ETF | EIS | 16.667% | 01/27/2016 |

| iShares MSCI Ireland Capped Investable Market ETF | EIRL | 16.667% | 02/18/2015 |

iShares International Model ISHRINTL

| ETF Name | Symbol | DWA Suggested Weighting | Date Added |

|---|---|---|---|

| iShares MSCI Brazil ETF | EWZ | 20.000% | 07/20/2016 |

| iShares MSCI All Peru Capped Index Fund | EPU | 20.000% | 06/29/2016 |

| iShares MSCI Indonesia Investable Market ETF | EIDO | 20.000% | 03/02/2016 |

| iShares MSCI New Zealand Investable Market ETF | ENZL | 20.000% | 08/03/2016 |

| iShares Dow Jones U.S. ETF | IYY | 20.000% | 02/29/2012 |

iShares Emerging Market Model ISHREMERG

| ETF Name | Symbol | DWA Suggested Weighting | Date Added |

|---|---|---|---|

| iShares MSCI Taiwan Capped ETF | EWT | 16.667% | 02/18/2015 |

| iShares MSCI Brazil ETF | EWZ | 16.667% | 10/19/2016 |

| iShares MSCI All Peru Capped Index Fund | EPU | 16.667% | 05/18/2016 |

| iShares MSCI Russia Capped ETF | ERUS | 16.667% | 07/15/2015 |

| iShares MSCI Emerging Markets Asia ETF | EEMA | 16.667% | 02/18/2015 |

| iShares S&P Latin America 40 ETF | ILF | 16.667% | 11/23/2016 |

The iShares Sector Rotation ETF Portfolio ISHRSECT is designed to identify major sector themes in the market place through the use of the Point & Figure relative strength tools. The portfolio's composition is based on relative strength and is applied by comparing the iShares inventory components to one another by means of point & figure relative strength analysis. The relative strength analysis is then aggregated using a relative strength "matrix" ranking process, and the number of holdings are then based on the highest realtive strength components within the inventory of holdings. For more information on the portfolio construction and back testing, click here. The iShares Sector Rotation Portfolio will be updated Thursday mornings by 9:30 am EST.

The iShares Tactical ETF Portfolio ISHRTACTICAL is designed to identify major asset class and sector themes in the market place through the use of the Point & Figure relative strength tools. The portfolio's inventory draws primarily on sub-sector iShares, some asset class ETFs, and some commodity based iShares. Relative strength is compared not only to the market indices but also to the other iShares in the inventory. This model will also incorporate the use of fixed income ETFs to help mitigate risk in the portfolio. For more information on the portfolio construction and returns since the inception in 2002, click here. The iShares Tactical Portfolio will be updated Thursday mornings by 9:30 am EST.

The iShares International Model ISHRINTL is designed to identify themes within the international equity asset class, in terms of country and region strength. The portfolio's inventory is made up of approximately 45 International iShares ETFs. We implement the relative strength matrix metholodology as the rules-based decision making strategy for buy and sell decisions within the model. For more information on portfolio construction and performance, you can visit the model's information file attached here.

The iShares Developed Market Model ISHRDEV is designed to identify themes within the developed market space, in terms of country strength. The portfolio's inventory is made up of approximately 27 developed market iShares ETFs. We implement the relative strength matrix metholodology as the rules-based decision making strategy for buy and sell decisions within the model. For more information on portfolio construction and performance, you can visit the model's information file attached here.

The iShares Emerging Market Model ISHREMERG is designed to identify themes within the emerging market space, in terms of country strength. The portfolio's inventory is made up of approximately 27 emerging market iShares ETFs. We implement the relative strength matrix metholodology as the rules-based decision making strategy for buy and sell decisions within the model. For more information on portfolio construction and performance, you can visit the model's information file attached here.

Be sure to check out the iShares DALI Organizer Tool which shows you which asset classes are emphasized in DALI and then provides you with at least one model per all asset classes. In addition, from this one link you can input a dollar amount and then allocate that money across the different models. The iShares DALI Organizer Tool will then automatically calculate exactly how many shares to buy and exactly what percentage that position represents in a portfolio. You can then export this information to excel to potentially interact with your trading system.