With no changes to any of the iShares alternatives models this week, we take a look at the iShares Convertible Bonds ETF (ICVT). There are upcoming changes to iShares model lineup.

As reported in Wednesday's Fixed Income Update, we have recently seen upward movement in interest rates, meanwhile the NYCE US Dollar Spot Index DX/Y, broke a triple top, returning to a buy signal for the first time in more than a year. As a result, we have seen deterioration across many segments of fixed income. Within the Asset Class Group Scores, aside from the Inverse-Fixed Income group, there are only three other groups with average scores above 3.0, one of which is Convertible Bonds.

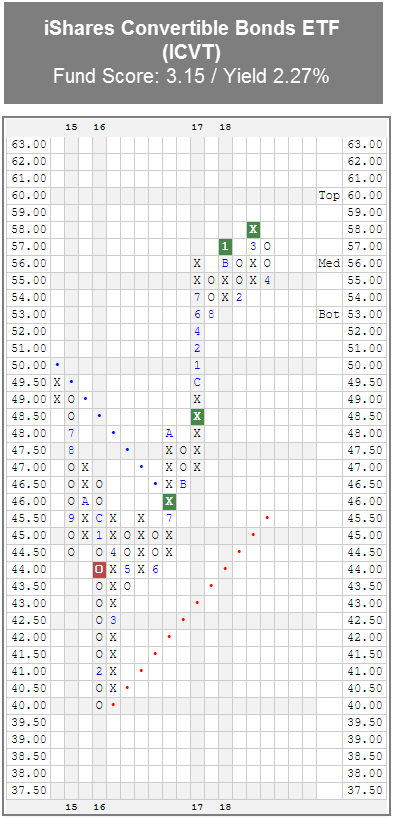

Those who are considering adjusting a fixed income allocation in light of these trends, may wish to consider the iShares Convertible Bond ETF ICVT. ICVT has given four consecutive buy signals dating back to 2016, most recently breaking a double top on 3/9/18. ICVT offers a fund score of 3.15 and a yield of 2.27%; the fund has three nearby support levels at $55, $54, and $53.

There are no changes to any of the iShares models this week. We wanted to take this opportunity to alert you to some upcoming changes to the iShares models lineup and the weekly iShares reports. First, the iShares Alternative Report and iShares Equity Report will be consolidated into a single, all-encompassing iShares report, the “iShares ETF Report”. Additionally, the models will be streamlined and reduced to four models that can be seen as the essential portfolio building blocks. The inventories of the remaining models are currently going through an evaluation to determine if there are ways to expand coverage within the model’s asset class. The models that will remain are:

- The iShares Fixed Income Model ISHRFIXED;

- The iShares Sector Rotation Model ISHRSECT;

- The iShares International Model ISHRINTL; and

- The iShares Tactical Model ISHRTACTICAL.

The models that will no longer be available are: