There are no changes in any of this models this week. We offer complete performance review for each of the iShares alternative models both for Q4 and 2016 as a whole.

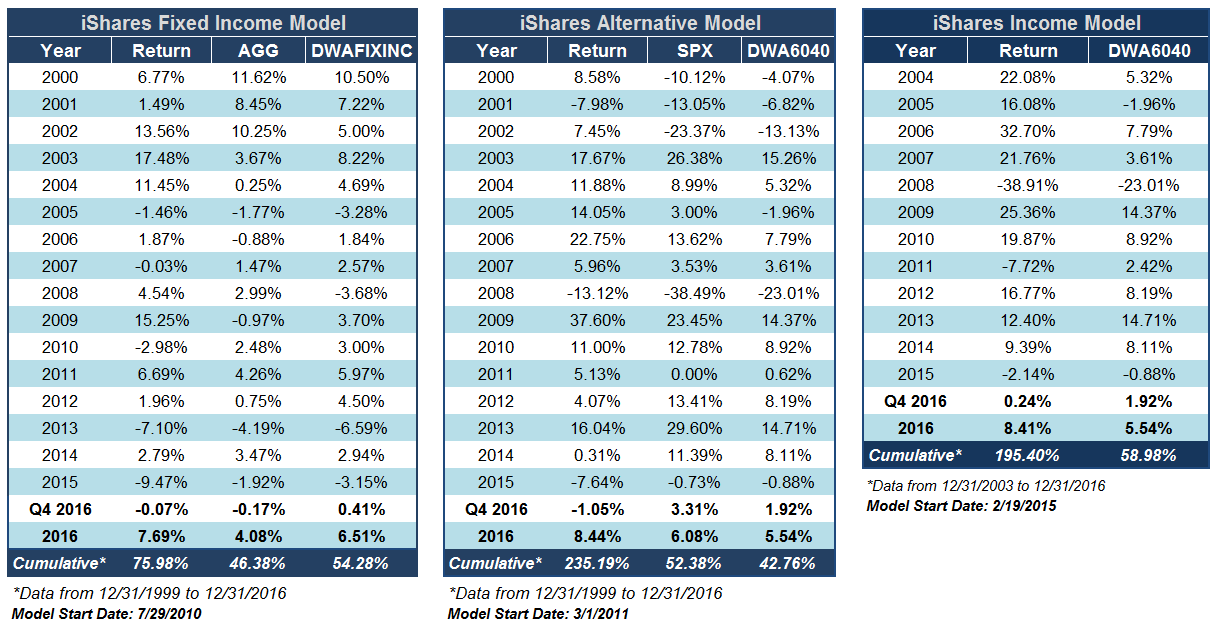

When all was said and done, the major "theme" in terms of asset class performance in 2016 remained US Equities. Despite heightened volatility coupled with a correction in Q1, money that was diversified away from US equities throughout the year, likely caused a lag relative to major market benchmarks such as the S&P 500 Index SPX and the Dow Jones Industrial Average DJIA. Nonetheless, there were still gains to be had in "alternative" areas of the market. For instance the broad fixed income benchmark, AGG, managed a 4.08% gain in 2016, despite a less than ideal Q4. The iShares Fixed Income Model ISHRFIXED was able to outperformance this benchmark both for the past quarter and the year as a whole, rallying 7.69% for the year. The iShares Alternative Model and the iShares Income Model, were also both able to beat their respective benchmarks for the year. Below we have provided a complete performance review for each of these models both during Q4 and 2016 as a whole.

iShares Fixed Income Model ISHRFIXED Q4 Changes:

- 12/28/2016 – Sell IGOV, Buy GHYG

- 11/23/2016 – Sell TLH, Buy CEMB

- 11/16/2016 – Sell LEMB, Buy HYG

- 11/09/2016 – Sell TLT, Buy EMHY

iShares Alternative Model ISHRALT Q4 Changes:

iShares Income Model ISHRINCOME Q4 Changes:

- 11/16/2016 – Sell KXI, Buy JPMV