Spotlighting silver's shine.

Remember, these are technical comments only. Just as you must be aware of fundamental data for the stocks we recommend based on technical criteria in the report, so too must you be aware of important data regarding delivery, market-moving government releases, and other factors that may influence commodity pricing. We try to limit our technical comments to the most actively traded contracts in advance of delivery, but some contracts trade actively right up to delivery while others taper off well in advance. Be sure you check your dates before trading these contracts. For questions regarding this section or additional coverage of commodities email james.west@dorseywright.com.

Data represented in the table below is through 05/19/2020:

Broad Market Commodities Report

Portfolio View - Commodity Indices

| Symbol | Name | Price | PnF Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|

| CL/ | Crude Oil Continuous | 32.50 | Negative | Buy | X | 47.38 | +4W |

| DBLCIX | Deutsche Bank Liquid Commodities Index | 239.98 | Negative | Sell | O | 294.56 | +6W |

| DWACOMMOD | DWA Continuous Commodity Index | 443.43 | Negative | Buy | O | 460.73 | +5W |

| GC/ | Gold Continuous | 1749.00 | Positive | Buy | X | 1562.38 | -2W |

| HG/ | Copper Continuous | 2.42 | Negative | Buy | O | 2.56 | +5W |

| ZG/ | Corn (Electronic Day Session) Continuous | 321.25 | Negative | Buy | O | 365.78 | +3W |

While Gold Continuous GC/ has certainly captured the attention of commodity investors by returning 15.04% on a year-to-date basis and 36.89% over the past year, sister precious metal Silver Continuous SI/ has been making moves of its own over the past few weeks. In fact, silver investors have experienced massive gains of 44.22% in the past 60 days relative to gold’s 17.24% during the same period. Despite this notable rally, SI/ remains in the red on the year (as of 5/19) with a -0.10% loss. The 1-year return for silver is a more-respectable 19.60%, which is widely divergent from the broader commodity group’s return of -12.30% using the proxy of the WidomTree Continuous Commodity Index Fund GCC.

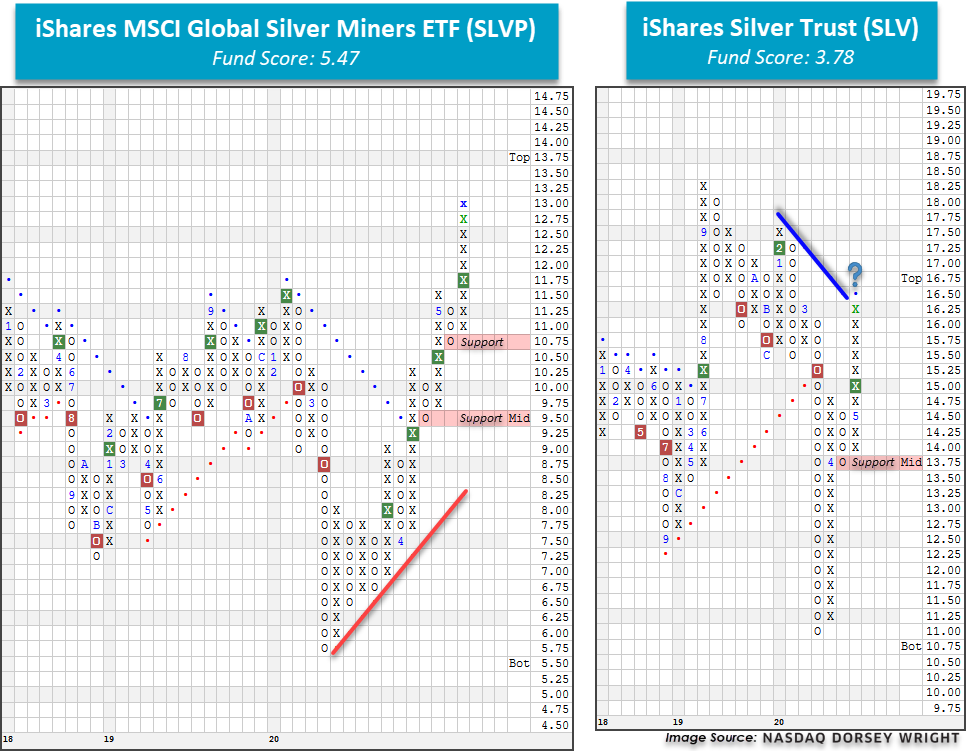

One way to capitalize on silver’s recent shine is by using the iShares Silver Trust SLV. The ETF seeks to track the day-to-day movement of the price of silver bullion and provides a liquid way to access the commodity’s exposure outside of the futures market. After declining significantly to move to a negative trend and multi-year low of $11 during the month of March, SLV has since rallied sharply to return to a buy signal and is currently testing its bearish resistance line at $16.25. This absolute improvement coupled with the relative outperformance of the underlying commodity has also helped propel SLV’s fund score to 3.78 on the back of a strong positive score direction of 1.77. Additionally, SLV’s 1-year performance of 19.60% places it in the top 4th performance percentile of all mutual funds and ETFs tracked on the Nasdaq Dorsey Wright platform. A further advance to $16.50 would reverse the trend for the fund and offer additional bullish confirmation. Note that SLV is heavily overbought at current levels and has the potential for initial support at $13.75.

An alternative way to mine the success of silver is by investing in the companies that extract the commodity from the ground. The iShares MSCI Global Silver Miners ETF SLVP provides such exposure and is trading in a positive trend on a fourth consecutive buy signal at a freshly-minted 52-week high of $13. This positive technical strength has resulted in a gain of 13.89% on the year, which has contributed to SLVP’s stellar fund score of 5.47 with an astonishingly-positive score direction of 5.00. Additionally, SLVP has recently experienced a flip to positive monthly momentum, suggesting the potential for further gains. Similar to SLV, the fund’s recent success has placed it in heavily overbought territory. Those seeking long exposure may be well served to wait for a pause or pullback noting that initial support is offered at $10.75. SLPV comes with a yield of 1.78%.