There was no change to the Franklin International Rotation Model this week, so we look at the Franklin FTSE Canada ETF (FLCA).

There was no change to the Franklin International Rotation Model this week.

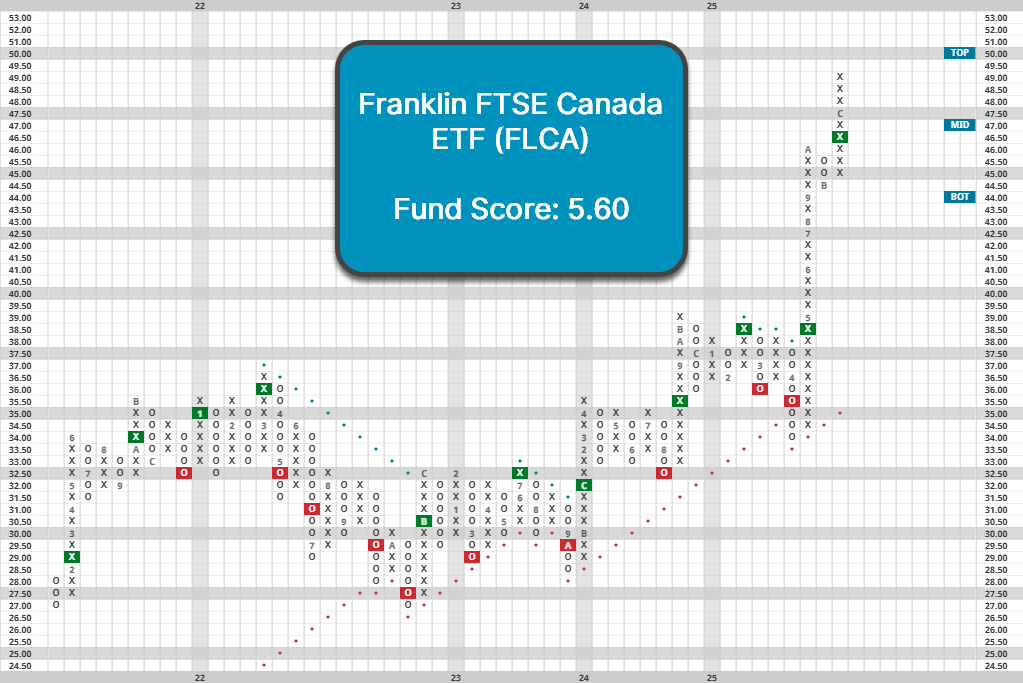

International equities had an outstanding 2025, and the asset class has continued to push higher through the first two weeks of this year. Canada has been among the stronger regions within international equities, and those looking to add exposure to the country could look towards the Franklin FTSE Canada ETF (FLCA). FLCA holds an extremely strong fund score of 5.60, which is 0.85 points higher than the average fund for the Canada region. On its default point and figure chart, the fund trades on two consecutive buy signals and has set new all-time highs over the last month. FLCA also trades in a positive trend dating back to April of last year. On relative basis, the fund displays relative strength versus domestic equities, sitting on an RS buy signal and column of Xs against the S&P 500 equal weight (SPXEWI). FLCA has also been a holding of the Franklin International Rotation Model since 2021, making it the longest current position in the model by several years. Upward action over the last few weeks has left the fund nearing the top of its 10-week trading band, so those looking to buy could wait for some consolidation or pullback to normalized territory around $48. Meanwhile, initial support lies at $44.50.