There was no change to the Franklin International Rotation Model this week.

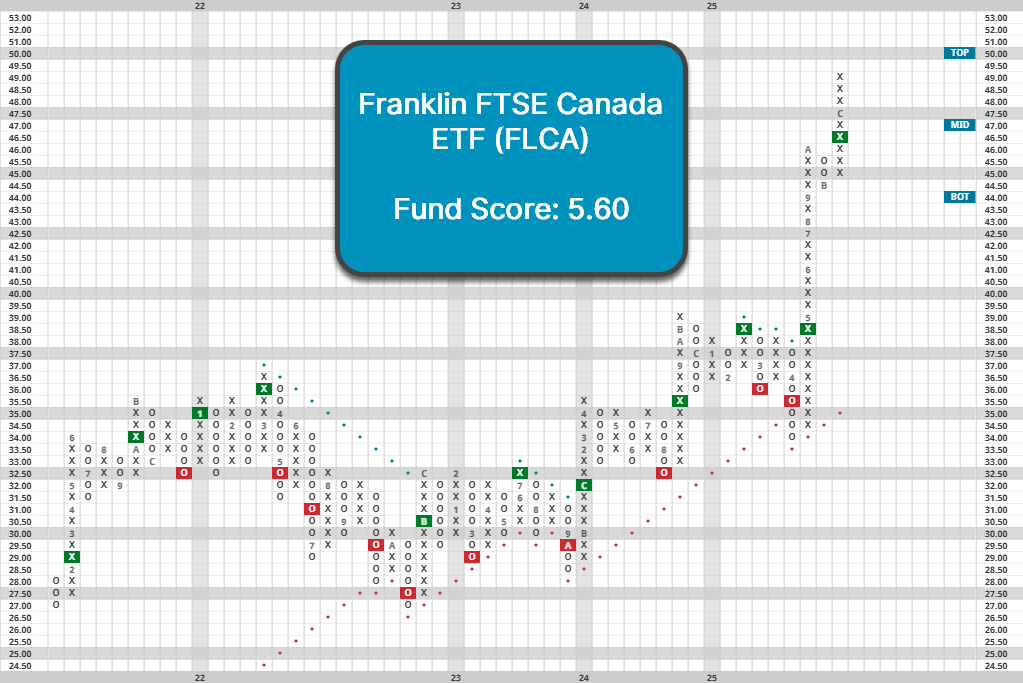

International equities had an outstanding 2025, and the asset class has continued to push higher through the first two weeks of this year. Canada has been among the stronger regions within international equities, and those looking to add exposure to the country could look towards the Franklin FTSE Canada ETF (FLCA). FLCA holds an extremely strong fund score of 5.60, which is 0.85 points higher than the average fund for the Canada region. On its default point and figure chart, the fund trades on two consecutive buy signals and has set new all-time highs over the last month. FLCA also trades in a positive trend dating back to April of last year. On relative basis, the fund displays relative strength versus domestic equities, sitting on an RS buy signal and column of Xs against the S&P 500 equal weight (SPXEWI). FLCA has also been a holding of the Franklin International Rotation Model since 2021, making it the longest current position in the model by several years. Upward action over the last few weeks has left the fund nearing the top of its 10-week trading band, so those looking to buy could wait for some consolidation or pullback to normalized territory around $48. Meanwhile, initial support lies at $44.50.

This section of the report categorizes select Franklin ETFs by their respective broad group. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those Franklin ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

| Large Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 4.3 | FLQL | Franklin US Large Cap Multifactor Index ETF | 5.22 |

| INCE | Franklin Income Equity Focus ETF | 5.11 | |

| UDIV | Franklin US Core Dividend Tilt Index ETF | 4.09 | |

| USPX | Franklin US Equity Index ETF | 3.95 |

| Global Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 4.0 | FLKR | Franklin FTSE South Korea ETF | 5.98 |

| FLMX | Franklin FTSE Mexico ETF | 5.82 | |

| FLCA | Franklin FTSE Canada ETF | 5.60 | |

| FLAX | Franklin FTSE Asia Ex Japan ETF | 5.54 | |

| FLJH | Franklin FTSE Japan Hedged ETF | 5.49 | |

| DIEM | Franklin Emerging Market Core Dividend Tilt Index ETF | 5.46 | |

| FLTW | Franklin FTSE Taiwan ETF | 5.46 | |

| FLBR | Franklin FTSE Brazil ETF | 4.82 | |

| FLGB | Franklin FTSE United Kingdom ETF | 4.57 | |

| FLEE | Franklin FTSE Europe ETF | 4.56 | |

| DIVI | Franklin International Core Dividend Tilt Index ETF | 4.54 | |

| FLGR | Franklin FTSE Germany ETF | 4.47 | |

| FLJP | Franklin FTSE Japan ETF | 4.24 | |

| FLCH | Franklin FTSE China ETF | 4.14 | |

| FLSW | Franklin FTSE Switzerland ETF | 3.55 | |

| FLIN | Franklin FTSE India ETF | 3.11 | |

| FLAU | Franklin FTSE Australia ETF | 2.64 |

| Small Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 4.0 | FLQS | Franklin U.S. Small Cap Multifactor Index ETF | 2.45 |

| Mid Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.8 | FLQM | Franklin U.S. Mid Cap Multifactor Index ETF | 4.34 |

| Global Fixed Income | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.4 | FLIA | Franklin International Aggregate Bond ETF | 2.00 |

| High Yield | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.1 | FLHY | Franklin High Yield Corporate ETF | 3.06 |

| Corporate Bonds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.0 | FLCO | Franklin Investment Grade Corporate ETF | 1.88 |

| Municipal Bonds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.8 | FLMI | Franklin Dynamic Municipal Bond ETF | 3.11 |

| FLMB | Franklin Municipal Green Bond ETF | 1.36 |

| Broad Fixed Income | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.8 | FLBL | Franklin Senior Loan ETF | 0.10 |

| Treasury Bonds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.5 | FTSD | Franklin Short Duration US Government ETF | 1.39 |

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time to give us a general picture of whether the Franklin ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong relative strength ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness. Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell.

Average Level 44.29

< - -100

-100 - -80

-80 - -60

-60 - -40

-40 - -20

-20 - 0

0 - 20

20 - 40

40 - 60

60 - 80

80 - 100

100 - >

< - -100

-100 - -80

-80 - -60

-60 - -40

-40 - -20

-20 - 0

0 - 20

20 - 40

40 - 60

60 - 80

80 - 100

100 - >

Legend:

- UPPERCASE indicates that the RS chart is on a buy signal.

- lowercase indicates that the RS chart is in a sell signal.

- GREEN lettering indicates the ETFs trend chart is on a buy signal.

- RED lettering indicates the ETF is on a sell signal.

- Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.