There are two changes this week.

- Xtrackers Global Dynamic FX Hedged Model DWSGLOBAL.TR: Sell CN, Buy EMSG

- Xtrackers Global ex-US Dynamic FX Hedged Model DWSALLWORLDEXUS.TR: Sell CN, Buy DBEZ

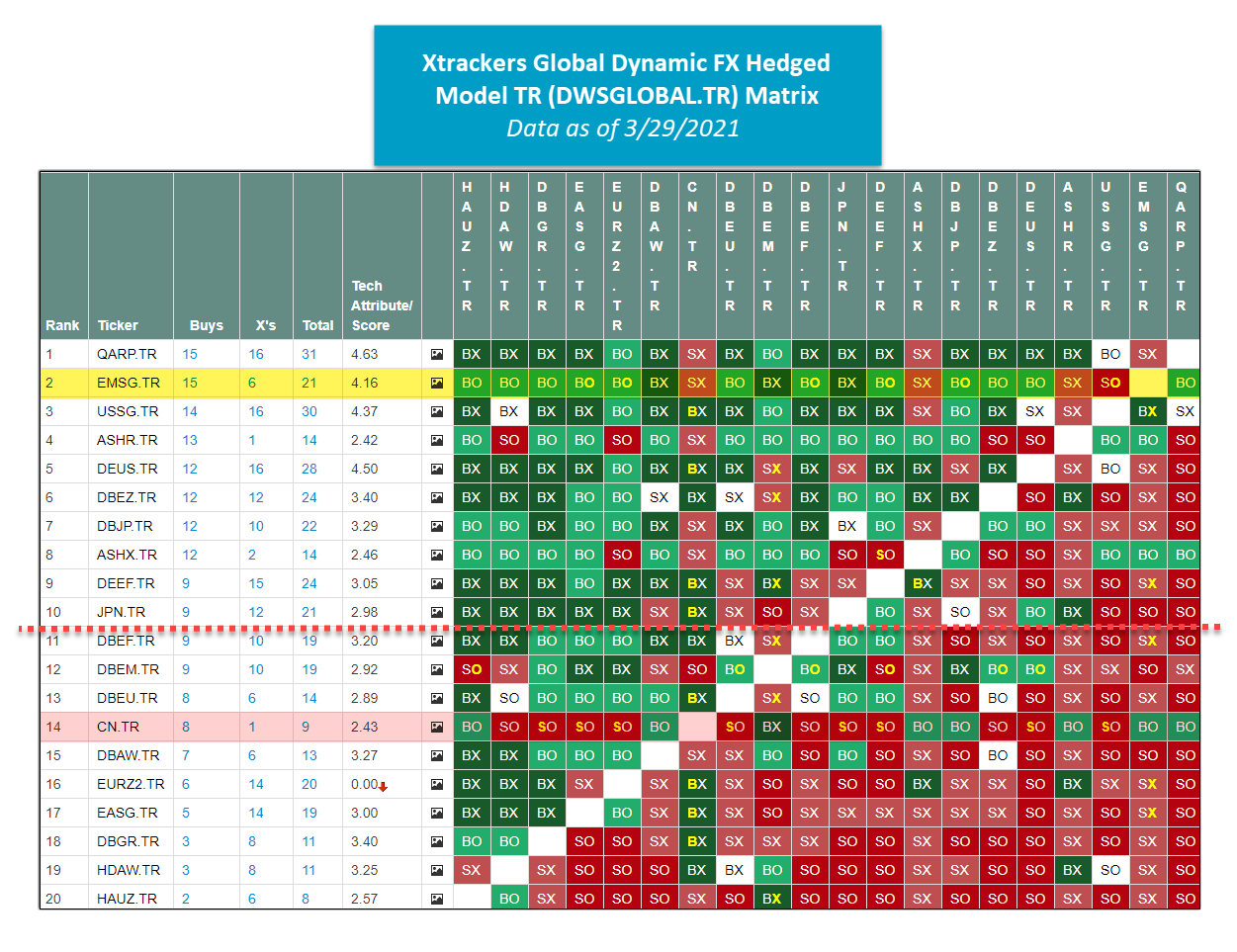

DWSGLOBAL.TR

The Xtrackers MSCI All China Equity ETF TR CN.TR fell sufficiently out of favor in the Xtrackers Global Dynamic FX Hedged Model DWSGLOBAL matrix. As a result, it was removed and, in its place, the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF TR EMSG.TR was added as it was the highest-ranked fund not currently held in the model. The model holdings are shown in the image below and have each been rebalanced to equal weight at 20% each.

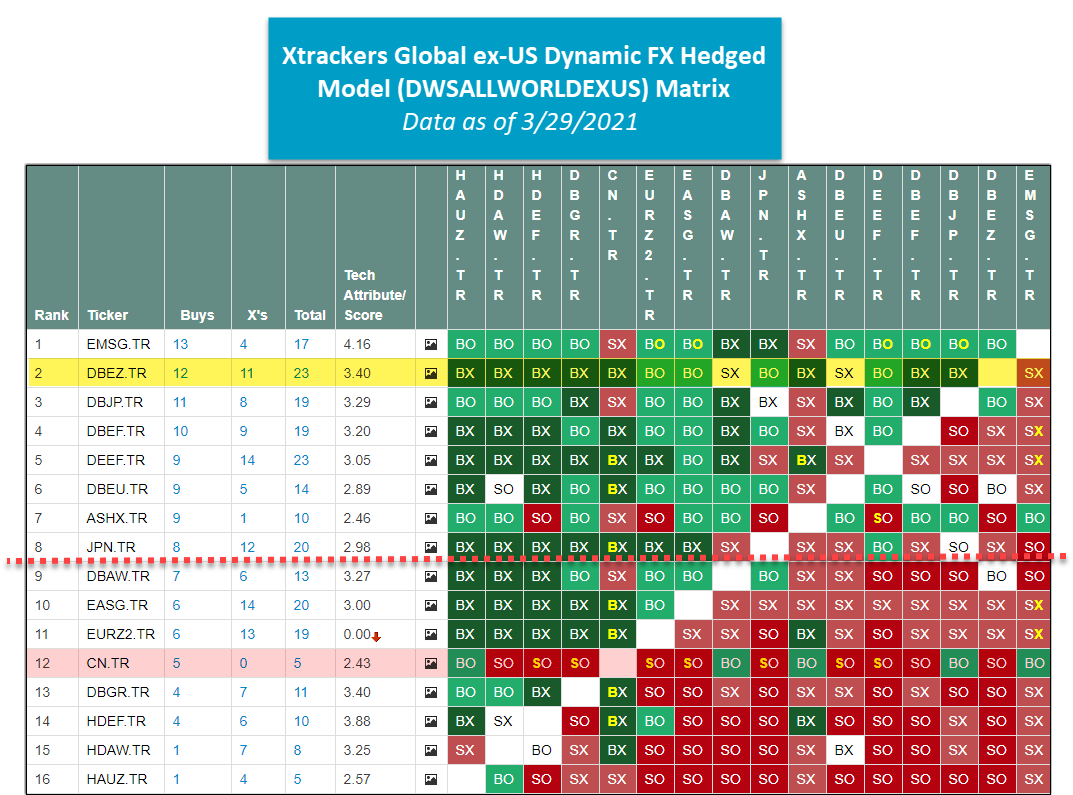

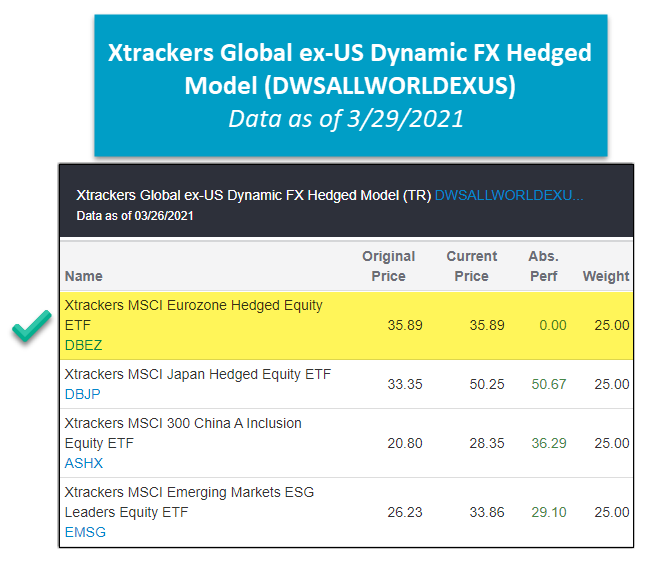

DWSALLWORLDEXUS.TR

The Xtrackers MSCI All China Equity ETF TR CN.TR fell sufficiently out of favor in the Xtrackers Global ex-US Dynamic FX Hedged Model DWSALLWORLDEXUS.TR matrix. As a result, it was removed and, in its place, the Xtrackers MSCI Eurozone Hedged Equity ETF Total Return DBEZ.TR was added as it was the highest-ranked fund not currently held in the model. The model holdings are shown in the image below and have each been rebalanced to equal-weight at 25% each.

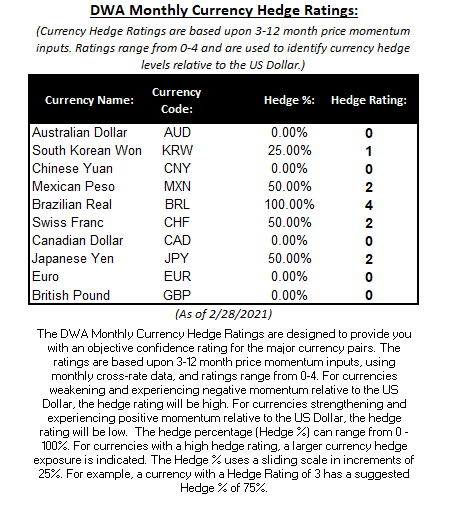

The DWA Monthly Currency Hedge Ratings are designed to provide you with an objective confidence rating for the major currency pairs. The ratings are based upon 3-12 month price momentum inputs, using monthly cross-rate data, and ratings range from 0-4. For currencies weakening and experiencing negative momentum relative to the US Dollar, the hedge rating will be high. For currencies strengthening and experiencing positive momentum relative to the US Dollar, the hedge rating will be low. The hedge percentage (Hedge %) can range from 0 - 100%. For currencies with a high hedge rating, a larger currency hedge exposure is indicated. The Hedge % uses a sliding scale in increments of 25%. For example, a currency with a Hedge Rating of 3 has a suggested Hedge % of 75%.

The table below is a review of important technical data on a select group of DWS Xtrackers ETFs. Significant changes within the past week are highlighted in Green if positive or Red if negative. This portfolio is designed to be used as a "radar" screen to bring your attention to potentially important technical changes that may require your attention and potential action. When evaluating the Fund Score, the strongest issues have scores of 4 or higher while those ETFs with scores below a 3 are no longer considered solid citizens.

Symbol

Name

Price

Fund Score

PnF Signal

RS Col.

PnF Trend

Weekly Mom

ACSG

Xtrackers MSCI ACWI ex USA ESG Leaders Equity ETF

32.55

4.13

Buy

X

Positive

-8W

ASHR

Xtrackers Harvest CSI 300 China A-Shares ETF

38.40

2.42

Sell

X

Positive

-6W

ASHS

Xtrackers Harvest CSI 500 China A-Shares ETF

34.60

2.07

Sell

O

Positive

-6W

ASHX

Xtrackers MSCI 300 China A Inclusion Equity ETF

28.35

2.46

Buy

X

Positive

-6W

CN

Xtrackers MSCI All China Equity ETF

44.30

2.43

Sell

X

Positive

-6W

DBAW

Xtrackers MSCI All World ex US Hedged Equity ETF

32.60

3.27

Buy

O

Positive

-8W

DBEF

Xtrackers MSCI EAFE Hedged Equity ETF

36.37

3.20

Buy

O

Positive

+5W

DBEM

Xtrackers MSCI Emerging Markets Hedged Equity ETF

28.50

2.92

Sell

O

Positive

-6W

DBEU

Xtrackers MSCI Europe Hedged Equity ETF

32.37

2.89

Buy

O

Positive

+5W

DBEZ

Xtrackers MSCI Eurozone Hedged Equity ETF

35.89

3.40

Buy

O

Positive

+5W

DBGR

Xtrackers MSCI Germany Hedged Equity ETF

31.22

3.40

Buy

O

Positive

+4W

DBJP

Xtrackers MSCI Japan Hedged Equity ETF

50.25

3.29

Buy

O

Positive

+1W

DEEF

Xtrackers FTSE Developed EX US Multifactor ETF

31.20

3.05

Buy

O

Positive

+1W

DEUS

Xtrackers Russell US Multifactor ETF

41.90

4.50

Buy

O

Positive

+2W

EASG

Xtrackers MSCI EAFE ESG Leaders Equity ETF

30.07

3.00

Buy

O

Positive

+1W

EMSG

Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF

33.86

4.16

Sell

O

Positive

-6W

EURZ

Xtrackers Eurozone Equity ETF

25.54

3.09

Buy

O

Positive

+1W

HAUZ

Xtrackers International Real Estate ETF

27.51

2.57

Buy

O

Positive

+2W

HDAW

Xtrackers MSCI All World ex US High Dividend Yield Equity ETF

25.38

3.25

Buy

O

Positive

+1W

HDEF

Xtrackers MSCI EAFE High Dividend Yield Equity ETF

24.07

3.88

Buy

O

Positive

+2W

JPN

Xtrackers Japan JPX-Nikkei 400 Equity ETF

33.80

2.98

Buy

O

Positive

-15W

SNPE

Xtrackers S&P 500 ESG ETF

34.73

4.49

Buy

O

Positive

+1W

USSG

Xtrackers MSCI USA ESG Leaders Equity ETF

36.40

4.37

Buy

O

Positive

+1W

Symbol

Name

Price

Fund Score

PnF Signal

RS Col.

PnF Trend

Weekly Mom

ESCR

X-Trackers Bloomberg Barclays US Investment Grade Corporate ESG ETF

21.58

1.98

Buy

O

Positive

-15W

ESEB

X-Trackers J.P. Morgan ESG Emerging Markets Sovereign ETF

21.14

1.45

Sell

O

Positive

-14W

ESHY

X-trackers J.P. Morgan ESG USD High Yield Corporate Bond ETF

21.09

2.99

Buy

O

Positive

-15W

RVNU

Xtrackers Municipal Infrastructure Revenue Bond ETF

28.88

2.75

Buy

O

Positive

+1W

The ETFs with the most relative strength buy signals (suggesting outperformance) versus the others in the group are listed at the top. These ETFs should be overweighted in the portfolio. Those ETFs with the least amount of relative strength buy signals versus the others in the group are listed at the bottom. These ETFs should be underweighted in the portfolio.

Xtrackers Global Dynamic FX Hedged Model (TR) DWSGLOBAL.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| Xtrackers CSI 300 China A-Shares Hedged Equity ETF TR | ASHX.TR | 20.000% | 0.7799 | 03/30/2020 |

| Xtrackers Harvest CSI 300 China A-Shares ETF TR | ASHR.TR | 20.000% | 0.7875 | 03/23/2020 |

| Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF TR | EMSG.TR | 20.000% | 1.3320 | 03/29/2021 |

| Xtrackers Russell 1000 US Quality at a Reasonable Price ETF TR | QARP.TR | 20.000% | 1.5469 | 02/03/2020 |

| Xtrackers MSCI USA ESG Leaders Equity ETF TR | USSG.TR | 20.000% | 1.3878 | 02/03/2020 |

* - Dates prior to 9/6/2016, which is when the Xtrackers Global Model Portfolio became available in the DWS Weekly ETF Report, are representative of when the position was added to the backtested model.

Xtrackers Global ex-US Dynamic FX Hedged Model (TR) DWSALLWORLDEXUS.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| Xtrackers MSCI Eurozone Hedged Equity ETF Total Return | DBEZ.TR | 25.000% | 1.9187 | 03/29/2021 |

| Xtrackers MSCI Japan Hedged Equity ETF Total Return | DBJP.TR | 25.000% | 2.4416 | 03/23/2020 |

| Xtrackers CSI 300 China A-Shares Hedged Equity ETF TR | ASHX.TR | 25.000% | 0.7799 | 03/09/2020 |

| Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF TR | EMSG.TR | 25.000% | 1.3320 | 02/03/2020 |

* - Dates prior to 9/6/2016, which is when the Xtrackers All World Ex US Model Portfolio became available in the DWS Weekly ETF Report, are representative of when the position was added to the backtested model.

Xtrackers Developed ex-US Dynamic FX Hedged Model (TR) DWSDEVINTL.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| Xtrackers MSCI EAFE Hedged Equity ETF Total Return | DBEF.TR | 33.333% | 2.3529 | 07/22/2019 |

| Xtrackers MSCI Eurozone Hedged Equity ETF Total Return | DBEZ.TR | 33.333% | 1.9187 | 06/24/2016 |

| Xtrackers MSCI Japan Hedged Equity ETF Total Return | DBJP.TR | 33.333% | 2.4416 | 03/23/2020 |

* - Dates prior to 9/6/2016, which is when the Xtrackers Developed Intl Equity Model Portfolio became available in the DWS Weekly ETF Report, are representative of when the position was added to the backtested model.