There are two changes this week. Xtrackers Global Dynamic FX Hedged Model: Sell CN, Buy EMSG Xtrackers Global ex-US Dynamic FX Hedged Model: Sell CN, Buy DBEZ

There are two changes this week.

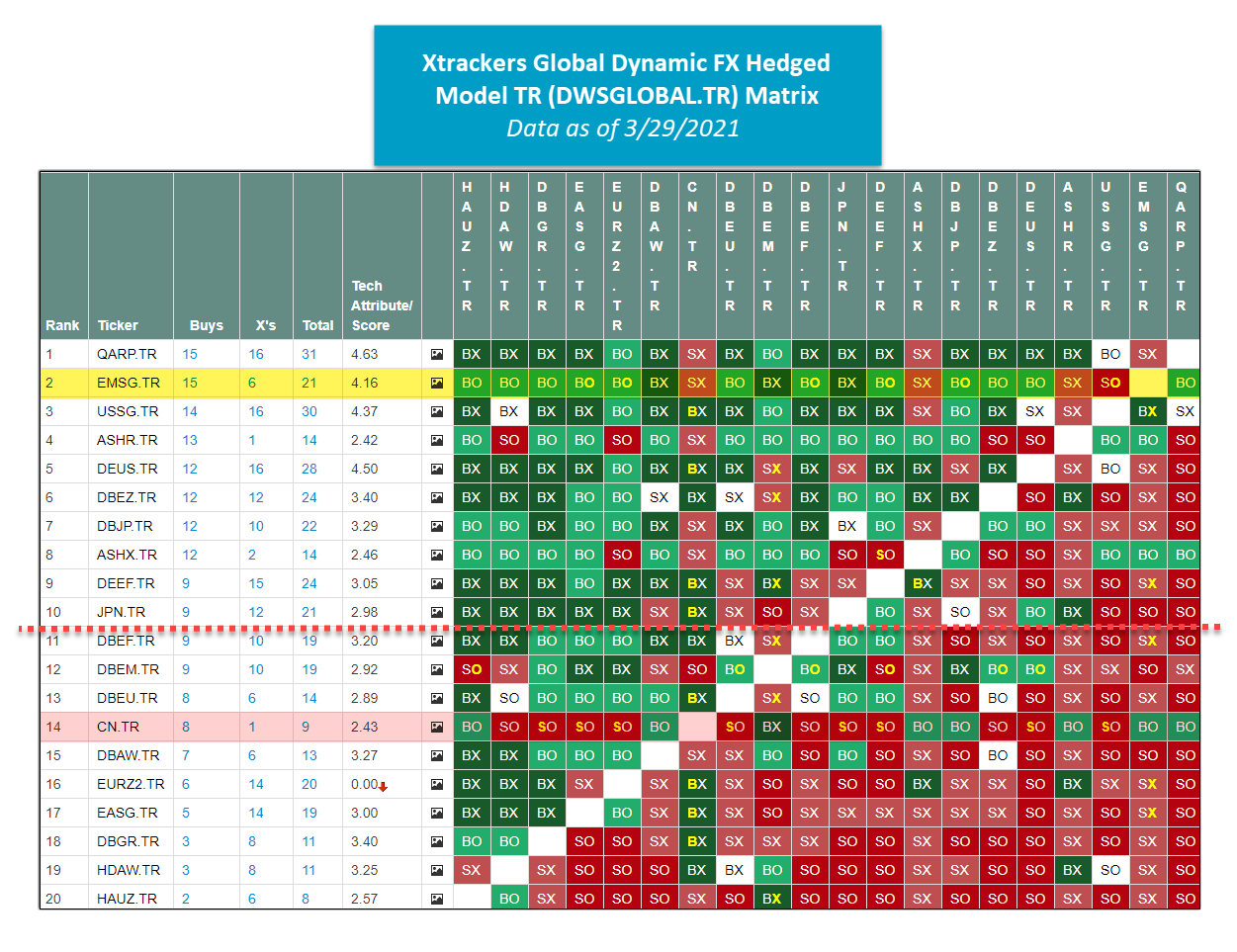

- Xtrackers Global Dynamic FX Hedged Model DWSGLOBAL.TR: Sell CN, Buy EMSG

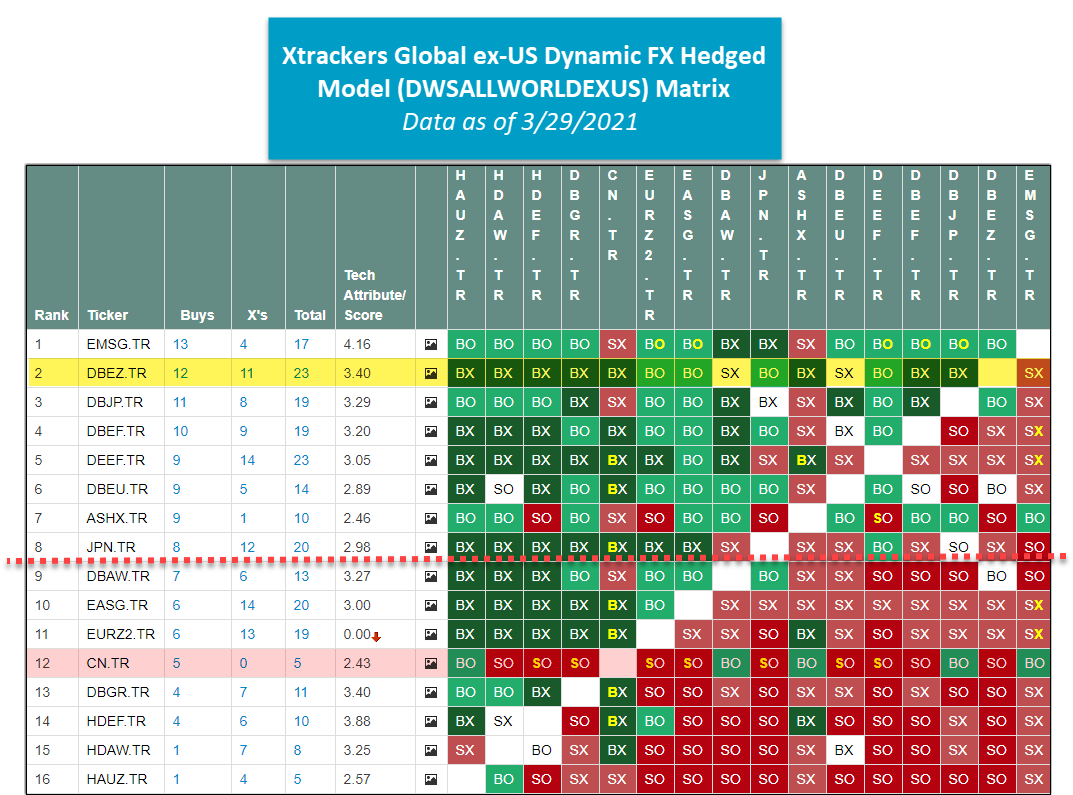

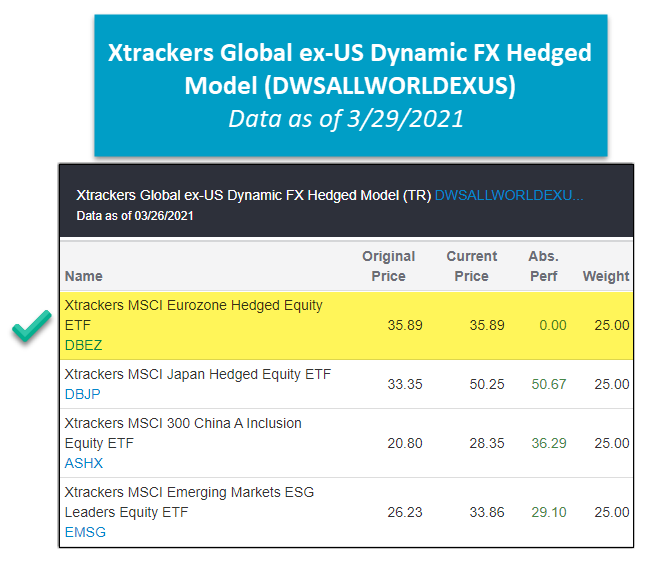

- Xtrackers Global ex-US Dynamic FX Hedged Model DWSALLWORLDEXUS.TR: Sell CN, Buy DBEZ

DWSGLOBAL.TR

The Xtrackers MSCI All China Equity ETF TR CN.TR fell sufficiently out of favor in the Xtrackers Global Dynamic FX Hedged Model DWSGLOBAL matrix. As a result, it was removed and, in its place, the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF TR EMSG.TR was added as it was the highest-ranked fund not currently held in the model. The model holdings are shown in the image below and have each been rebalanced to equal weight at 20% each.

DWSALLWORLDEXUS.TR

The Xtrackers MSCI All China Equity ETF TR CN.TR fell sufficiently out of favor in the Xtrackers Global ex-US Dynamic FX Hedged Model DWSALLWORLDEXUS.TR matrix. As a result, it was removed and, in its place, the Xtrackers MSCI Eurozone Hedged Equity ETF Total Return DBEZ.TR was added as it was the highest-ranked fund not currently held in the model. The model holdings are shown in the image below and have each been rebalanced to equal-weight at 25% each.