Notable Technical Developments from the Technology, Industrial, Financials, Consumer Discretionary, Communication Services, Utilities, and Real Estate Sectors.

U.S. Sector Updates

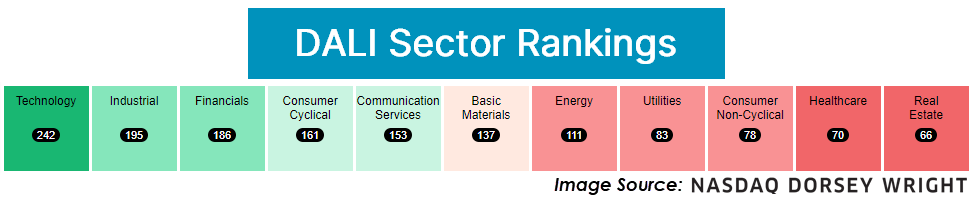

The past week saw no significant technical developments in the Basic Materials, Energy, Consumer Staples, or Healthcare Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal weight, and 8 - 11 underweight.

Technology – Overweight

Weekly Technology Video (4:32)

Strength continues to broaden out in Technology, with small caps (PSCT) reversing up into a column of Xs against the large-cap tech representative (XLK). The chart continues to favor XLK from a longer-term perspective, but the near-term improvement from PSCT suggests small-caps are worth considering. One name held in PSCT that looks actionable at current levels is AGYS, which runs software for the hospitality industry. Large-cap tech will be in focus over the next week with more names reporting earnings. IBM shows a constructive technical picture heading into earnings Wednesday afternoon (7/24). ON has shown substantial consolidation over the past several weeks, primed to breakout in either direction depending on earnings next Monday (7/29). MSFT continues to have one of the most consistently strong technical pictures heading into its earnings release next Tuesday (7/30).

Industrials – Overweight

Weekly Industrials Video (4:04)

The sector remains a firm overweight this week. Main standouts came from aerospace and defense names, seeing ITA move to new highs. On the earnings front, continue to avoid UPS, as it posted its 5th consecutive sell signal on its default chart after poor quarterly results and guidance. GE advanced but remains in an actionable spot for those who want to add to this perfect 5/5’er. GD slipped on its earnings but holds relevant support. Watch current levels closely. ODFL moved higher but remains a name to avoid for the long term. Recent action has been constructive but hasn’t been quite enough to improve the overall technical picture.

Financials – Overweight

Weekly Financials Video (1:51)

Financials continue to gain relative strength in our DALI rankings, now sitting just nine signals behind Industrials. Participation has also been noteworthy with 68% of stocks on a Point & Figure buy signal, the most since November 2022. Investors can consider KCE with a 5.8 fund score.

Consumer Discretionary – Equal Weight

Weekly Discretionary Video (5:18)

Cyclical stocks fell this past week along with the broader market with XLY falling 2.9%. Even with the negative action within the broader sector, the building space continued to see a notable increase in participation with the bullish percent for the subsector ^BPBUIL returning to bull confirmed status. D.R. Horton DHI rallied to new highs on earnings last week, while General Motors GM fell this week after citing issues in China during their earnings call and Tesla TSLA missed on most metrics. Earnings continue to be in full swing within the sector with roughly 15 stocks within the sector from the S&P 500 report over the next week.

Communication Services – Equal Weight

Weekly Communication Services Video (3:45)

Communication Services remains in 5th place this week as some of the tech-focused declines bring the sector lower. With that said though, action hasn’t been severe enough to suggest larger names are losing relative strength quite yet. GOOGL (GOOG) moved lower after earnings but maintained its string of four consecutive buy signals as of 7/24. CMCSA fell to 2024 lows and is a name to avoid, while SPOT rocketed higher. Continue to dollar cost into exposure to take advantage of normalization on the back of the recent 15% gain after earnings.

Utilities – Underweight

The broader Utilities sector was roughly flat for the week with XLU up 30 basis points. Participation continued to increase within subsectors of Utilities, with the bullish percent for the Electric Utilities ^BPEUTI reversing back into Xs over the past week. Additionally, the positive trend indicators for the Electric Utilities ^PTEUTI and Gas Utilities ^PTGUTI also reversed into Xs, showing not only an increase in stocks returning to buy signals but also movement of trends back to positive. NextEra NEE reported mixed earnings, but continues to be a notable name showing technical improvement. Additional earnings for the sector this week include DTE Energy DTE, CMS Energy CMS, Edison EIX, and PG&E PCG.

Real Estate – Underweight

Weekly Real Estate Video (2:41)

The real estate sector continues to trade strong. SPDR ETF XLRE was the best performing of the major 11 over the past seven days, as well as the rolling 30 days. On the Asset Class Group Scores page, real estate is just shy of the green zone with an acceptable fund score threshold of 3.0. That said, we are seeing some short-term signs of overbought conditions. Two stock standouts the past week were SPG and CBRE.