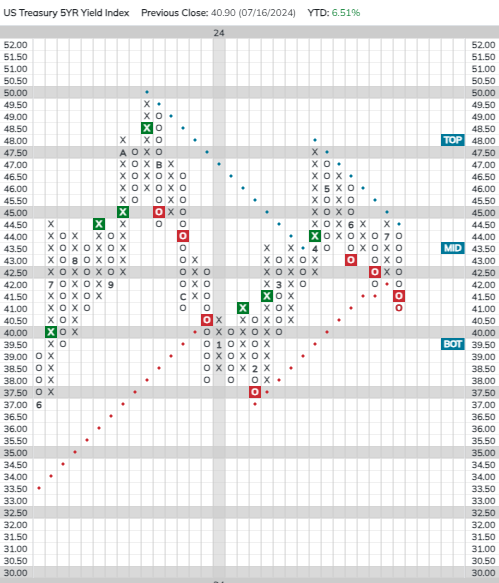

The US Treasury Five-year Yield Index (FVX) has fallen to a negative trend for the first time since April.

Weekly Fixed Income Update Video (2:50)

US Treasury yields were down over the last week. The US Treasury 10-year Yield Index (TNX) is now testing support and its bullish support line at 4.2%. Further in on the yield curve, the US Treasury Five-Year Yield Index (FVX) gave a third consecutive sell signal when it broke a spread triple bottom at $41.50 last week, putting it in a negative trend for the first time since April.

Declining yields have boosted bonds and the iShares US Core Bond ETF (AGG) returned to a buy signal last week when it broke a spread triple top at $98.25, taking out resistance that had been in place since March. Despite the recent improvement, AGG still has a weak 1.50 fund score.

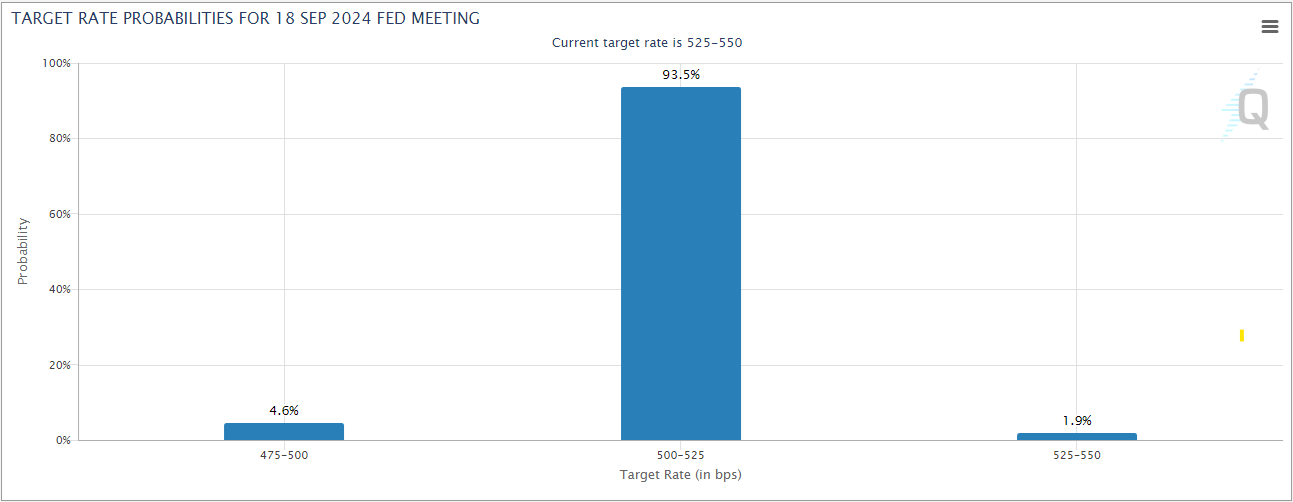

Fed futures are now pricing in a better than 95% chance of a rate cut at the Fed’s September meeting and a better than 50% chance of at least 75 bps of cuts by the end of the year.

Core groups have continued to show modest improvement recently. The US Fixed Income Long Duration group has crossed above the 2.5 threshold and the US Government-Agency group has reached the 3.0 score threshold for the first time since February.