Notable Technical Developments from the Financials, Consumer Cyclical, Communications Services, and Consumer Staples Sectors.

U.S. Sector Updates

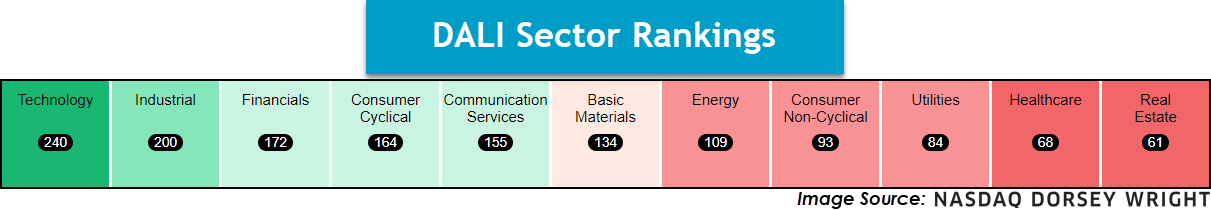

The past week saw no significant technical developments in the Technology, Industrial, Basic Materials, Energy, Utilities, Healthcare, or Real Estate Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

Financials – Overweight

Weekly Financials Video (3:10)

There haven’t been many, if any, major developments in the financials sector in the past week. However, big banks begin announcing earnings on Friday with JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C) as headliners. Like the rest of the market, strength in the sector resides in most of the largest names, so earnings on Friday will likely be amplified given the lack of strength elsewhere.

Consumer Discretionary – Equal Weight

Weekly Consumer Cyclical Video (3:54)

Discretionary stocks were positive over this past one week roll with XLY adding 1.8%. Tesla TSLA was a major contributor after surpassing Wall Street’s estimates for the companies Q2 deliveries. TJX and AMZN were also notable as they rallied to new chart highs. The Building subsector falls into the crosshairs again after ITB break through 2024 support on the trend chart. The positive trend (PT) and bullish percent (BP) indicators for the subsector also fell lower this week, though they still raise above their 2023 lows. Earnings begin for the broader sector this week with Delta DAL reporting on Thursday.

Communication Services – Equal Weight

Weekly Communication Services Video (2:55)

Communication Services remains in firm equal weight status to open the back half of the year as the space is led higher by tech focused names. META and NFLX posted buy signals on its default chart, while CHTR ran into some logical resistance on its default chart. Continue to add to larger names in the sector on logical pullbacks, and trim when possible for other technically weak options.

Consumer Staples – Underweight

Weekly Consumer Staples Video (1:52)

The consumer staples sector continues to rank low in DALI. Just 33% of non-cyclical stocks are in a relative strength column of X's (i.e., showing near-term outperformance) against the market, which is among the lowest levels in the past 20 years. Individual stock selection remains key and SFM is a name to consider.