The crypto space pulled back notably over the last seven days

The crypto space pulled back notably over the last seven days. Within the Nasdaq Crypto Index (NCI), many coins fell more than 10%, following other risk-on assets lower as rate cut expectations shift following last week’s inflation print. Bitcoin ($BTC) remained somewhat insulated from the fall (only slipping roughly 8%), but the decline across the board does bring several interesting technical developments to the forefront. Bitcoin specifically moved back into O’s and is testing what has proved to be a key $60,000 mark ahead of its upcoming halving. A number of other notable coins, including Litecoin ($LTC) and Ethereum ($ETH) broke relevant support and returned to sell signals on their default charts. Recent crypto articles have discussed the importance (much like in the equity market) of participation outside of the “core” focus of Bitcoin, so declines outside of Bitcoin are concerning for the well-being of the space in general.

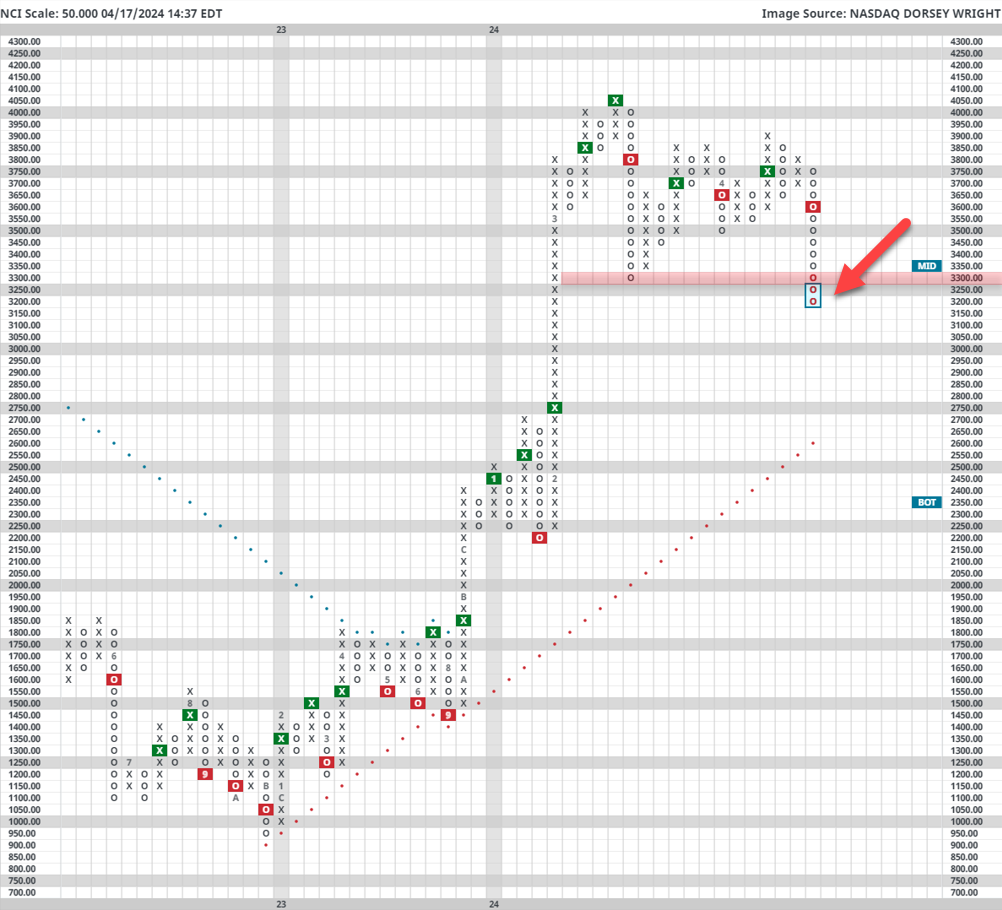

While it is heavily weighted towards Bitcoin, NCI does provide insight into this participation outside of $BTC alone. A quick look at the default chart reveals a notable break of a key support level at 3,300 - emphasizing the previously mentioned precarious situation the space finds itself in. From here, traditional support isn't seen until the positive trend line below at 2,600. A journey to this point would be a near 20% decline, and while a move in a single column to these levels is statistically unlikely, further deterioration from areas outside of Bitcoin could act as a headwind going forward. Regardless, keep a watchful eye here in the near term as further declines could suggest a pause in relative strength as we move through April into May.