Trend following as a strategy has been around for decades. The basic idea is by buying when price is moving up and selling/hedging when price is moving down, one can outperform a buy and hold strategy. Typically, it is thought of as an equity-based strategy but it has been applied to many other asset classes including Fixed Income.

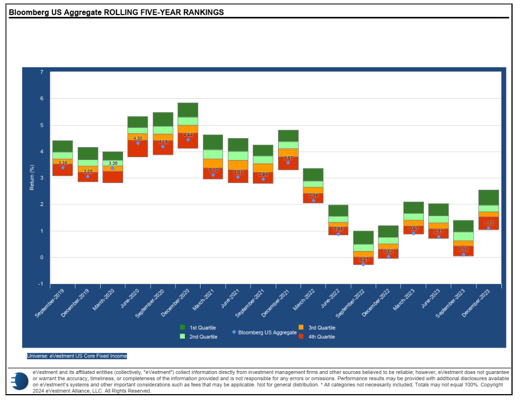

Trend following as a strategy has been around for decades. The basic idea is by buying when price is moving up and selling/hedging when price is moving down, one can outperform a buy and hold strategy. Typically, it is thought of as an equity-based strategy but it has been applied to many other asset classes including Fixed Income. In fact, we often find outperformance can be more consistent in Fixed Income due to the nature of Fixed Income index construction. Most indexes are market-cap weighted meaning the most indebted areas of the market get the highest weight. This tends to become a problem when these areas start to have issues (ex. being overweight mortgage-backed securities in 2008). Because of this issue, passive Fixed Income benchmarks tend to perform worse relative to active management (see below). This provides an opportunity for trend following approaches which, in theory, should be able to rotate out of poorly performing areas when passive indexes cannot.

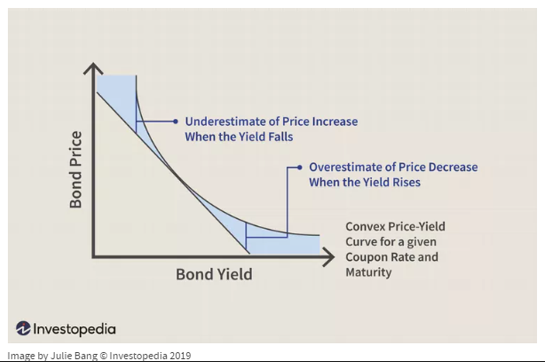

Fixed Income markets have seen historic declines since the Federal Reserve began raising interest rates in early 2022. In fact, 2022 was the worst year for bonds in at least 250 years. Why was it so bad? How could calamities such as the Great Depression, World War II, and the Civil War not cause more substantial issues for the market? Part of it comes down to the convex nature of bond pricing. When rates are low, more of a bond’s return comes from the return of principal at maturity vs. coupon payments made along the way. This naturally lengthens the duration of bonds (making them more sensitive to changes in interest rates) with greater price changes occurring the lower interest rates get (see below). Given that the period leading up to 2022 saw the lowest interest rates in recorded history, this had a major effect on bond prices and explains why similar rate changes in the past didn’t have the same impact on prices we saw here. Additionally, the Aggregate Bond Index is also more weighted towards US Treasuries now which further increases its interest rate sensitivity. All of this, combined with the speed of the rate increase led to the historic decline.

If the market only went down though a trend following approach likely would have done well as it could have allocated more of the portfolio toward the short end of the curve and sidestepped steeper declines in longer dated securities. However, along with the increase in rates we also saw a sustained increase in bond volatility. One way to measure this is through the ICE BofA MOVE Index which is like the VIX index for equities in that it uses options to calculate the implied volatility for treasury bonds. The average value of this index over time is 93. The average value since the beginning of 2022 is 119 (almost 30% higher). This is a difficult environment for a trend following strategy as by definition it requires the markets to form stable trends in one direction or another to succeed. In volatile markets though, even if the markets trend, the countertrend moves are often significant enough to cause the strategy to generate false signals. It also doesn’t help when the period of high volatility is sustained as it has been. In fact, the MOVE index recently traded below the long-term historical average (93) for the first time in two years (see below). Looking at historical data, levels of sustained high volatility like this have only been seen in 2008/2009 and 1994/1995 before this. The good news is that we seem to be moving back to a more normal environment which should allow trend following-based approaches to resume their previous success.

Nasdaq Dorsey Wright is a registered Investment advisory firm. Registration does not relfect any certain level of skill or training.

Past performance does not guarantee future results. In all securities trading, there is a potential for loss as well as profit. It should not be assumed that recommendations made in the future will be profitable or will equal the performance as shown. Investors should have long-term financial objectives when working with Dorsey Wright. The relative strength strategy is NOT a guarantee. There can be times where all investments, asset classes, and strategies are unfavorable and depreciate in value. Relative Strength is a measure of price momentum based on historical price activity. Relative Strength is not predictive and there is no assurance that forecasts based on relative strength can be relied upon.

The information contained herein has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any recommendation (express or implied) or information in this material without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources believed to be reliable (“information providers”). However, such information has not been verified by DWA or the information provider and DWA and the information providers make no representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein. DWA and the information provider accept no liability to the recipient whatsoever whether in contract, in tort, for negligence, or otherwise for any direct, indirect, consequential, or special loss of any kind arising out of the use of this document or its contents or of the recipient relying on any such recommendation or information (except insofar as any statutory liability cannot be excluded). Any statements nonfactual in nature constitute only current opinions, which are subject to change without notice. Neither the information nor any opinion expressed shall constitute an offer to sell or a solicitation or an offer to buy any securities, commodities or exchange traded products. This document does not purport to be complete description of the securities or commodities, markets or developments to which reference is made. Advice from a financial professional is strongly advised.

There are risks inherent in international investments, which can make such investments unsuitable for certain clients. These include, for example, economic, political, currency exchange, rate fluctuations, and limited availability of information on international securities. Dorsey Wright, and its affiliates make no representation that the companies which issue securities.

Indexes are unmanaged. It is not possible to invest directly in an index.

©Copyright 2024. All rights reserved. Nasdaq® and the Nasdaq Stock Market® are registered trademarks, or service marks, of Nasdaq, Inc. in the United Stated and other countries.