US Treasury yields were down slightly over the last week following the Fed’s March meeting.

Weekly Fixed Income Update Video (2:11)

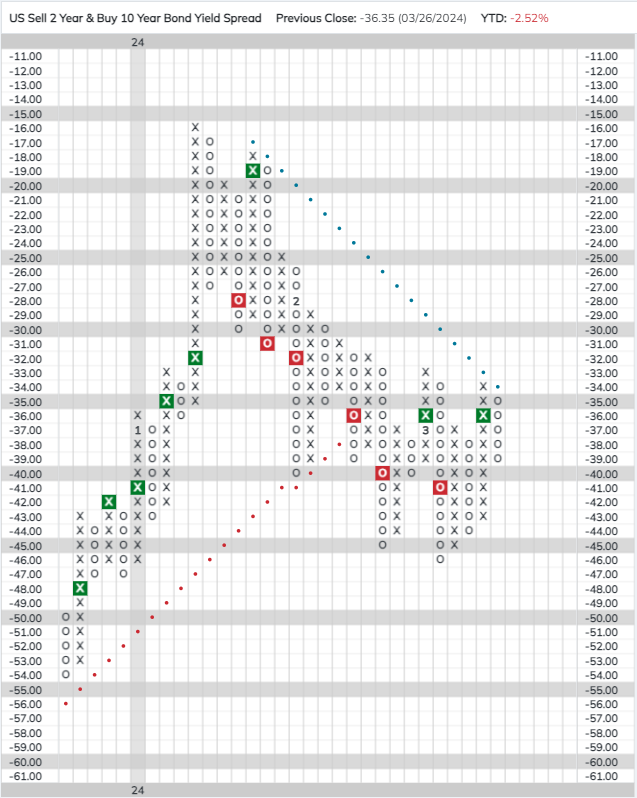

US Treasury yields were down slightly over the last week following the Fed’s March meeting. As discussed last week, the statement of econ projections released following the meeting showed the FOMC median projection is still for roughly three 25 bps cuts this year. However, members’ median projection for the fed funds rate in 2025, 2026, and the longer term increased, indicating their estimate of the neutral rate has risen. The change in projections could help support relatively higher yields in longer maturities, potentially helping to normalize the yield curve which has been inverted since 2022. Thus far, the two/10-year Treasury yield spread (USYC2Y10) has not moved significantly, remaining in roughly the same range it has been in for the last few weeks.

For those wondering how to position in the current market, your best bet may be to look to short-duration bonds and funds. Short-duration US fixed income currently outscores long-duration US fixed income, with an average score of 2.51 vs. 2.20. The possibility that there could be more support for higher yields at the long end of the curve adds another reason to favor short duration over long; and, at least for the time being, short duration US Treasuries still generally offer higher yields than their long-term counterparts - another point in favor of exposure to short maturities.

The fixed income rankings in the Asset Class Group Scores (ACGS) look largely the same as they have for the last couple of months. Floating rates and high yields sit atop the rankings, while most core groups still sit in the red zone with scores below 2.5.