Colombia has shown sharp recent improvement.

Latin American equities continue to demonstrate strength through the first few weeks of 2024. This can be seen through the Asset Class Group Scores (ACGS) page, which has Latin America as the second-highest ranked non-US group at an average score of 4.81. This strength has been especially notable since October, as the group was positioned below the suitable 3.00 score line at the end of that month. Some areas within the Latin American space have seen more resilient technical pictures, like Mexico. Brazil has also seen strength during this ascent, with more rapid improvement in the small-cap space.

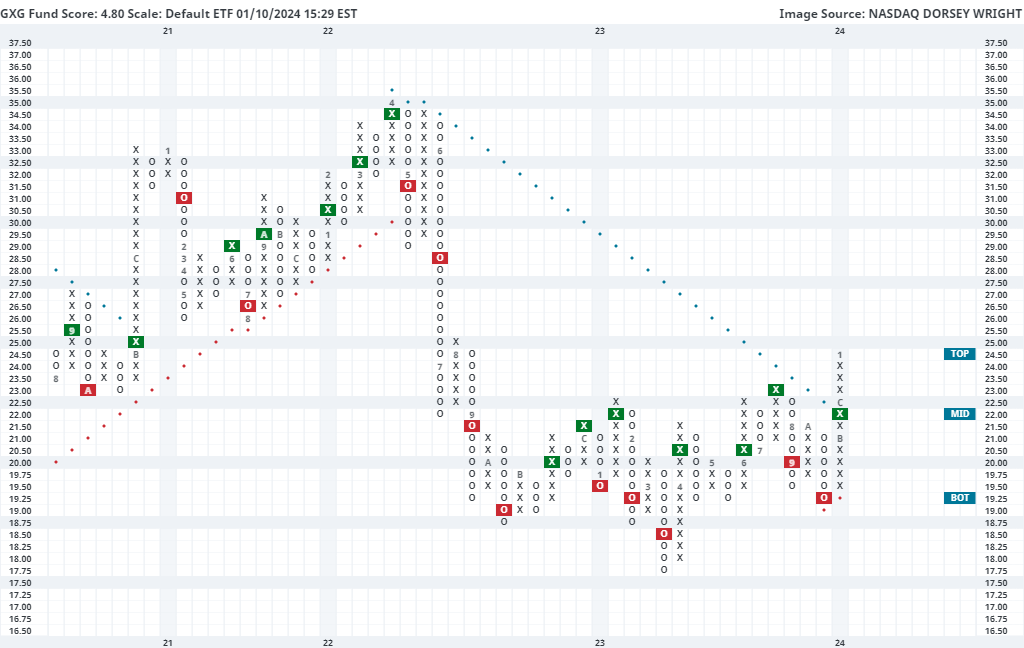

Another area that has flown under the radar is Colombia, as shown through the Global X MSCI Colombia ETF GXG. This fund moved higher last month to return to a buy signal at $22, which also moved the fund back into a positive trend. The more notable breakout came shortly thereafter when the fund rose to $24.50 last week, reaching its highest level since August 2022. GXG carries a strong 4.80 fund score, besting the average non-US equity fund (3.19) and is paired with a sharply positive 4.02 score direction. Like many other areas in international equities, GXG is extended at the current chart level, with a weekly overbought/oversold reading of 85% (through 1/10). While the fund is extended, GXG is an area to keep an eye on for a potential pullback or normalization alongside expanding breadth in Latin America. Initial support is not seen until $19.25 on the default chart, with further support seen on the more sensitive ¼ point chart at $22.75.