There certainly never is a quiet week within the cryptocurrency space

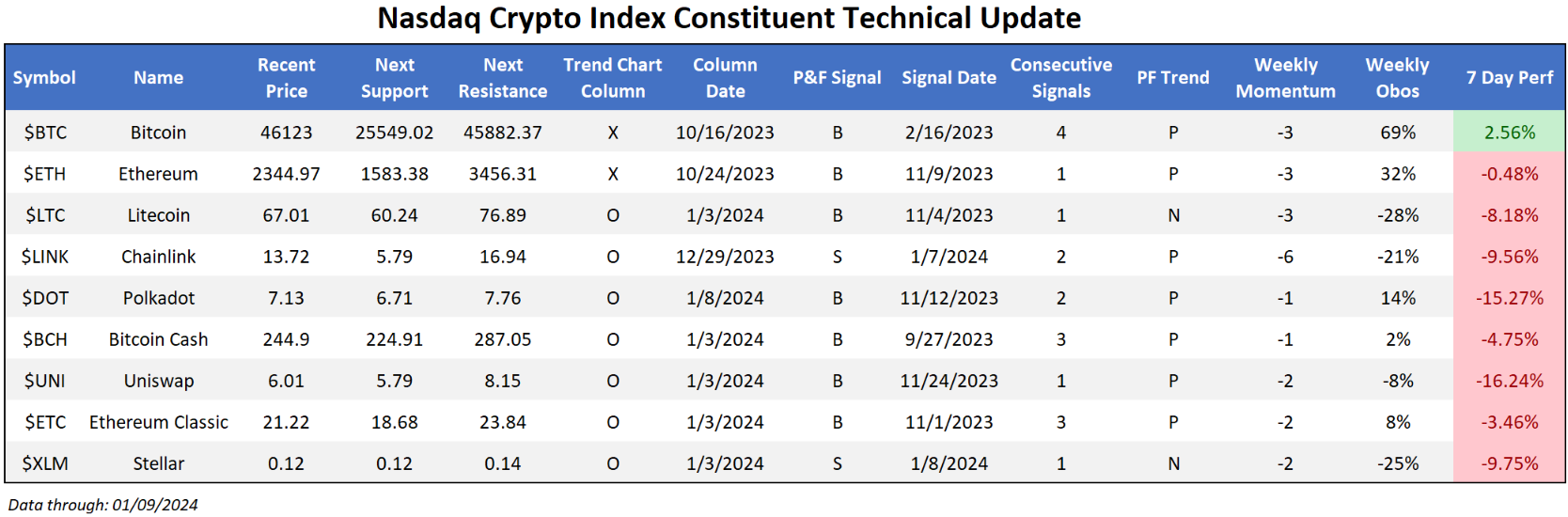

There certainly never is a quiet week within the cryptocurrency space. The main topic on the docket was the possible approval of a spot Bitcoin ETF, which has been the main catalyst for upside action recently. The start to the year has been somewhat lackluster for the broad space, with the lack of definite approval leaving some near-term doubt in the picture surrounding the outstanding ETF applications. The big news was the false report coming from the SEC’s X (Twitter) account yesterday (1/9/23) that mentioned the ETF had been approved, which later was corrected and sent Bitcoin falling after market close. Within the Nasdaq Crypto Index (NCI), all but one coin fell for the last seven days. Many reversed back down to relevant levels of support- a development to monitor if the space continues to tread water. The approval process continues to evolve rapidly- something we will update as things become clearer and more concrete.

$45,000 has been a key level for Bitcoin. At this time of this writing, $BTC has rebounded nicely, reclaiming $46,500 as the market eyes the eventual approval of such a key ETF. Because of its natural volatility, the default charts for cryptocurrencies are percent-based, which helps eliminate some of the noise found in the markets. That isn't to say, however, that traditional trend charts can’t be of use. A quick look at the 500-point chart shows the failure to breach past $45,000 during what was an extremely productive 2023 for the space. Even after yesterday’s pullback, the constructive point worth adding here is the near-term hold of this mark. The drop brings the crypto king into more normalized trading levels, and interested parties could continue to add here…. With the understanding that enhanced volatility could be in play surrounding the ETF approval in the near future.