The past week saw no significant technical developments in the Consumer Cyclical, Basic Materials, Communication Services, Utilities, Healthcare or Real Estate Sectors. Those that saw noteworthy movement are included below.

U.S. Sector Updates

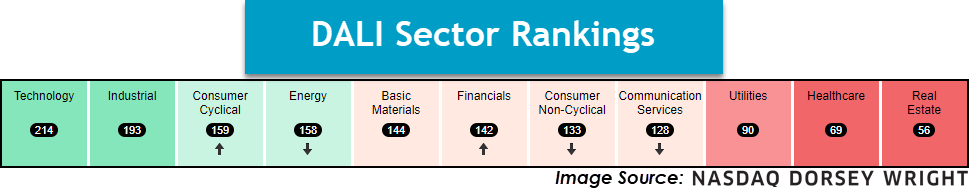

The past week saw no significant technical developments in the Consumer Cyclical, Basic Materials, Communication Services, Utilities, Healthcare or Real Estate Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

Technology – Overweight, Improving

The technology sector continues to sit atop the DALI sector rankings, adding an additional signal over the past few days. Participation is broadening out, however, we are seeing many areas move into overbought territory. Given the long-term strength, keep an eye out for buy-on-pullback opportunities as we head toward next year, such as DELL.

Industrial- Overweight

The group remains in overweight territory this week, only lagging behind technology. With this said, there are a number of strong contenders available for consideration at the time of this writing. From a fund perspective, PAVE holds a strong 5.59 fund score and is testing 2023 highs. On the equity front, those interested could look towards United Rentals (URI), which recently posted new all-time highs. While JBHT moved back to a positive trend, it is nearing the top of a nearby trading range and should be avoided for now.

Energy- Equal Weight, Weakening

Energy fell to fourth in the DALI sector rankings. The Energy Select Sector SPDR Fund (XLE) was down roughly 235 bps over the last week as crude and natural gas were down heavily. Energy sits in equal-to-overweight territory in the DALI sector rankings but the fund score and chart of XLE tell a different story. XLE has given multiple consecutive sell signals putting in a series of lower tops and lower bottoms and the fund has an unfavorable 2.63 fund score. Keep an eye on exposure and weed out individual positions that begin to break down.

Financials – Equal Weight, Improving

Financials moved up in the DALI sector rankings this week to sixth place, putting it in equal weight territory for the first time in many months. The Financials group as well as the Financial-Banks groups boast the two highest score directions of any sector on the Asset Class Group Scores page. The recent move lower in long-term interest rates has likely been a driving factor in the improvement of banks specifically. One of the main concerns for banks, highlighted by the Silicon Valley Bank situation earlier this year, is the amount of unrealized losses on their fixed-income portfolios. The move lower in interest rates has undoubtedly helped alleviate some of the concerns. The SPDR Regional Bank ETF (KRE) has a fund score of 3.10 and is one box away from testing its July high of $49.50. KRE does sit near heavily overbought territory with a weekly overbought/oversold reading of 69%, so it would be best to wait for a more attractive entry point. Nonetheless, the improvement in the financials sector is a notable shift but still a sector not worthy of overweight status yet.

Consumer Non-Cyclical- Equal Weight

Consumer Staples fell to seventh in the DALI ranks over the past week, which is good from a macro standpoint given the sector's defensive tilt. Consumer Discretionary continues to separate itself as a comparative leader. SPDR Fund XLP is in a sell-on rally position, but momentum is doing well within the sector. Focus on high relative strength names and avoid the current laggards. COST trades at fresh highs ahead of earnings and WMT fell to a negative trend.