Long-term yields fell significantly on Wednesday following the Fed's December meeting.

The Fed wrapped up its December meeting Wednesday, leaving rates unchanged as had widely been expected. Yields fell significantly following the meeting with the US Treasury 10-year Yield Index (TNX) falling to just above 4.0%. The move to 4.05% will put TNX in a negative trend for the first time since May. Further in on the yield curve, the US Treasury Five-year Yield Index (FVX) also fell to a negative trend when it hit 4.0%.

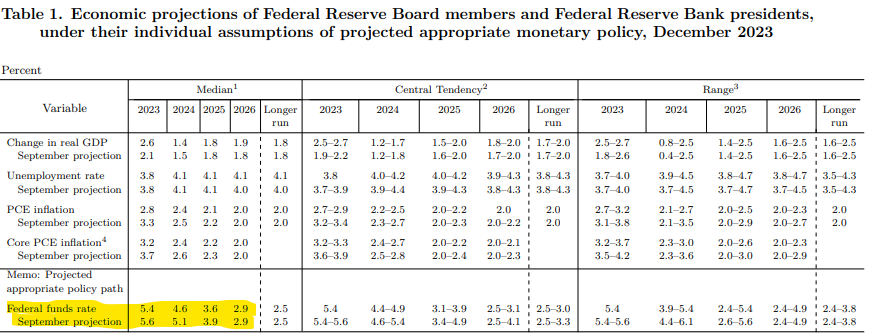

The impetus for the rally in bonds (and equities) appeared to be the Fed’s statement of economic projections which showed FOMC’s median projection for the level of the Fed funds in 2024 had fallen to 4.6%, down from 5.1% in September, implying roughly 75 basis points of cuts next year. While this is less than the 100-125 basis points of cuts the market had been pricing in, it shows that Fed officials do foresee lowering rates next year.

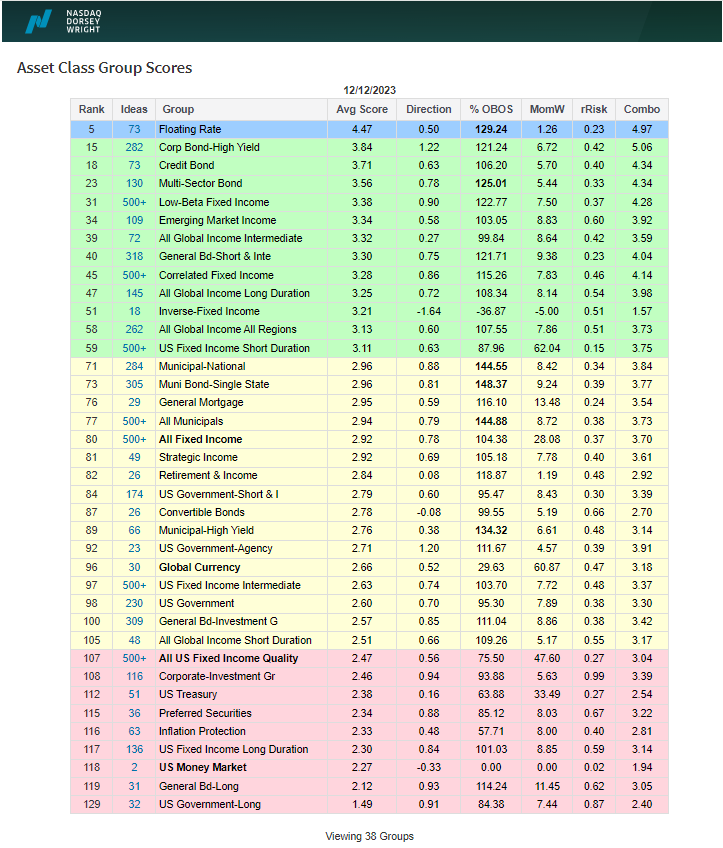

The fixed income rankings in the Asset Class Group Scores show what is probably the strongest fixed income market we’ve seen since at least March. Floating rates remain atop the rankings and are the only group with a score north of 4.0. High yield corporates and credit bonds sit in second and third respectively, showing a risk-on posture to credit. We can also see that most fixed income groups now sit in the green or yellow zones, in contrast to a few weeks ago when most groups were in the red zone. We still see a number of core groups in the red zone; however, their scores have improved noticeably over the last several weeks. Wednesday’s move in yields will likely serve to help those scores improve further. It is worth noting that many fixed income groups now sit in heavily overbought territory, with weekly overbought/oversold readings north of 100%. So, if we were to see some pullbacks or consolidation over the short-term it shouldn't come as a surprise.