Wednesday turned into a volatile day after Fitch announced it had downgraded the rating on US debt from AAA to AA+ on Tuesday evening. This may be the biggest news story this week but there are still big earnings coming up on Thursday.

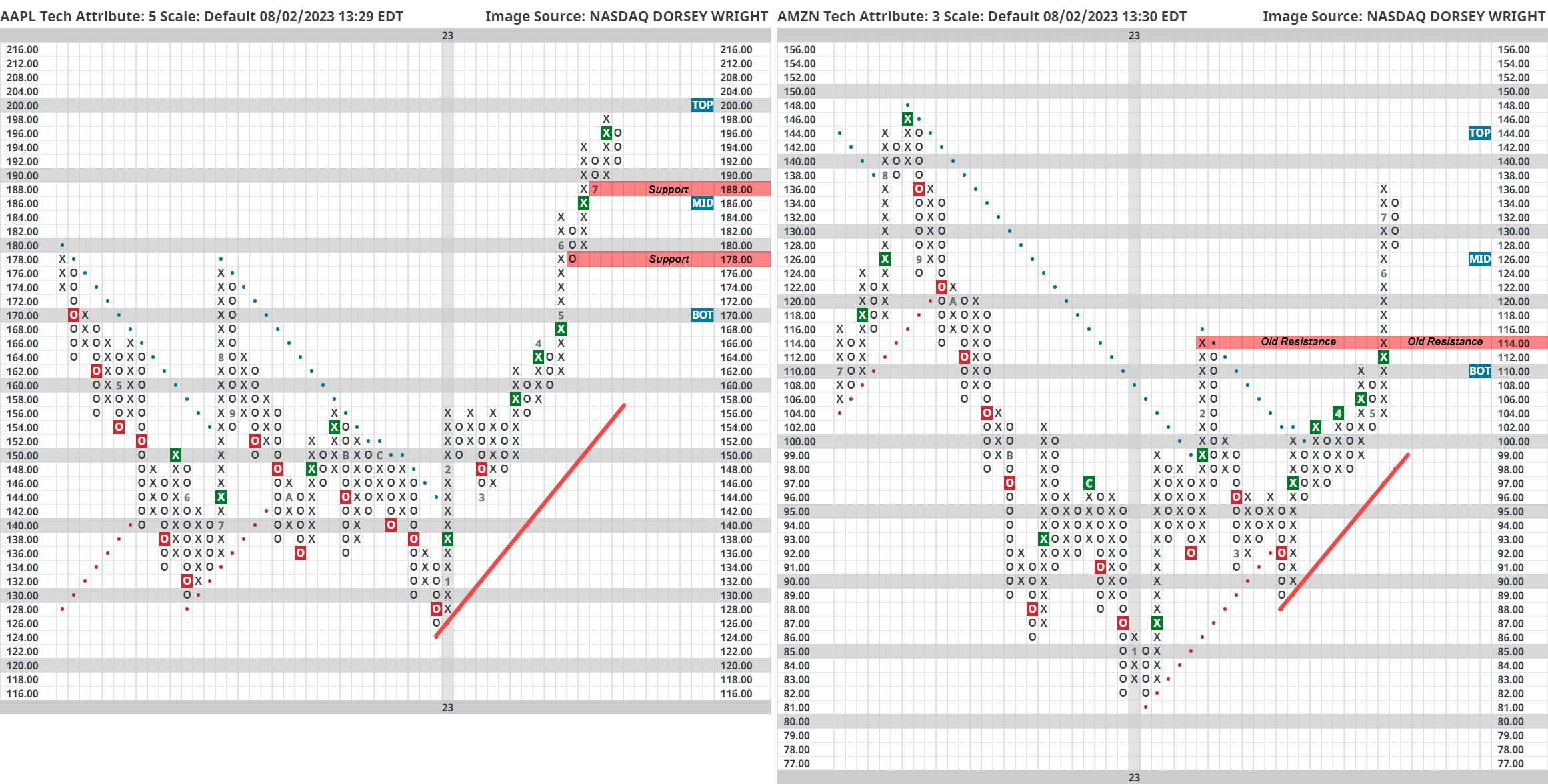

Wednesday turned into a volatile day after Fitch announced it had downgraded the rating on US debt from AAA to AA+ on Tuesday evening. This may be the biggest news story this week but there are still big earnings coming up on Thursday. Apple (AAPL) and Amazon (AMZN) will drop their earnings report after market close on August 3rd. Big tech earnings have received mixed receptions from investors. Netflix (NFLX) and Tesla (TSLA) took a beating after their earnings announcements while other names in the space had more positive reactions. Apple’s importance can’t be understated since it’s the largest stock in the world. That’s not to undersell Amazon either, it’s a top five market cap name as well. Out of the two reporting Thursday, Apple has the stronger technical picture. AAPL is a perfect 5 for 5’er, trades on five consecutive buy signals, and reached a new all-time high this year. Amazon has had an exceptional 2023 so far with a year-to-date return of 56% and has put together a string of five consecutive buy signals. However, AMZN remains a 3 for 5’er as it’s been unable to return to a buy signal on its relative strength charts versus the market and its peer group. Outside of Nvidia (NVDA) which reports on August 23rd, this week will wrap up earnings for most of the mega cap names.