Commodities have Strengthened Recently, so we look at the catalysts for the space- energy.

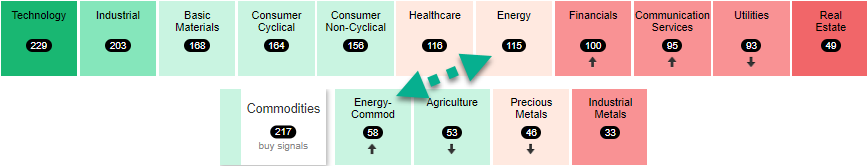

Commodities have tumbled throughout the course of the year. This has come mostly at the expense of 2022’s darling energy, which has fallen within our broad rankings throughout 2023. Despite this, there have been recent signs of life for the area. Today’s report will aim to travel outside of just DALI and create a more complete picture of where energy (both equity and commodities) stands as we roll into August. As this is the DALI piece, we can start our analysis there. Energy-focused names have picked up a total of 50 buy signals across both their Commodities and Sector rankings since the beginning of July. This gain has coincided with a rise in the rankings, seeing the energy sector rise from 10th to 7th in the sector rankings and last to first within the commodity rankings. A brief aside from the main theme of today’s report, it is worth noting the renewed coordination of movement between energy-focused groups across the broad asset classes. 2022 saw energy equities surge forwards in the face of slumps for energy-based commodities, a somewhat puzzling divergence. Nonetheless, while energy-based equities still sit a ways away from where they entered the year, the magnitude of upside participation for the group does warrant a watchful eye.

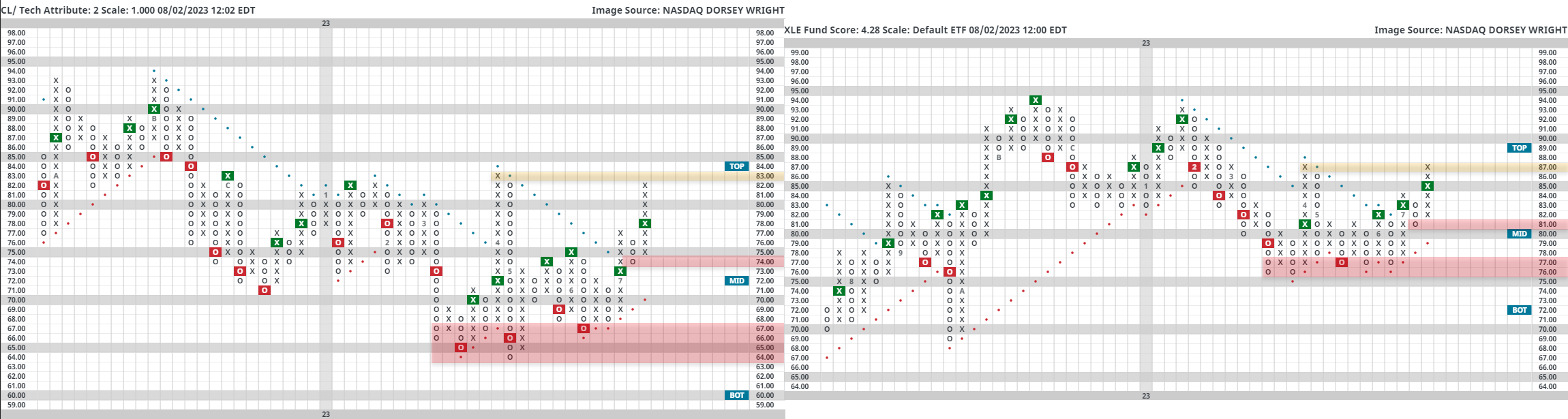

DALI isn't the only space on the platform that is signaling recent strength for the energy space. Crude oil (CL/) and the SPDR Select Fund XLE have similar-looking technical pictures, sitting on consecutive buy signals with localized support just above the middle of their 10-week trading band. Furthermore, both names have bases of support offered at the lows for the year, marked on the charts below, and have recently journeyed back into a positive trend. XLE has recently seen a nice pickup in its fund score, sitting at 4.28 at the time of this writing. This has come mostly throughout July, seeing the fund outperform SPX by just over 4.5%. XLE also returned to a column of X’s on its 3.25% chart against our cash proxy MNYMKT, adding to the weight of the evidence in favor of the sector. Both Crude Oil and XLE sit near resistance on their charts, so short-term pullbacks could be in store.

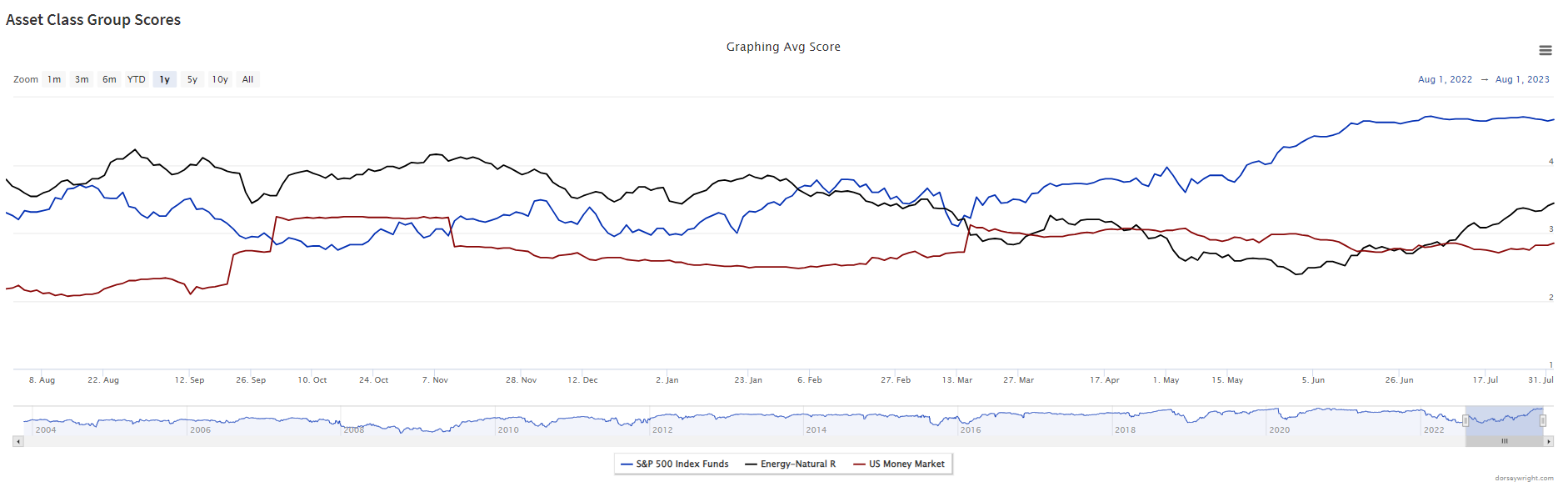

The final part of the report today will journey over to the Asset Class Group Scores page. Especially for swift moves off relative lows, it can be useful to look across the platform’s broad focused areas for confirmation of action from one reading to the next. By graphing the score for an average energy fund against that of both cash and the broad market, one can see a recent pickup for the energy space. Most notably, the recent advances have seen the group diverge from cash, similar to other points made throughout this analysis.

The point being- despite still sitting a ways off of 2022 highs, a number of areas are suggesting energy may have found some sort of relative bottom. With these advances, it may be prudent to pick up focused exposure to technically acceptable stocks within the group. To create a shopping list, remember that you can use the security screener to find strong candidates within the sector.