Most international equities show near-term consolidation while Turkey gains momentum.

International equity markets pulled back this week following risk-off movement on the heels of the US credit downgrade. This comes after most areas in the international equity space saw notable improvement in July, especially within emerging markets, as the iShares MSCI Emerging Markets ETF EEM gained 4.70% from June 30 through August 1. The iShares MSCI EAFE ETF EFA rose 1.42% over the same period, continuing to climb steadily higher but not showing the same level of near-term strength as the emerging space. Even though most broad representatives are pulling back this week, price consolidation after periods of sharp improvement can be a healthy sign for continued strengthening of the long-term technical picture.

One area that has not contributed to the near-term pullbacks has been Turkey, which was one of the biggest risers in the NDW Country Index Matrix over the past month. Most of that improvement came in the past week, as the country representative ticked up into the 19th position out of the 42 countries examined from the 27th position on Thursday, July 27. This price appreciation came after the Turkish central bank only raised interest rates by 250 basis points to 17.50%, significantly less than the 500 basis points that were expected (source: Financial Times).

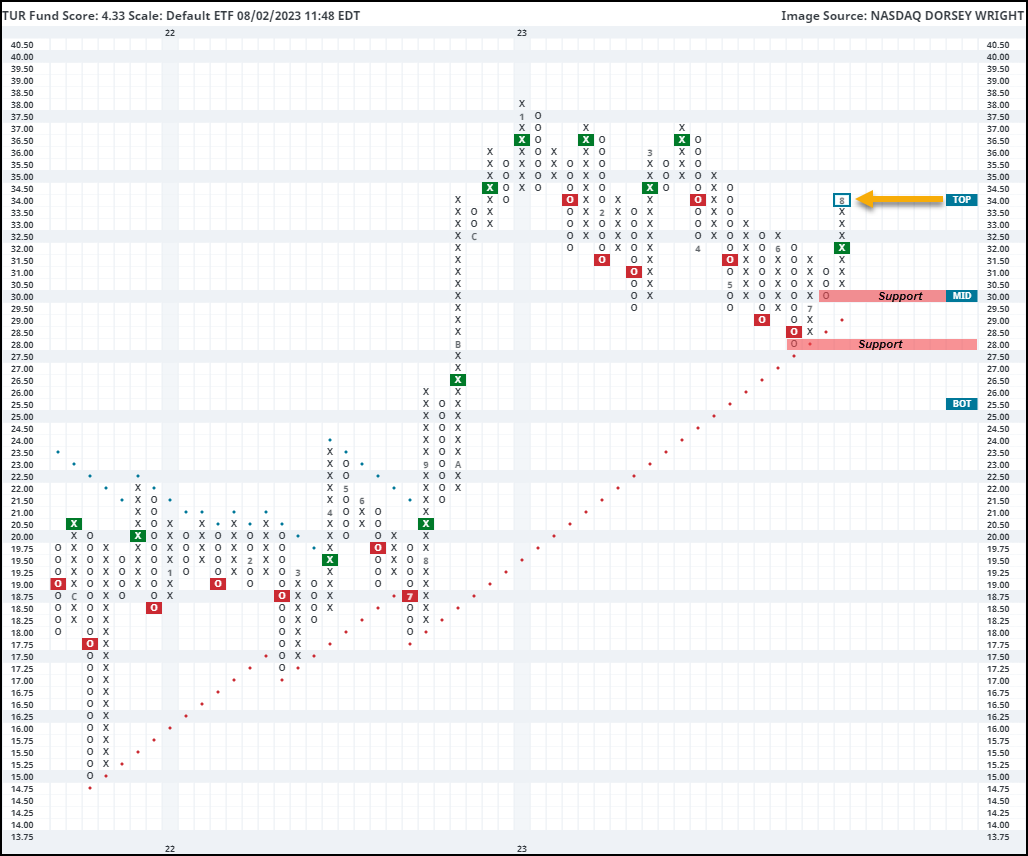

That equity improvement can also be seen in the iShares MSCI Turkey ETF TUR, which moved higher over the past week to give a buy signal at $32 before advancing to the current chart position at $34. This ends a streak of four consecutive sell signals for TUR that had been ongoing since March. That decline also brought the fund down to test its bullish support line at $28 before reversing higher last month. That maintenance of the LT technical picture paired with the near-term improvement makes Turkey a space to monitor as we head into August. TUR also has a 3.71% yield, highlighting a potential income opportunity. The fund carries a strong 4.33 fund score posting paired with a 2.18 score direction, providing further indication of the recent strength. However, TUR did move into an overbought position with this appreciation at an intraday weekly overbought/oversold level of 86.57% at the time of this writing on Wednesday. Those looking to add exposure may consider easing in or waiting for some normalization in the trading band. Initial support may be seen at $30, with further support at $29, the current location of the bullish support line. Further overhead resistance may be seen at $35 and $37.