The 10-year US Treasury yield reached a new 2023 on Wednesday following Fitch's downgrade of the US's credit rating.

US Treasury yields moved higher over the last week. The US Treasury 10-year Yield Index (TNX) reached a new 2023 high on Wednesday when it broke a spread triple top at 4.10%, its third consecutive buy signal.

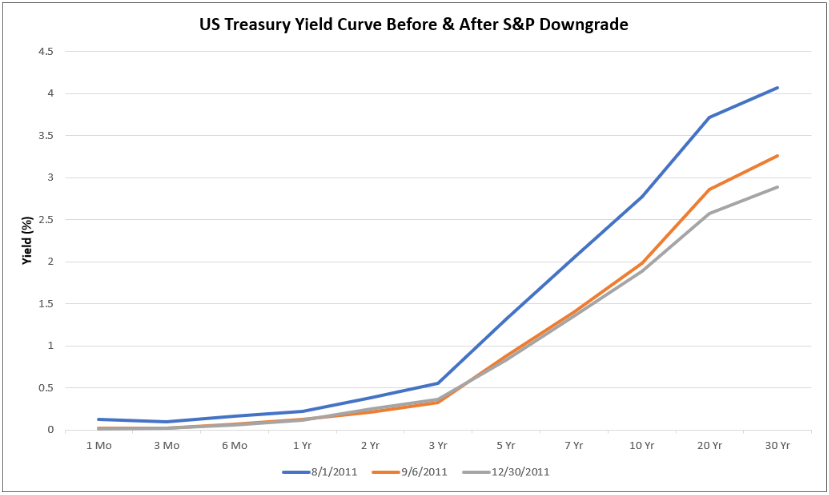

TNX’s breakout comes on the heels of Fitch downgrading the US’s credit rating, citing the national deficit and the debt ceiling fight. The rise in Treasury yields seen on Wednesday is what one would intuitively expect following a credit downgrade as investors demand a higher return for greater credit risk. However, historically, this has not always been the case. The chart below shows the US Treasury yield curve before and after S&P downgraded the US’s credit rating on August 5, 2011.

As you can see, Treasury yields were lower on September 6, 2011, roughly one month after the downgrade, and fell further by the end of the year. This is not to say that yields will fall following this downgrade as there are a myriad of factors affecting the level of Treasury yields, but the limited historical data there is suggests that a credit downgrade doesn’t necessarily beget higher Treasury yields.

The fixed income rankings in the Asset Class Group Scores look largely the same as they have for the last few weeks. Most of the strength remains in segments outside the core market – like non-US fixed income, convertibles, and high yield bonds. One notable development is the rise of inverse fixed income, which now ranks third among all fixed income groups. Many core groups, like US Treasuries and investment grade corporates, remain in the “red zone” with scores below 2.5 and Wednesday’s action will likely serve to further weaken these groups.