In this Macro Update from the Nasdaq Economic Research Team, US Economist Michael Normyle discusses the latest Fed decision, GDP, inflation, and wage growth.

It’s been a busy week for economic data. But there were really just four key events…

- Fed rate hike on Wednesday (7/26)

- Q2 GDP (7/27)

- PCE inflation (7/28)

- Wage growth (7/28)

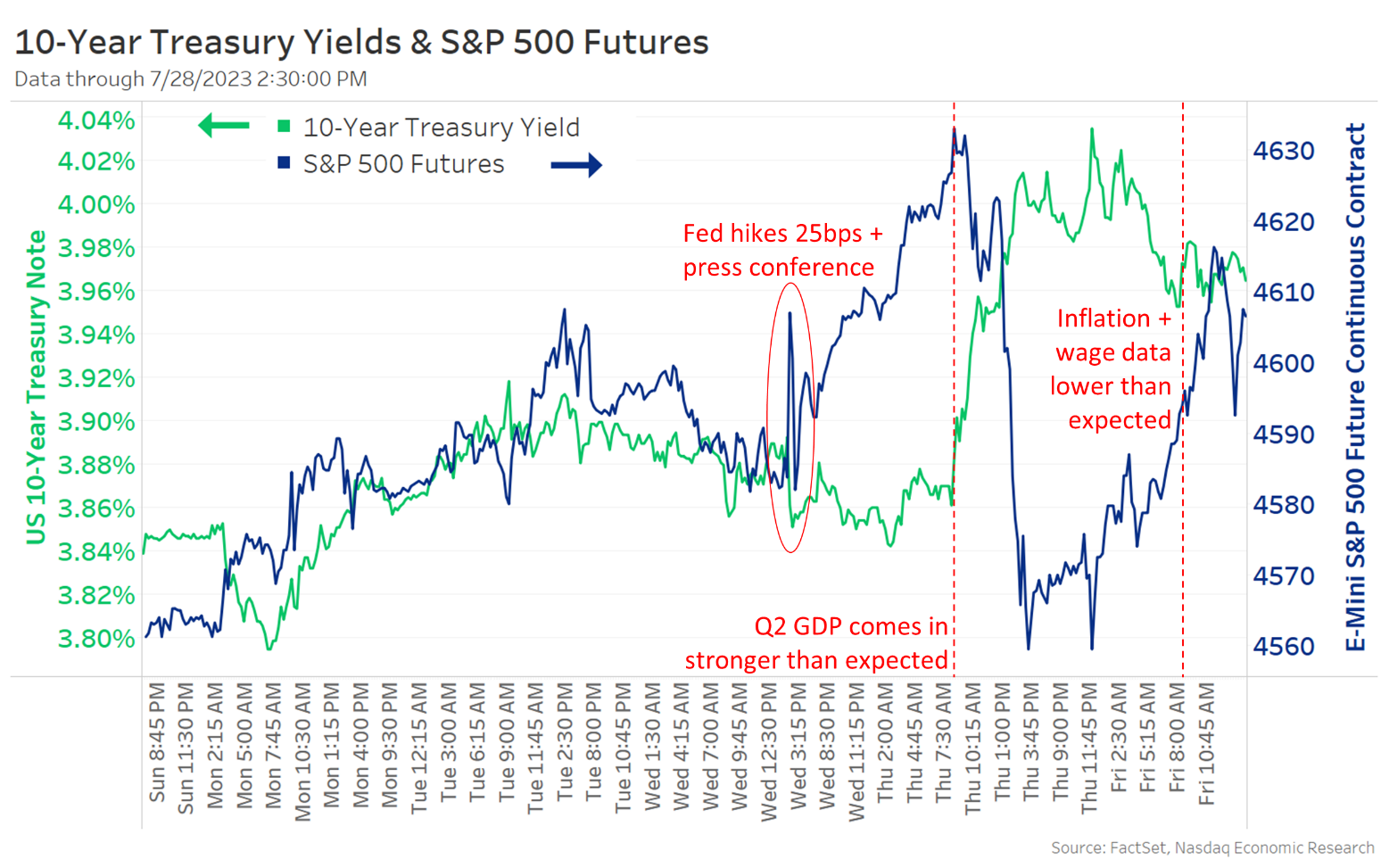

Those data were the best of both worlds for the Fed. GDP shows the economy remains resilient, while inflation and wage growth slowed a bit more than expected, helping position the Fed for the “soft landing” that looks increasingly possible. Add earnings news on top of this week’s deluge of data and it’s no wonder markets have been up and down. For the week, the major equity indices are up 1%-2% (blue line). Possibly more importantly, 10-year Treasury rates are now around 4% (green line). In case you missed it, 10 days ago they were 3.75%.

1. Fed hikes 25bps as expected, leaves door open to hike or pause going forward

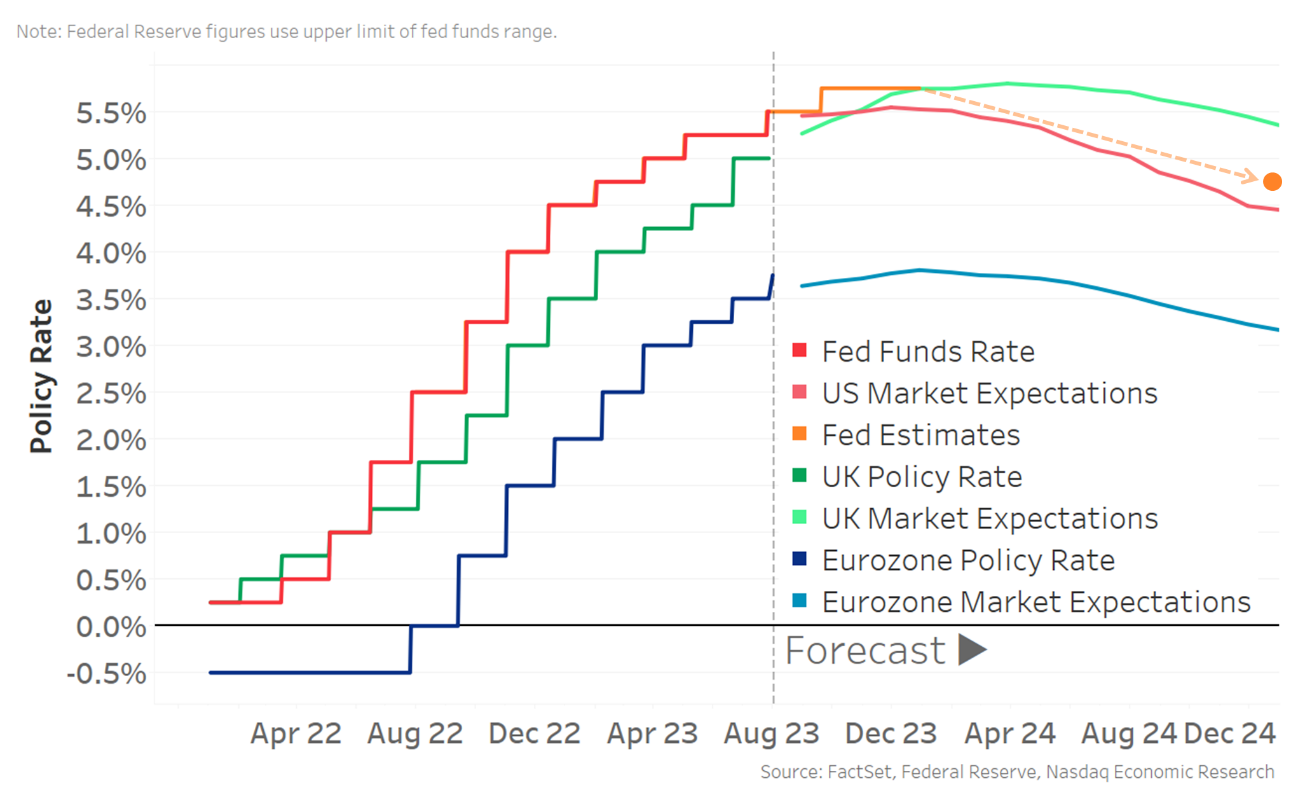

As expected, the Fed hiked 25bps to 5.5% – a 22-year high. But the positive for markets was that Chair Powell emphasized data dependency going forward, so it’s possible this was the last hike this cycle – as markets have priced (light red line) – if inflation eases as the Fed wants. And we can add the Fed staff to the growing list of economists no longer forecasting recession.

2. Q2 GDP growth picks up speed on broad-based gains, signaling no recession

Q2 GDP data also helps the “no recession” camp. Q2 real GDP came in stronger than expected, seeing 2.4% annualized growth, up from 2% in Q1. And the gains were broad-based. Consumer spending remained the biggest contributor, as people continue to spend, especially on services. Government spending also helped. The big surprise was that businesses boosted investment, despite higher rates and tight credit conditions, which had depressed investment in recent quarters.

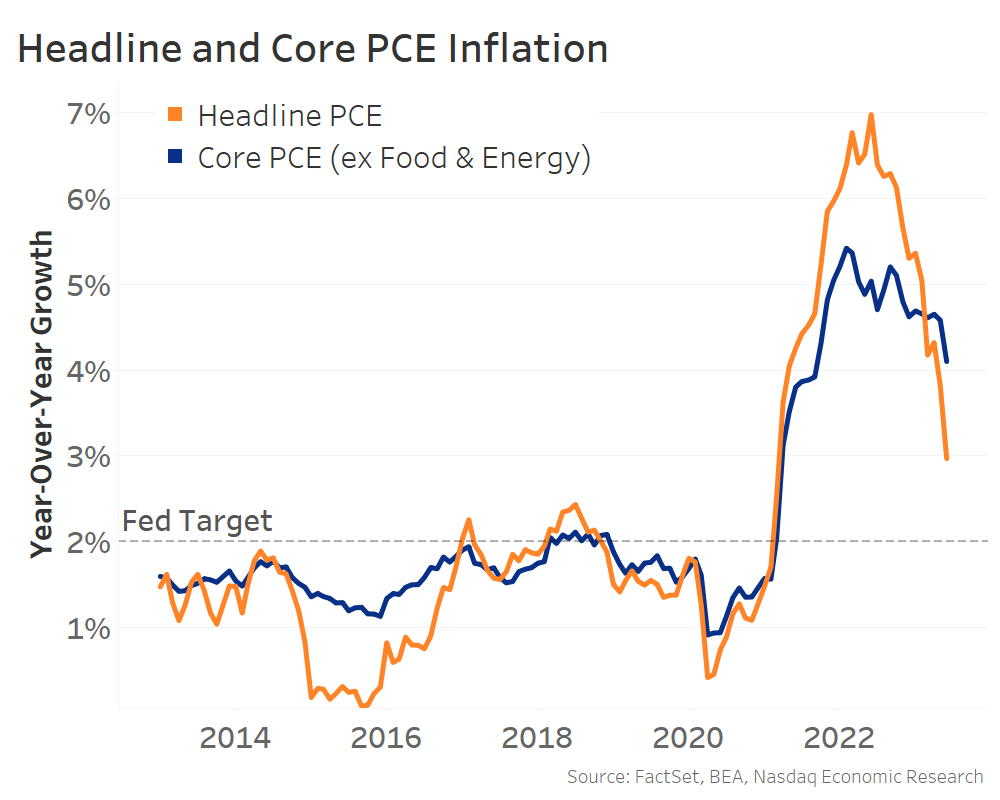

3. Broad disinflation – including key core services – sends PCE inflation lower

Headline PCE inflation is the gauge the Fed prefers. It fell to 3.0% YoY from 3.8% (orange line), and core PCE inflation slowed to 4.1% YoY from 4.6% (blue line). This pretty much mirrors the CPI data we got earlier this month (see our recap here). Energy is the biggest drag on inflation, but we’re now seeing disinflation across the board – from food to core goods and now even the sticky housing and wage-driven core services components.

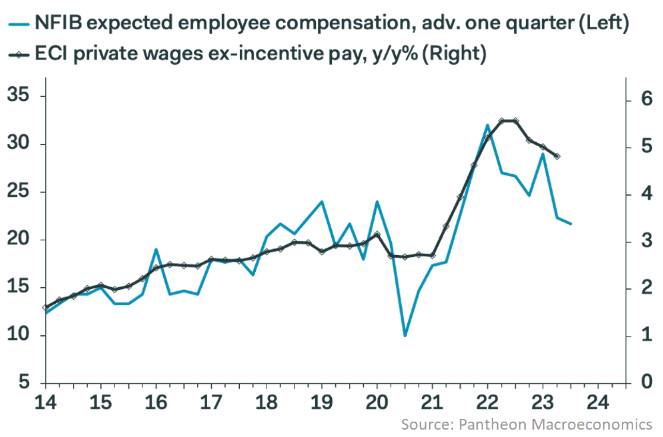

4. Wage growth also slowing, partly helping PCE inflation fall

Finally, we got further confirmation that wage growth is slowing with the Fed’s preferred wage metric (the Employment Cost Index) rising at a 4.1% annualized rate (black line) – its smallest increase in two years. Based on forward-looking small business compensation plans (blue line), it looks like it should keep slowing.

Lots for the Fed… and markets… to like

So, GDP shows the economy remains resilient, and even saw a rebound in business investment – so it’s not just consumers driving the economy. PCE inflation, including core, is falling toward the Fed’s 2% target. And that’s helped by slower wage growth, which augurs well for a continued fall in inflation. From here, the Fed will get two more jobs reports and two more CPI reports before its September meeting. If we continue to see solid, but not blowout, jobs numbers and further easing in inflation – especially core – the Fed should be able to hold off on further rate hikes, as markets expect.