A review of Emerging Markets and their recent strength

Beginners Series Webinar: Join us on Friday, July 28th at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is: Dynamic Asset Level Investing (DALI) and DALI Strategies Register Here

Domestic Equites have had a busy week. From yesterday’s Fed rate hike decision, 2nd quarter GDP coming in higher than expected today, and a slew of household names reporting earnings this week it doesn’t seem like there could be a more action-packed week for the market. All things considered, results across the board have been mostly positive. Strong earnings from META & GOOGL highlight a continuously strong tech focused market, and positive results from Boeing (BA) pushed the Dow Jones Industrial Average .DJIA to tie (but unfortunately not break…) its longest daily gain streak in history. The one hang-up from a macro perspective seems to be a continuously strong labor market, leaving the door open for future rate hikes, which would hinder the equity space and drive concerns that further tightening could jeopardize the chance of a soft landing.

The domestic equity rise has provided a nice break from discussing the international space, which we certainly covered at length throughout the last quarter of 2022 and first of 2023 as the space roared forwards in the face of domestic declines. That certainly isn’t to say that the space hasn’t had its fair share of notable technical improvements, however. From a macro perspective, the space has been aided by a technical breakdown from the US Dollar DX/Y, but it is worth noting that inflation globally has been a bit stickier than we have found here in the US. For now, the former has been the market's main focus, with the broad space maintaining its relative strength across both DALI and the Asset Class Group Scores (ACGS) page. Within the group, a variety of areas have been actionable throughout the year, although we have mentioned a number of times the current preference for developed markets. Developed markets proxy EFA is outperforming emerging proxy EEM by just roughly 3.5% since the start of 2023. This theme is echoed by each fund's respective fund score (EEM’s 3.58 vs. EFA’s 4.18), which suggests developed markets remain resilient. Throughout the course of July, however, EEM has outperformed SPX and EFA by over 1.2%, suggesting some aspects of near-term strength. This strength was enough to see EEM post a second consecutive buy signal and move to new rally highs.

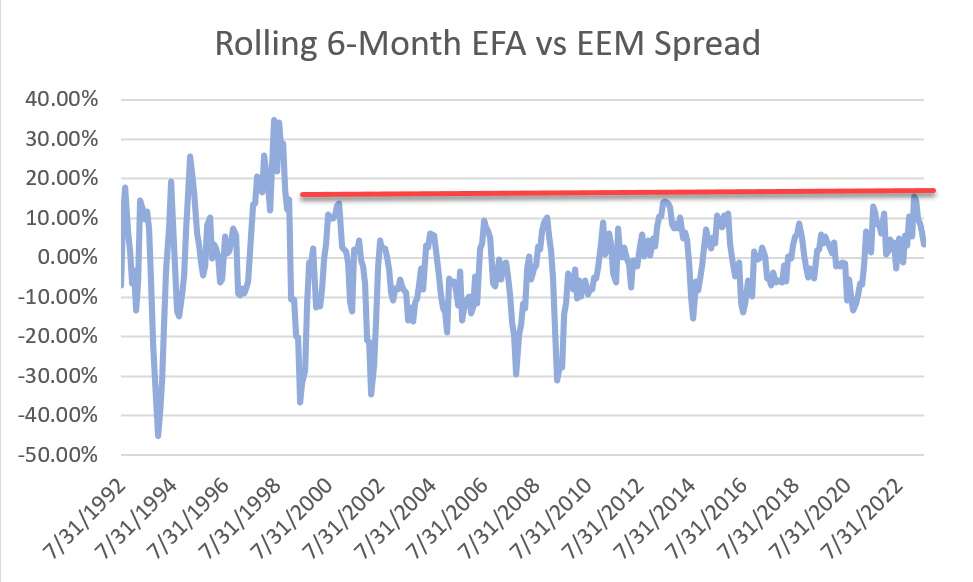

But is this outperformance for the emerging space simply a bump in the road or a sign of changing tides? While no one indicator is a “silver bullet” as they say, one aspect which we typically use as a judge of where we stand from a historical standpoint between two groups are performance spreads. With this in mind, one can run rolling 6-month performance spreads between the funds in hopes of identifying patterns that arise. As seen in the chart below, there does seem to be an emerging cap around the 15% outperformance of EFA in favor of EEM, at which EEM begins to outperform. Remember, an uptick in outperformance for one group does not necessarily mean one group is falling while the other is rising (as both can be moving higher/lower, just of different magnitudes…) but it is notable nonetheless. All things considered, keep an eye on emerging markets and their strength over the coming weeks to see who can hold the strength within the international space.