The core of the market is exceptionally strong while fixed income languishes.

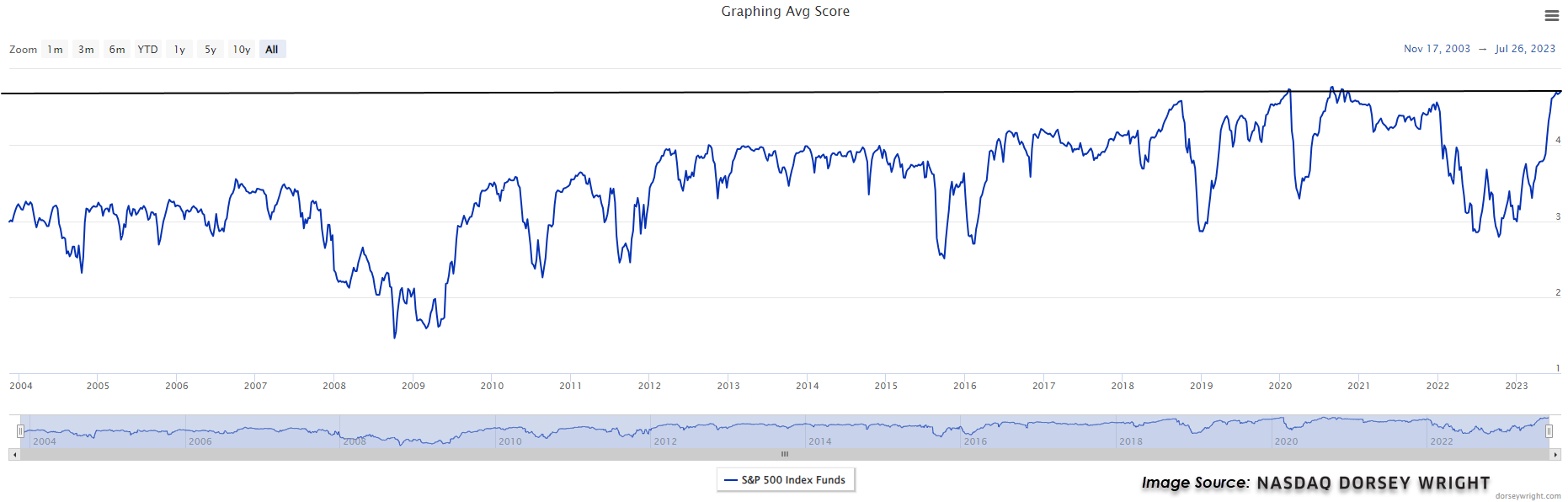

Domestic equities have roared back in 2023 led by some of the largest names putting up triple-digit returns like Tesla (TSLA), Nvidia (NVDA), and Meta (META). This has led the S&P 500 Index Funds group to reach an average score of 4.70 for only the third time in its history dating back to 2004. The other two periods when the group reached a score of 4.70 was in February 2020 and then a few times from August to November 2020. While both these periods were followed by big moves, one in each direction, it does show how narrow the equity market is right now. The Equity Core Percentile Rank has sat around 98% since the end of May meaning that the S&P 500 Index Funds group has scored higher than 98% of all groups tracked for nearly two months. This doesn’t mean the market is headed for disaster but rather that the narrowness of the market will have difficulty lasting much longer. Both average score for the S&P 500 Index Funds Group and the Equity Core Percentile Rank have reached these levels before, but they typically do not last for a long period. It would be expected that there will be some broadening out of the market or at least a few groups that begin to challenge the core of the market.

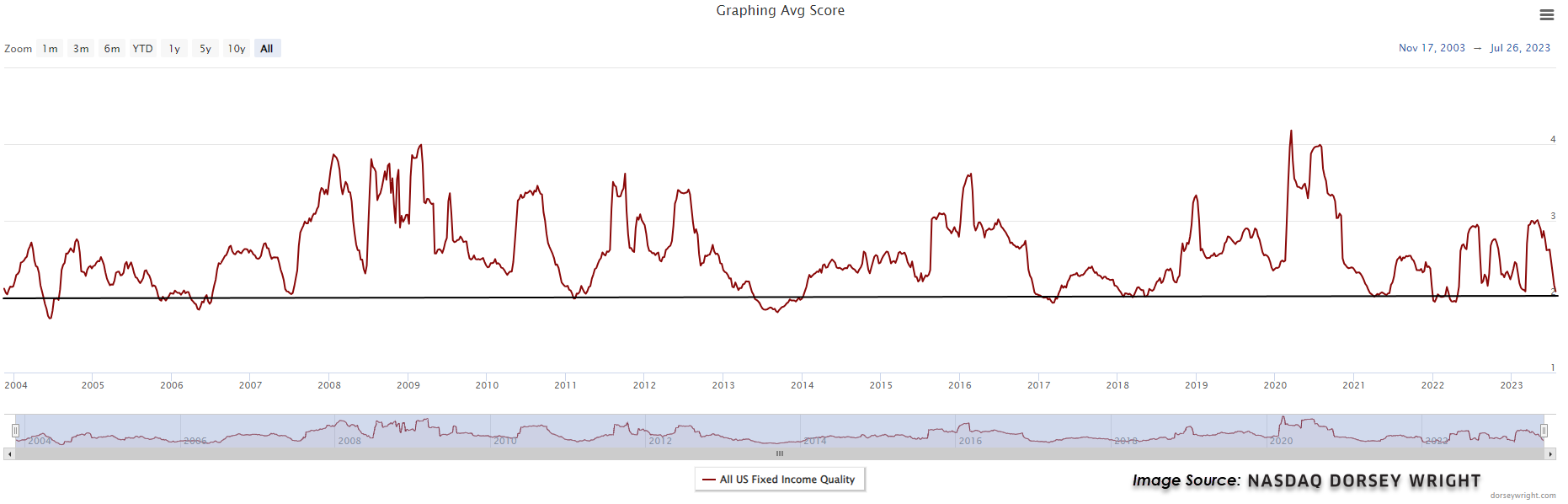

On the exact opposite side of the coin, the All US Fixed Income Group is scoring close to the 2.0 level, an area rarely visited for very long. The weakness in the fixed income space has been on the heels of the most aggressive Federal Reserve rate hiking cycle in recent history. Coupled with the strength in equities, fixed income groups mostly lack any relative or absolute strength. However, given the group’s current score there could be some contrarian opportunities. For example, if some clients need to do a change in allocation due to their age or they’re close to retirement, then now might be a good time to think about having those conversations. Touched on in more detail in today’s featured article, it does appear that the Fed is near or at the end of its rate hiking cycle which may give some respite to the fixed income space. The asset class is still one to avoid overweighting for the time being, but for those that need exposure, it’s not the worst time to dip your toes in at these levels.