News came out on Tuesday that the Banc of California would be absorbing PacWest Bank, one of the hardest hit regional banks in March.

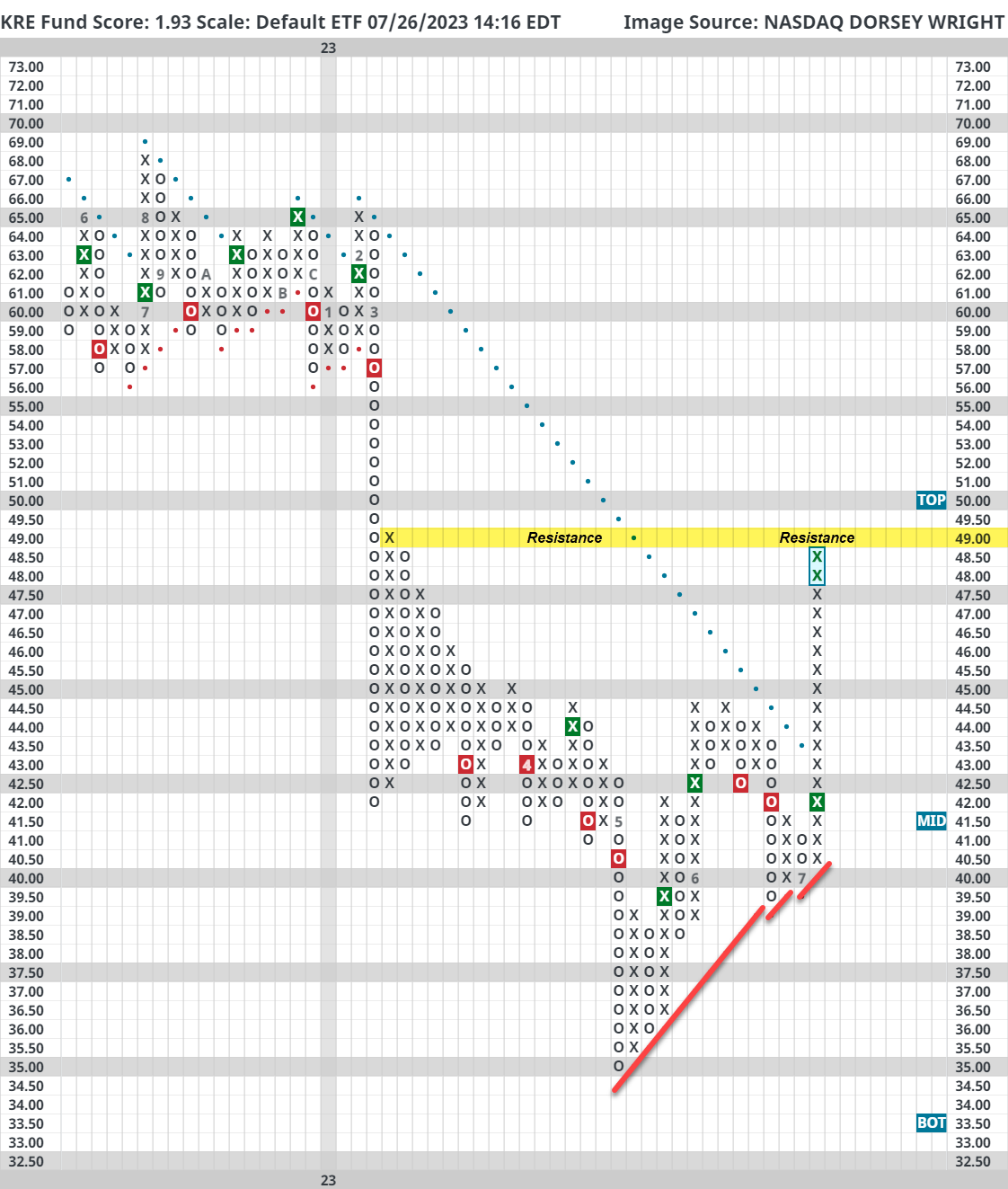

Regional banks have been a constantly watched space since February when cracks in the sector became apparent. The Fed came to the rescue and patched up some of the holes in the space through vehicles like the Bank Term Funding Program in mid-March. Still, there were a couple of banks that either went under or were seized and sold like Silicon Valley Bank and First Republic Bank. On Monday, the FDIC issued a statement that some banks were “not reporting estimated uninsured deposits in accordance with the instruction (Source: New York Times).” Perhaps not a coincidence, news came out on Tuesday that the Banc of California would be absorbing PacWest Bank, one of the hardest hit regional banks in March. The two combined banks will have just about $30.5 billion in deposits, $4 billion less than PacWest itself entered the year with. The news led to major volatility for both names with PacWest (PACW) marking a high of $11.21 and a low of $7.50 before eventually closing at $7.69. The bank then rallied after the close to open at $9.69 on Wednesday. Despite the volatility, the regional banking space has taken the news well so far. The SPDR S&P Regional Banking ETF (KRE) gained nearly 5% during today’s session. The fund trades on a buy signal and entered a positive trend two weeks ago for the first time since March. KRE is now one box away from testing its last level of resistance since its downfall in March at $49. While the Fed did some patchwork, it appears the regional banking space is still going through major changes.